In his first monetary policy announcement as Reserve Bank governor, Urjit Patel gave clear indications that he had made a perfect sense of the market and government sentiments. The Monetary Policy Committee (MPC) under his watch reduced the benchmark repurchase rate by 25 basis points to 6.25 per cent on October 4, paving way for a reduction in interest rates.

The market read the rate cut as ‘dovish’, a departure from former governor Raghuram Rajan’s ‘hawkish’ stance over inflation. “We were expecting that the new governor will continue with the same hawkish stance as the previous governor,” said Jayant Manglik, president (retail distribution), Religare Securities. “Inflation is still not subsided and, in fact, has some chances to spike in the coming few months. A scope for cutting the policy rates was also there for the December policy instead of this one.”

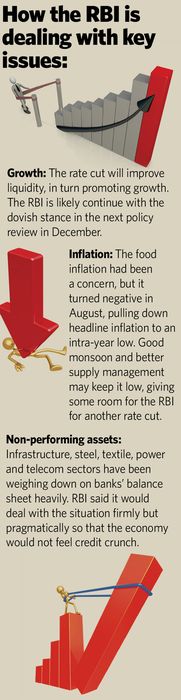

In fact, a cut in borrowing and lending rates is now expected in the December policy announcement, too. “We believe the rate cut was very much required for the economy, and if inflation data support there could be another cut of 25 bps towards the end of the financial year,” said Dinesh Thakkar, chairman and managing director of Angel Broking.

It was an RBI committee headed by Patel as deputy governor that drew the outlines of the MPC framework. With the MPC in place, the RBI’s focus now is not just capping inflation figures. The committee has been given the mandate of “maintaining price stability... while keeping in mind the objective of growth.” The government in August notified an inflation target of 4 per cent, which could vary month-on-month within a range of 2 to 6 per cent for the next five years under the monetary policy framework agreement with the RBI.

In the current policy, the MPC members said they expected inflation to remain within the 5 per cent range, the target for the 2016-17 fiscal. “There could be brief spurts or spikes given the festival season and some other external reasons, but we largely believe that the inflation will settle back to the 5 per cent range to end the fiscal,” said R. Gandhi, deputy governor in charge of monetary policy in the RBI.

The RBI expects a rise in inflation owing to a spike in food prices, increased government salaries and an increase in minimum wages announced this year by the government. “A lot of these supply side issues have already been in government focus and stocks of items like pulses are likely to get better,” said Gandhi.

As per the current agreement, the RBI will step in only if the inflation touches 6 per cent on the upper bracket or 2 per cent in the lower. “The MPC will ensure that the policy decisions are much better, firm and yet decisive when it comes to any monetary actions,” said Patel.

The MPC, which was given a statutory and institutionalised framework by amending the Reserve Bank of India Act, 1934 by the Finance Act, 2016, is equally represented by the government and the RBI. The government nominees on the panel are Chetan Ghate, professor at the Indian Statistical Institute; Pami Dua, director of Delhi School of Economics; and Ravindra H. Dholakia, professor at IIM Ahmedabad. From the RBI, the nominees are Patel, Gandhi and executive director Michael Patra.

“The government and the RBI are in sync with the numbers. This rate cut will boost liquidity and improve sentiments. Sentiments on the whole are upbeat and the decisions of the MPC will go down well with all sections of the government,” said Finance Secretary Ashok Lavasa.

The government, however, did not agree with Patel’s warning that the International Monetary Fund was likely to downgrade its GDP numbers globally. “This is the year when we are expecting the economy to inch towards an 8 per cent growth. Certainly we are looking towards better times here on,” said Lavasa.

The RBI is still concerned about the non-performing assets of banks. “We will deal with the situation with firmness, but also with pragmatism so that the economy does not feel any lack of credit to support the growth in the economy,” said Patel after his policy review announcement. He seemed to talk with a straight bat, but restricting his views to policy decisions.

The news of two slight dampeners also arrived on the day of the policy review announcement. Tempering the expectations of a bumper crop year, the India Meteorological Department said that the southwest monsoon had been at 97 per cent of the long period average, significantly lower than the forecast of 106 per cent. Then the price of crude oil crossed $50 a barrel on the same day. While both these factors can upset the 4 per cent inflation target, what remains to be seen is whether Patel will swoop down on inflation like a hawk or sing like a canary on high branch when the next policy review is due.