Do you have a lump sum amount which you want to invest immediately? And, are you finding it tough to choose between mutual funds and systematic investment plans (SIP)?

SIPs require a fixed amount of regular investments over a set period of time. Typically, it is fixed on a monthly basis. The biggest advantage of SIPs is that it helps you invest small amount of your earnings regularly without compromising on your other savings, investments or expenses. Second, you need not bother about the ups and downs of the market as the rupee cost of averaging helps you in the long run. Third, it helps you to plan for your future financial goals in advance.

Lump sum investment in mutual funds, on the other hand, is an attractive proposition when the market has hit rock bottom and the only way it could go now is up. It is a tricky situation, because it is a challenge to time the market. If you invest when the market is at its peak and, subsequently, it witnesses a downfall, you would incur a loss.

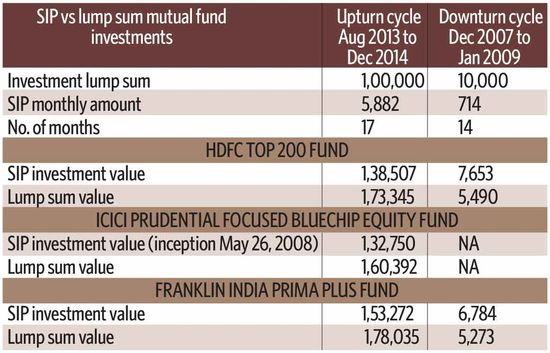

So, which one do you pick? Let us look at how an investment of Rs.1 lakh any of the top three mutual funds have grown in the up and down cycles. We have considered two durations: between August 2013 and December 2014, called an upturn cycle, and between December 2007 and January 2009, called the downturn cycle.

During the upturn, the lump sum mutual fund investment generated higher returns as compared to SIPs. During the downturn, SIPs generated higher value.

You could invest lump sum if you think you could time the markets, and if the timing is right. The wise thing to do, however, would be to take the benefit of SIPs as they are not dependent on the ups and downs in the market.

You could also invest a portion of the lump sum directly, and the remaining through SIPs. Or, you could opt for systemic transfer plans where you could invest in debt funds and then transfer the funds to equity funds on a systematic basis. However, before picking an investment plan, discuss the options with a financial advisor, who would devise a plan for you depending on your risk-taking capacity and financial goals.

In conclusion: c

* Invest lump sum only when you can time the market or invest through SIPs.

* SIPs do well in the long run and across economic cycles, and during downturn.

* SIPs reduce risks and create value in the long run.

Rego is chief executive officer and founder of Right Horizons.