For those who are thrilled by the announcement of a trade deal between India and the US, there is one name to remember.

South Korea.

Last year, America’s eastern Asian ally was overjoyed when President Donald Trump worked out a trade deal with it in return for measures like raising the number of American cars that could be exported there and Korea’s dismantling of tariff and non-tariff barriers.

Then, disaster stuck. Last month, without any notice, Trump threw a tantrum and said he was raising tariffs on Seoul, alleging that the country was taking too long to ratify his deal. Last heard, the Koreans were scampering to Washington to figure out what had gone wrong.

They say the proof of the pudding is in the eating. For the just-announced US-India deal, this could be doubly so. First, beyond Trump’s exuberant declaration that tariffs would be dropped from 50 per cent to just 18 per cent for merchandising exports, the details are still to be worked out.

And of course, the full bilateral trade agreement (BTA) is still in the works. This is just a preliminary step to get the vexing tariff issue out of the way.

Yet, for all practical purposes, Prime Minister Narendra Modi and his team seemed to have finally managed to wrench out of the vexing situation the nation was caught in. The US was India’s biggest trading partner, and, more than that, there was a lot at stake. Being the world’s most valuable market, it was too important to be lost, no matter what brave face you put forward by signing deals with the likes of the EU and the UK.

That is why it has been a cause of celebration, despite the fact that the fine print was yet to be revealed. Soon after Trump and Modi revealed the ‘good news’ on social media, businesses went on a celebratory mode. The Gujarat GIFT Nifty surged 800 points overnight, and the Bombay Sensex also rallied the following day.

ITC chairman Sanjiv Puri called the deal symbolic of “India’s confidence and ascent in the global economic order”, while Bharti Airtel chief Sunil Mittal said the “flurry of FTAs is an affirmation of India’s role at the centre of global frameworks, aimed at building resilient international trade patterns”.

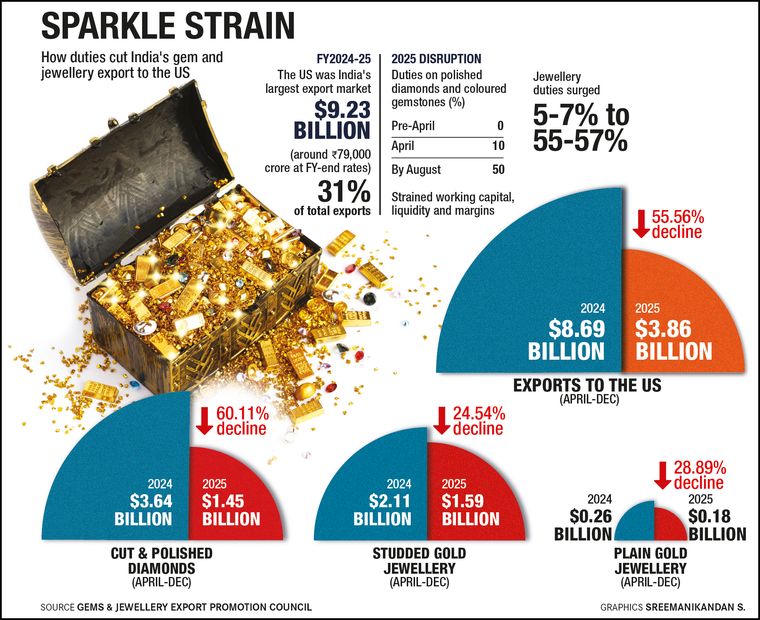

There is more to it than meets the eye. While exporters to the US did suffer in the last few months when tariff was raised to 50 per cent, a deal being struck was always never about returning to the status quo. This is because trade with the US has been at the centre of India’s new strategy of becoming a manufacturing powerhouse, attracting international investment by offering itself as an alternative to China. Despite an Apple here or a Micron there, that plan had not only not really taken off, but it was in imminent danger of a crash with sky-high US tariffs.

This is simply because of the lure and value of the American domestic market and any global manufacturer would have been reticent to set up a manufacturing plant in India if products made here did not have competitive tariffs in the US market.

That is a bullet Modi has dodged for now, but that is not the only one.

India is not exactly at the forefront of the AI and semiconductor revolution. Huge funding is being diverted into these sectors and going majorly to a clutch of nations in East Asia. India was handicapped in aiming for investors in this sector because of the US uncertainty. But the AI Impact Summit, scheduled for later in February, could set the stage for a renewed and updated push in this crucial realm.

But worry points remain. Trump did mention ‘agricultural’ in his statement, and while most experts do not believe sensitive areas like dairy and GM crops have been opened up, it was enough for a political storm, both within and outside Parliament.

The fine print of the deal will be crucial, as is the effective implementation in letter and spirit. “For India in particular, we have to ensure that our customs enforcement does not prevent us from getting the full benefits of the deal by causing unnecessary delays and disputes at the border,” said economist Rahul Ahluwalia, founder of the think-tank Foundation for Economic Development (FED). “We also have to reform regulations and institutions so that the local business ecosystem is competitive enough to take away market share from competitor countries like China, Vietnam and Bangladesh in the EU and the US markets. Only then will we achieve the full growth potential that these deals give us.”

He has a point. To attract international businesses to set up shop in India, thereby bringing in their valuable foreign investment into the country, India needs an attractive tariff regime with other countries. And while trade pacts with the Europeans, the British and even New Zealand was pushed through with that in mind, the big ticket was always going to be US and the tariff you had vis-a-vis your rivals in the neighbourhood who were angling for the same foreign investment. Bangladesh, for instance, has acquired a prowess in textiles, and Vietnam has proved itself to be a better alternative to China than India when it comes to electronics.

But now, with a tariff rate of 18 per cent, India has regained its advantageous position, compared to the 20 per cent that Bangladesh, Vietnam and Sri Lanka have got. The Philippines has 19 per cent. And it is imperative that India does not lose this momentum.

While Trump has gleefully declared that India has stopped buying Russian oil, the reality is a tad different. Last summer, 40 per cent of India’s oil imports were from Russia. While that came down to 25 per cent in December, it still forms the biggest chunk and it is not clear how quickly India will bring it down. And also, how much of an extra cost it will incur by moving to alternatives, including oil from the US and from its recently captured wells in Venezuela, as Trump has so helpfully suggested.

How Indian businesses will take advantage of the reduced tariffs and a comprehensive BTA in the works would be keenly watched. The worst affected and large sectors could be first off the ground. “Although this reduction will enhance price competitiveness of Indian exports as soon as the lower tariffs come into play, the immediate set of benefit is likely to go to export-heavy sectors such as textiles, apparel, auto components and engineering goods,” said Krishan Arora, partner and India Investment Roadmap Leader, Grant Thornton Bharat.

While both countries work out the nitty gritty of rates and exemptions, the bigger question is about how many newer areas and expansion of businesses that Indian traders can venture forth and conquer. It is no knockout victory yet, with many more rounds to go before the podium.