For many, marriage could be in the cards this year. A wedding is one of the most important events in anyone’s life. Apart from the other aspects of marriage, there is the financial aspect to consider, especially in India where weddings tend to be a grand affair.

The cost of a wedding depends on the type of wedding one chooses. Theme weddings or specialised weddings such as those held by business families could cost several lakhs. On the other hand, one can have smaller, less lavish weddings without spending one’s life savings.

The longer one can save for a wedding, the more the investment avenues with lower risk. Say, if one has more than 20 years to save, then one can look at equity mutual funds—ideally mid- and large-cap funds—or even direct equities that will give good returns over this time horizon. The lower the investment period, the less the options available to invest. For instance, if the time horizon is five years, then equity is no longer an option. For even shorter time periods, the best investment avenues are debt and gilt funds, which protect capital but give lower returns. It is wise to keep in mind that the longer one waits to save, the more one has to save.

One should also keep in mind inflation, as this will erode the value of any investment. If the inflation is 7 per cent and the rate of return on the investment in 12 per cent, the actual return one can earn will be only 5 per cent. This should be factored in while deciding the investment avenues and time horizons.

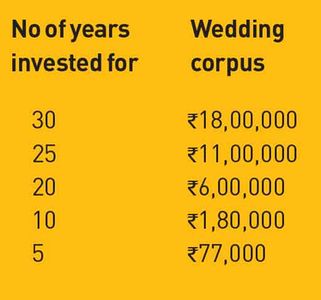

If one invests Rs.10,000 each year at 10 per cent interest per annum, the corpus will be as below:

Another important aspect of any Indian wedding is shopping for jewellery, clothes and gifts. It is always advisable to start buying jewellery from early on, especially for your child’s wedding, as it spreads out the cost of gold or other precious metals and stones over the years. The ideal way to invest in gold is a monthly investment.

Also, it is better to invest in gold mutual funds or gold exchange traded funds, which can later be converted to physical gold. This will give the benefit of rupee cost averaging. This can result in a substantial corpus to purchase or convert into gold by the time your child is ready to get married.

One should also make a budget for the wedding beforehand, with detailed cost breakups on how much is to be spent on venue, shopping and food. In all Indian weddings, there is always a lot happening and one should keep in mind that there will be quite a few unplanned expenses.

Rego is CEO and founder of Right Horizons, an end-to-end investment advisory and wealth management firm.