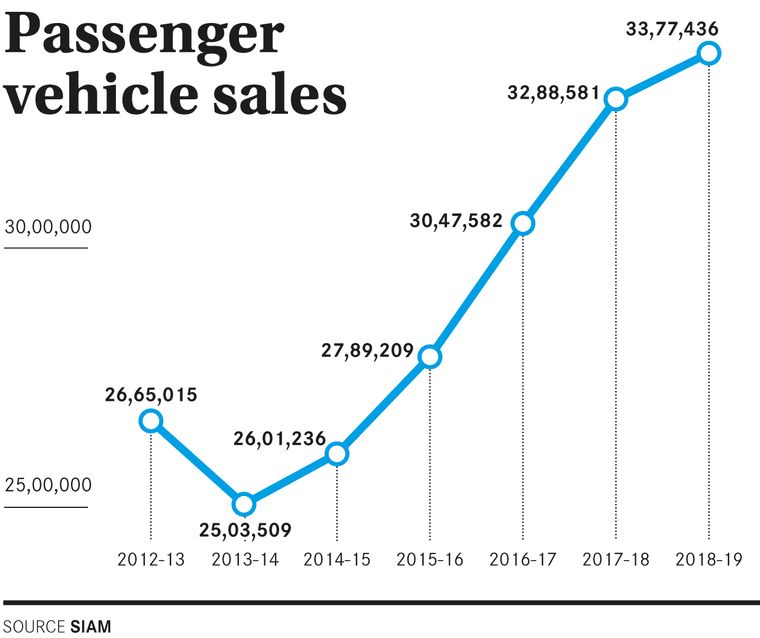

India’s passenger vehicle industry has long been the toast of the economy. In January, it overtook Germany to become the world’s fourth largest PV market by volumes, after China, the US and Japan. Consulting firm McKinsey has predicted that India would become the third largest market by 2021.

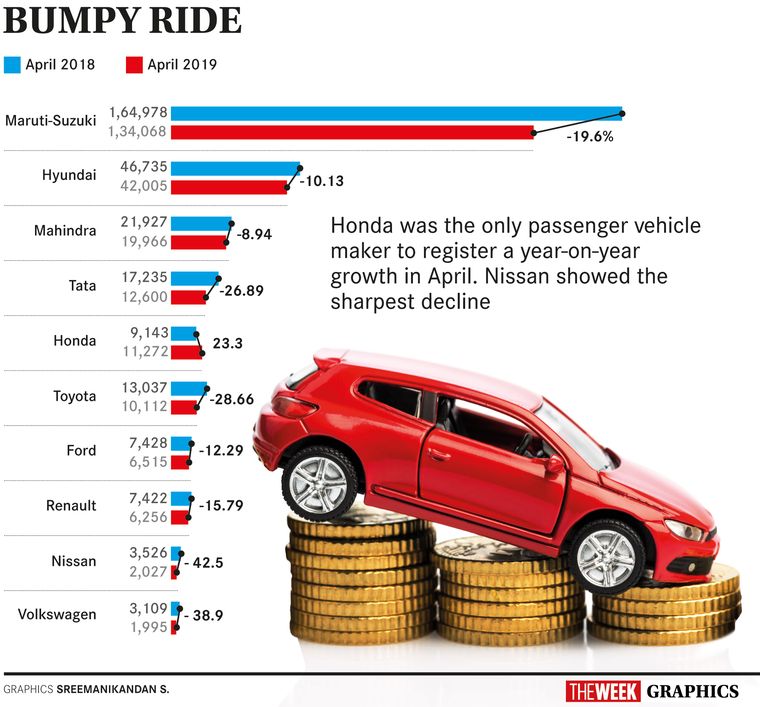

The industry, however, seems to have hit an unexpected bumpy stretch, forcing automakers to hit the brakes. Maruti-Suzuki, which makes every second car sold in the country, saw its domestic sales in April slump 19 per cent year-on-year to 1,34,068 units. Its closest rival, Hyundai Motor, fared no better, reporting a 10 per cent decline in sales to 42,000 units in the month.

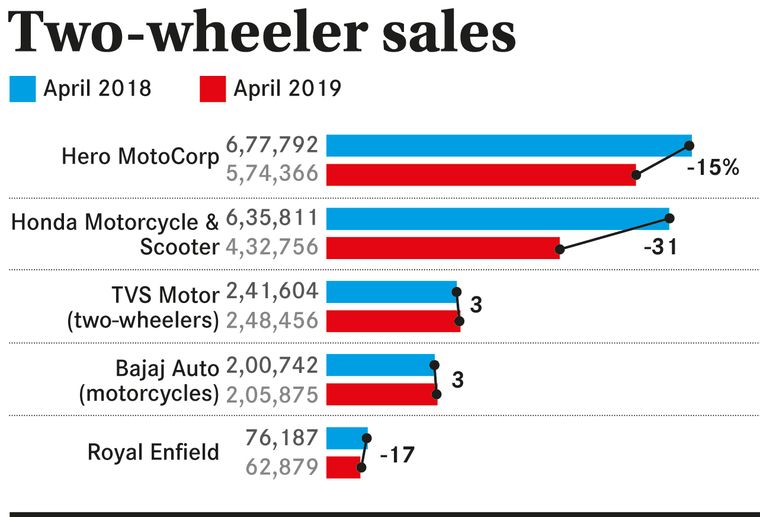

The two-wheeler market also has hit the slow lane. Hero MotoCorp, the country’s largest bike-maker, plunged 17 per cent to 5,74,366 units last month. Honda Motorcycle and Scooter registered a sharper decline of 31 per cent, and Royal Enfield reported a 17 per cent decline.

There are many reasons for the slowdown. Most automakers raised prices in January as raw material prices were on the uptrend. From April, new safety norms for two-wheelers became mandatory. All motorcycles and scooters above 125cc are now required to have anti-lock braking system, and smaller displacement vehicles (up to 125cc), a combined braking system. This has pushed up two-wheeler prices by Rs 1,000 to Rs 10,000.

A bigger blow was dealt by the Insurance Regulatory and Development Authority of India, which made long-term third-party insurance mandatory for car (three years) and two-wheeler (five years) purchases last September, after a Supreme Court order. A personal accident cover for the owner-driver, worth Rs 750, was also made mandatory. This pushed up the overall insurance premiums for new car purchases by Rs 5,000 to Rs 20,000, depending on the model. For two-wheelers, the insurance premiums have gone up by Rs 1,000 to Rs 10,000, depending on engine capacity.

“Prima facie the rise in the insurance cost and raw material cost, which has led to the increase in the final pricing of the vehicle on road, is pinching the customer,” said Foram Parekh, analyst at Indiabulls Ventures.

A slowdown in rural consumption on the back of subdued farm prices, and a low pay hike for the organised workforce are also crimping demand. “Automobile sales come under discretionary spending,” said Madan Sabnavis, chief economist at CARE Ratings. “There are issues on the demand side as well as the supply side. If you look at the demand side, one is that the rural economy story did not work out last year. Second, not enough jobs are being created and people are not getting higher salaries in the organised sector. Therefore, your purchasing power has come down.”

Signs of rural distress are visible. Mahindra & Mahindra’s farm equipment sales declined 8 per cent last month. Escorts’ agri-machinery sales were down 18 per cent. “An analysis of macro (household savings data) and micro (sector and company volume data) suggests that households may have gradually reduced consumption because of insufficient income growth,” said Sanjeev Prasad, co-head of Kotak Institutional Equities.

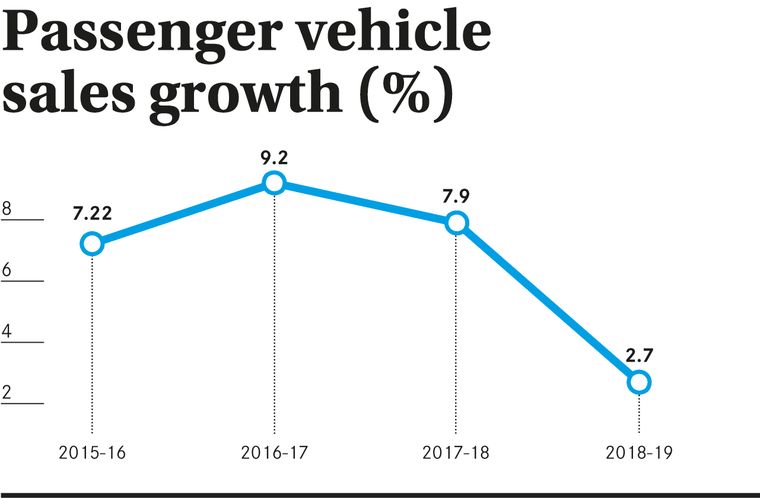

Data released by the country’s major automakers show that for the year ended in March 2019, PV sales grew just 2.7 per cent, the worst in five years. Cumulative sales growth in April declined around 16 per cent from a year ago. Honda was the only one to buck the trend in the month, reporting a 23 per cent jump in sales helped by new models Civic and Amaze as well as the low base effect of the last year. Honda, too, remains cautious, though. “The elections and the overall subdued market sentiment continue to affect the sales momentum,” said Rajesh Goel, director, sales and marketing, Honda Cars India.

The sentiment was echoed by Tata Motors, which reported a 20 per cent drop in domestic sales of PVs and commercial vehicles. “The industry has recorded degrowth for the tenth consecutive month,” said Mayank Pareek, president, passenger vehicle business unit, Tata Motors. “Weak consumer sentiments are reflected in this and we have also been impacted.”

The crisis at IL&FS sapped liquidity from the non-banking financial services sector over the past few months. It has made auto loans difficult to come by, dampening consumer appetite for new purchases. “NBFCs have been major lenders in the segment,” said Sabnavis. “While some have done well, others have had problems sourcing funds. So the cost of borrowing has also gone up.”

Commercial vehicle sales, too, have been down in the past few months owing to the new axle load norms approved by the government. The maximum load carrying capacity of heavy trucks was increased by 20 to 25 per cent, which allows fleet operators to increase load on existing vehicles and, in turn, reduces the demand for new trucks. “The industry is yet to recover from the revised axle load norms, while the postponement of demand due to general elections has also dragged down CV sales,” said Girish Wagh, president of CV business unit at Tata Motors. The company reported 18 per cent drop in domestic truck and bus sales.

Automakers are now focusing on reducing inventories in the market, and aligning production to demand. On July 1, the second phase of safety regulations for cars will kick in. It requires all cars to have a driver-side airbag, seat-belt reminder, rear parking sensors and some other safety features. They will further raise the on-road prices.

From April 1, 2020, automakers will have to shift to the new Bharat-VI emission norms. That means, they will not be able to sell the BS-IV vehicles from April 1. Most companies will make the transition over the next few months to ensure that there is no unsold inventory of the dated vehicles. “The industry is heading towards a tougher year because of the volatility in fuel prices, increase in car prices owing to new regulations and stricter inventory control for smooth switchover to BS-VI regime by year end,” said Goel.

On the other hand, automakers are expecting a spike in sales in the second half of the year, as customers may want to avoid paying a premium for BS-VI vehicles. “We do expect FY20 to be a tale of two halves. Probably some of the challenges may continue into quarter one as we correct the inventory. But thereafter, we do expect pickup and moving on to festive and then to sort of pre-buying because of BS-VI,” said Niranjan Gupta, CFO, Hero MotoCorp.

Maruti-Suzuki has already signalled it may phase out a few diesel cars from April 1, as the stricter emission norms will increase prices and the difference will go up further for the petrol models. Diesel vehicles accounted for around a quarter of the company’s total sales in 2018-19, and analysts feel the volumes could come down because of this. In a post-earnings conference call with analysts, Ajay Seth, chief financial officer of Maruti-Suzuki, said 2019-20 could be an unpredictable year. “These regulations would lead to increase in price and may affect the demand, specifically for price-sensitive, entry-level cars,” he said. “It is also interesting to see how the customers will respond to the change in regulations.”