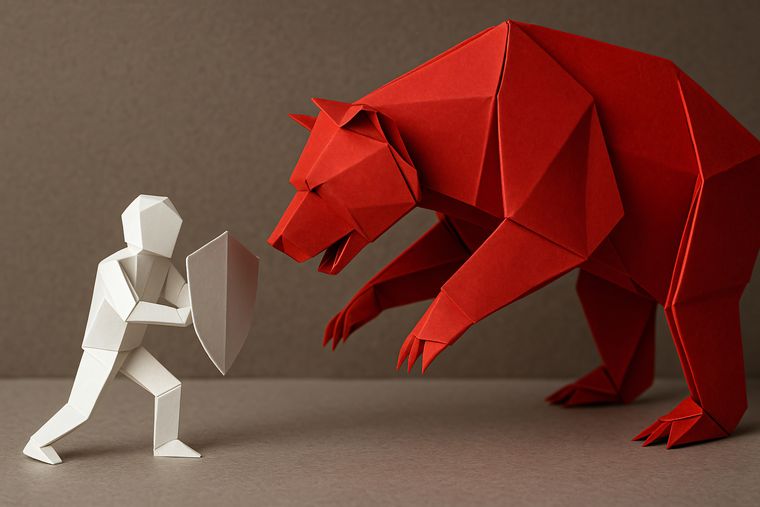

Stock market pundits have long maintained that volatility is an investor’s best friend, as it creates liquidity and allows buyers to acquire quality stocks at favourable prices. In recent months, Indian capital markets have been reeling under bouts of turbulence driven by global geopolitical tensions, inflationary concerns, sustained selling by foreign portfolio investors (FPIs), the pressures of earnings season, and narratives around elevated valuations.

Such phases are not unprecedented. Over the past two decades, markets have weathered repeated disruptions and have continued to reward patient investors. History suggests that those who invested during uncertain times often generated significant returns, largely because markets ultimately remain tethered to earnings and valuations and tend to correct themselves sooner rather than later.

Investing in capital markets remains safe in the current scenario, provided investors temper expectations of quick returns and accept volatility as part of the journey. “In fact, volatility gives access to stocks which you otherwise cannot dream to acquire,” said Kishor Ostwal, CMD, CNI Infoxchange Pvt. Limited.

According to Ostwal, FPIs currently have around 72 per cent exposure concentrated in five sectors—financials, oil and gas, FMCG, health care and IT. A prudent strategy, he said, may be to tread cautiously in these areas where selling pressure could persist, even though overall FPI exposure has now fallen below 15 per cent. By contrast, sectors such as metals, mining, infrastructure, chemicals, defence, public sector companies, railways and artificial intelligence have relatively limited FPI exposure. The declines in these stocks, therefore, may be driven more by sentiment than by fundamentals, implying that they could rebound faster once confidence returns. “Risk-reward works only in difficult times; hence the current scenario is good for risk takers. Equity is all about taking risk. One should check the growth of the company, price-earnings ratio and enterprise value, which mitigate the risk of buying an expensive stock. Focus should be on value buying rather than buying on news,” said Ostwal.

Volatile phases often trigger aggressive selling, leading to lower valuations and creating entry opportunities. However, caution remains essential. Investors are advised to steer clear of high-volume stocks, companies with concentrated ownership, and those where promoters frequently appear on television channels promoting their businesses. Impulsive buying driven by headlines can be particularly risky in unsettled markets, as such narratives rarely hold up under pressure. Similarly, purchasing stocks immediately after strong results may not always be wise, given that large investors sometimes use positive announcements as an opportunity to exit.

Typically, investors who select well-researched stocks target returns of 25 to 40 per cent. Those willing to settle for more moderate gains—around 15 per cent—may prefer mutual funds, where professional fund managers oversee allocation decisions and risk management.

Analysts observe that Indian equities have delivered double-digit returns in 2025 despite global headwinds and record foreign institutional investor outflows. Markets have drawn support from fiscal stimulus measures—including tax cuts and GST 2.0—along with rate reductions by the Reserve Bank of India and robust inflows from domestic institutional investors, all of which have helped absorb shocks.

“We expect polarised performance from the Indian markets. Our internal study shows that within NSE 500 companies, in the 14-month period till May 31, 2024, weaker quality and slow-growth companies delivered significantly higher returns compared with those with good quality and high growth. However, this is changing. Since June 2024, the market has been rewarding high-growth and high-quality companies, and punishing low-quality and low-growth companies,” said Abhishek Tiwari, CEO, PGIM India Asset Management.

He expects the high-growth, high-quality segment to outperform, while companies lacking either attribute may surrender the excess gains built up in FY24. Long-term data, he emphasises, consistently shows that growth supported by quality offers the strongest probability of constructing a winning portfolio. “We also believe that depending on risk profiles and goal horizons, mixing products like Balanced Advantage Funds, Multi Asset Allocation Funds and assets like precious metals, REITs and InvITs can be a booster to investment portfolios,” he added.

In the current climate, safety is as much a function of time as it is of timing. While markets have recently undergone both price and time corrections, historical evidence indicates that such periods of gloom often represent the most attractive entry points for long-term wealth creation. Investing tends to be safest for those with a three-to-five-year horizon and no immediate liquidity needs. At prevailing levels, the risk-reward balance appears to tilt in favour of patient investors capable of looking beyond short-term noise.

“The primary safeguard against market turbulence is a well-structured portfolio tailored to your specific risk profile and existing holdings. Diversification across various market caps—large, mid and small—acts as a natural shock absorber. More important, investors should pivot towards ‘quality’ by sticking to companies that demonstrate a clear earnings tailwind despite macroeconomic headwinds. Focusing on businesses with robust cash flows and visible growth ensures that your capital is anchored in fundamental value rather than speculative momentum,” said Prabhakar Kudva, director and principal officer of portfolio management services at Samvitti Capital.

Kudva adds that investors must recognise volatility not as a flaw in the system but as an inherent feature of equity markets. “Higher returns are essentially the reward for enduring the ‘lumpiness’ of market performance,” he said. “The key to navigating this is matching the nature of your money with the nature of the asset; only long-term funds—money not required for at least three years—should be deployed in equities. By aligning your risk profile with a disciplined, long-term approach, you turn volatility from a threat into a tool for compounding.”