When a terrible drought hit the land of Oudh in 1784, Nawab Asaf-ud-Daulah did not distribute free food to his starving subjects. Instead, he provided employment and got them to build the Imambaras in Lucknow. Among these, the Bada Imambara is best known, especially for its quirky labyrinth. This is the famous bhool bhulaiya—a maze consisting of passages and corridors, staircases, dead ends and pitfalls.

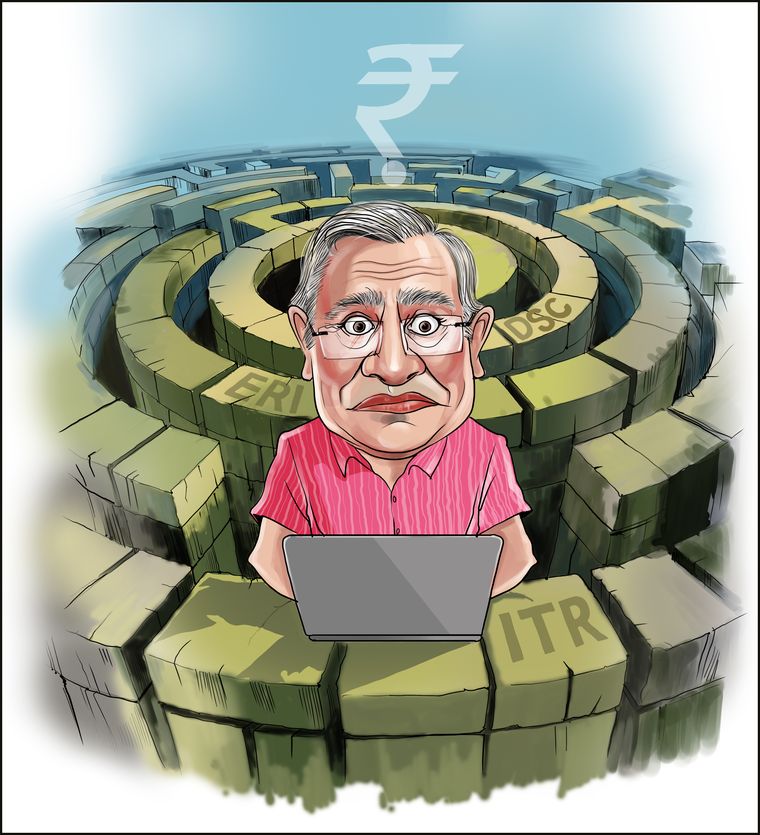

I am convinced that it was some descendent of the generous Nawab who designed the modern-day maze called the Income Tax portal. It is a wondrous creation, just like the bhool bhulaiya, with convoluted corridors, unexpected dead ends and treacherous pitfalls. The website pushes you on paths that you do not want to take, and then leaves you totally confused and lost. It serves a purpose higher than any bhool bhulaiya ever could, because it bridges the gap between the physical and the metaphysical. It tests your faith in the Almighty and teaches you spiritual tolerance. It also poses innumerable questions of an existential nature, ranging from “What is your PAN, TAN, XAN” to “Are you filing as Individual/HUF/Firm/ET/Other?” Sometimes the website is downright rude and calls you names in abbreviated form, like ITR, ERI, DSC and even an owteepee!

Last Friday, while trying to file my return, I got lost in the labyrinth of “Error 503: Service Unavailable. Invalid JSON format.” Suddenly I came to the crossroads of the ‘DTSV Scheme of 2024’ and ‘Download CSI File’ and got stuck on ‘eTutorials’. My respect for the IT johnnies went up several notches. They are truly edified blokes! By providing a tutorial they have acknowledged that their website is a bhool bhulaiya. Bravo! It takes courage to admit that you have mucked up and these tax walas have done so with such grace!

I had barely started my eTutorial when I got timed out. I logged in again and got timed out again. And again. And again. Since it was close to midnight and I was cranky and sleepy, I screamed at my computer for a good ten minutes.

“Why don’t you seek Gopu’s help? That no-good friend of yours fancies himself to be a tax expert and hands out advice to all and sundry,” said my sleepy wife, petulantly.

The old girl was right! I should have thought of Gopu earlier! He never tires of giving advice and he uses tax codewords for anything and everything. His vocabulary has phrases like “Where’s your 12BB”, “Have you got a 26QE”, or “Have you reported speculative losses?” When I once asked him what 12BB was for, he enigmatically replied, “It makes the government slightly less suspicious of you.”

Gopu came by on Sunday to help me file my IT return. I confessed to him that I did not know the difference between FY and AY. I also admitted that I get frustrated by the taxman’s diktats that keep changing, exempting, altering, modifying, replacing, substituting or adjusting rules, subrules, footnotes and loopholes.

“Why do they keep changing the rules and rates and returns?” I asked Gopu. “Why the hell can’t they execute their improvements, simplifications and rationalisations in one go?”

“Just who do you think you are—some hotshot finance minister?” taunted Gopu. “Aren’t you aware there is a whole paper pulping industry out there somewhere, that thrives on outdated compendiums, ready reckoners, handbooks and collations of rulings of courts, CATs, BATs and ITATs?”

When we got down to business, Gopu had a good laugh at my pathetic finances. He declared that by agonising over my tax return, I was subjecting myself to a ‘financial colonoscopy’ without reason. He sniggered that this year we have till mid-September to file our returns because the income tax blighters scored a self-goal. They made their codes and forms so complicated that they themselves need more time to understand them! Very cleverly, and condescendingly, they have made it known that the date has been extended as a special favour to the taxpayer!

Gopu and I then spent a lot of time filling the boxes, columns and forms bearing numbers like 80C, 80CC, 80CCC and 80CCD (1). We wasted a lot of time getting timed out. But we certainly spent the most time with CII.h(50)H. With a misty look in his eye, Gopu said, “Earlier there used to be Delta(TH)C9, too, which was loads of fun. Sadly, because of changing laws, one can’t have it now.”

Later, in the evening, when we got thoroughly confused, we decided to give up and live to file another day. “You know, Gopu,” I said, “the government may have the sovereign right to snatch my money, but I resent the spin that is given to this extortion. I am told that I pay taxes for my own good. But actually, I’m financing freebies for assorted freeloaders, for which some modern day Asaf-ud-Daulah will take credit. Can’t I stop paying taxes altogether?”

“Well, there I can’t help you, my friend,” said Gopu, getting up to return home. “Not for nothing is it said that death and taxes are inevitable. What people like you should accept is that death is simpler. And kinder. And quicker.”

K.C. Verma is former chief of R&AW. kcverma345@gmail.com