On a balmy September morning, BJP president Amit Shah had an interactive session with captains of industry at an event organised by the Federation of Indian Chambers of Commerce and Industry in Delhi. It had been only a few days since the Reserve Bank of India in its annual report published the data on the demonetisation and revealed that about 99 per cent of the withdrawn currency had returned to it. This had left a gaping hole in the government’s claims about the demonetisation netting fake currency and eradicating black money.

Shah, however, was unfazed. “We are watching the media,” he said. “You can say a lot of things about the demonetisation, debate it, but one thing which no one can deny is that it has led to an increase of the formal economy.”

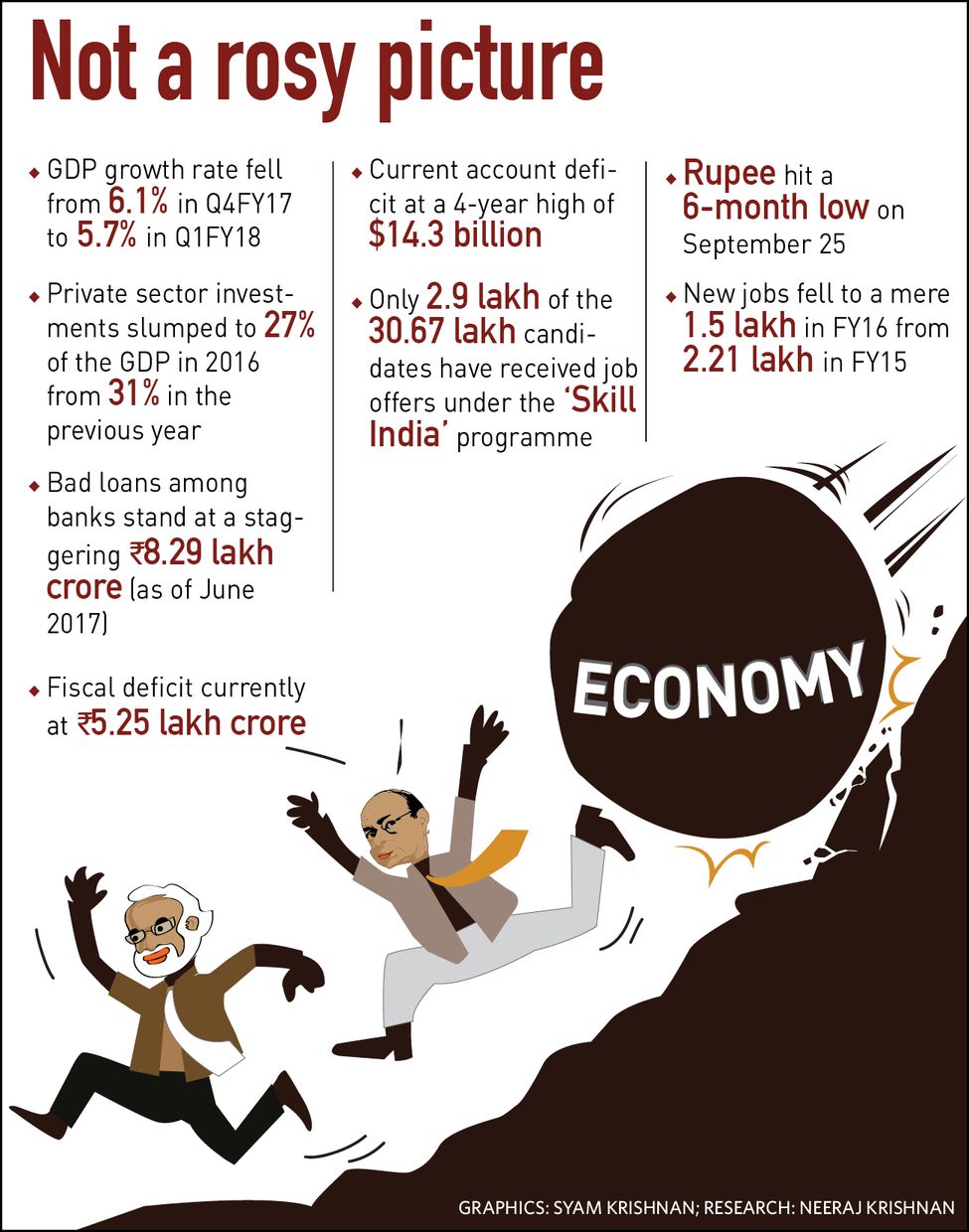

However, it was not just the media who had been criticising the government. Before Shah took the dais, he had heard bad things about the government from the industrialists who attended the session. He had some advice for them. “In the past three years, the Modi government spent huge amounts to build the ‘Brand India’. FICCI’s job is not only to bring forward complaints but also to make suggestions about how Indian industry can cash in on this goodwill,” he said. He attributed the 2 per cent drop in the GDP growth, at 5.7 per cent for the April-June quarter, to “technical reasons”.

An increase in tax payer base (up 27 per cent) and advance tax collection (up 42 per cent) are the only positive things that Shah and company could gloat about. And some friends, like Subramanian Swamy and S. Gurumurthy, have acknowledged that the demonetisation drive had the economy hit rock bottom. Senior BJP leader Yashwant Sinha launched a scathing attack on the government’s economic policies, calling demonetisation an “unmitigated economic disaster” and Goods and Service Tax a “badly conceived and poorly implemented” havoc.

Former NITI Aayog vice chairman Arvind Panagariya had foreseen the problems that the demonetisation could create and advised Prime Minister Narendra Modi to go slow on the note-ban drive on more occasions than one. Those warnings were ignored, ultimately leading to Panagariya’s exit seven months later.

The latest indication of a crisis is the Modi government returning to the ways of its predecessor, the Manmohan Singh government, to deal with it. On September 25, the government formed a five-member Economic Advisory Council, comprising economists from the NITI Aayog and some others. The last time such a council was formed was in 2009, with former RBI governor C. Rangarajan heading it. The panel was much relied on by Manmohan Singh to bring the economy back on course after the global financial crisis. The Economic Advisory Council has the mandate to advise Modi on ‘any issue, economic or otherwise’.

Note of caution: Finance Minister Arun Jaitley with Arvind Panagariya, former vice chairman of NITI Aayog | PTI

Note of caution: Finance Minister Arun Jaitley with Arvind Panagariya, former vice chairman of NITI Aayog | PTI

Two weeks ago, Finance Minister Arun Jaitley indicated that an economic stimulus package for certain sections could be in the offing. The catch is that these packages would be an additional burden on taxpayers and can lead to more borrowings, which means more interest burden on the exchequer. By August, Jaitley had spent 94.7 per cent of the budgeted expenditure. With a stimulus, he is unlikely to meet the fiscal deficit target of 3.2 per cent of the GDP.

Among the first beneficiaries of any economic stimulus package would be the exporters, who suffered heavily from the erratic implementation of the GST. Exports worth $300 billion are facing gloomy prospects as there are complaints that their tax refunds are not coming on time. Exporters were brought under the ambit of 18 per cent GST with the promise that the tax they pay would be refunded. “Exporters cannot just wait, as they have to work in seasons and meet delivery deadlines, say for Christmas. Our working capital gets blocked after paying such huge amounts of GST. As a result, exporters are forced to borrow to meet short-term working capital needs,” said Ganesh Gupta, president, Federation of Indian Export Organisations.

The GST Council, a joint forum of the Centre and states to make recommendations on important issues related to the tax regime, had put in place a panel headed by Bihar Finance Minister Sushil Kumar Modi to look into these complaints. But Commerce Minister Suresh Prabhu has already assured that the fast-tracking of GST refunds of more than Rs 50,000 crore was likely by October. “We are consulting everyone on this and whatever is in the interest of the trade will be done,” Prabhu told THE WEEK. “Alongside this, the NITI Aayog is also working on a roadmap to improve employment generation through exports. All these measures will take some time to be firmed up. Once finalised, these will be among the prominent features of our new foreign trade policy.”

Fuel prices in India have been on an upward swing at a time when the global crude prices remained flat. More so since the dynamic daily pricing system for fuel was introduced in June. As a result, consumer price inflation rose to 3.36 per cent in August, up from 2.36 per cent in July and 1.54 per cent in June. According to data released by the petroleum ministry’s Petroleum Planning and Analysis Cell, the hike in fuel prices was on account of a 126 per cent jump in Central excise and state excise duties. Petroleum Minister Dharmendra Pradhan, however, passed the buck to the state governments. “Nothing could be done about reducing prices until states agree to bring fuel under GST,” he said.

Over the past three years, states and the Central government hiked excise duties on fuel to make up for their falling revenue share because of the plummeting global oil prices. The tax bonanza had helped the Modi government to increase government spending on infrastructure and touch a high of 7.1 per cent in GDP growth. “If we take away government spending, we see that the economy has not grown anything beyond 4 per cent in these three years,” said Mahesh Vyas, managing director of Centre for Monitoring Indian Economy. “The problem is that private investment in developing infrastructure had remained at an all-time low, despite early indications of it rising when the new government took over in 2014.”

The GST Council extended the deadlines for filing returns several times in an attempt to bring the maximum number of businesses under the GST umbrella. Many companies had complained about glitches in the GST software and delay in processing of their returns. The GST Council has set up a ministerial group to look into the glitches in the GST Network. Infosys, the main GSTN software vendor, has been directed to “sort things out” by end of October. An Infosys official, who is also an office bearer at software body NASSCOM, said that the government finalised certain policies and informed the company about these changes at the eleventh hour.

Apparently, Infosys did not get time to run trials of the finished product, which might have led to the glitches. “It is like building a ship while sailing it,” said Sushil Modi after the recent GST Council meeting.

The hardest hit by the slowdown probably are the youth and farmers. Modi had promised to create a crore jobs in his Lok Sabha poll campaign in 2014. Three years later, the Pradhan Mantri Kaushal Vikas Yojna (PMKVY), which was launched to meet the prime minister’s promise, presents a different story. PMKVY data till end of June this year showed that though 30.67 lakh candidates had been trained under the government’s skilling programme, only 2.9 lakh had landed job offers.

Between 2013-14 and 2016-17 real wages in non-agricultural jobs for casual and unskilled workers declined by 0.1 per cent a year. Before 2013-14, it used to grow at 7 per cent. Real wages in the agriculture sector had been rising at 1 per cent a year in the past three years. Before 2013-14, however, it used to grow at 7.8 per cent a year.

The government is yet to come up with any concrete policy for farmers, though it had promised to double their income by 2022. On the other hand, farmer suicides have been rampant, prompting some states to announce farm loan waivers. “Farm loan waivers are short-term measures to bring farmers to the mainstream. Now we need to follow it up with long-term measures, as the crisis is fundamentally about farmers’ income. We have deprived farmers of their income while focusing on traders,” said activist Devinder Sharma.

Choudhary Rakesh Tikait, president of the Bharatiya Kisan Union, said farmers who had prosperous households in the 1970s had witnessed a significant drop in their income and been reduced to poverty. “The game plan of this government is to force farmers to sell their land and make themselves available as cheap industrial and construction workers in cities,” he said.

Modi, however, is still busy spinning new tales for the voting public. This time, it is of his dream of a ‘New India by 2022’, under which a six-point agenda was adopted by the BJP national executive, seeking to rid the country of poverty, terrorism, casteism, communalism and corruption. Unfortunately, here too the problems ailing the economy do not find a place, despite the demands from his own party members.