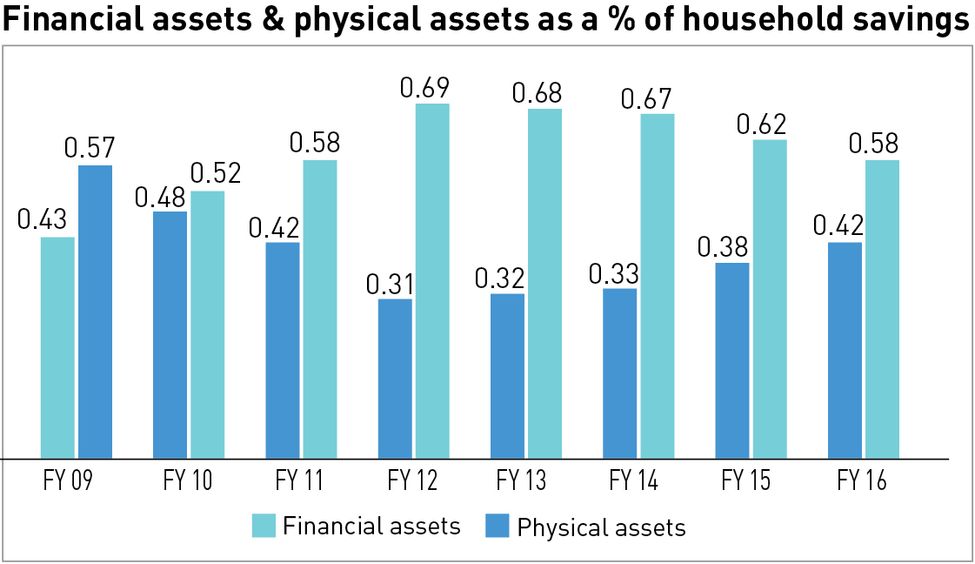

A mutual fund is a professionally managed investment fund that pools money collected from many investors for the purpose of investing in securities such as stocks, bonds and money market instruments. Mutual funds have outperformed the other asset classes in India over the long term. With the improving Indian economic prospect, better regulatory environment and improved corporate governance, the future outlook of mutual funds (debts, equity) looks sanguine and retail investors in India have begun to realise this opportunity, thereby increasing allocation of their savings to mutual funds. Furthermore, declining interest rate on fixed deposit (which had so far remained the preferred investment destination of Indians), flexible investment schemes by various houses and disciplined professional managements also helped attract people to mutual fund products.

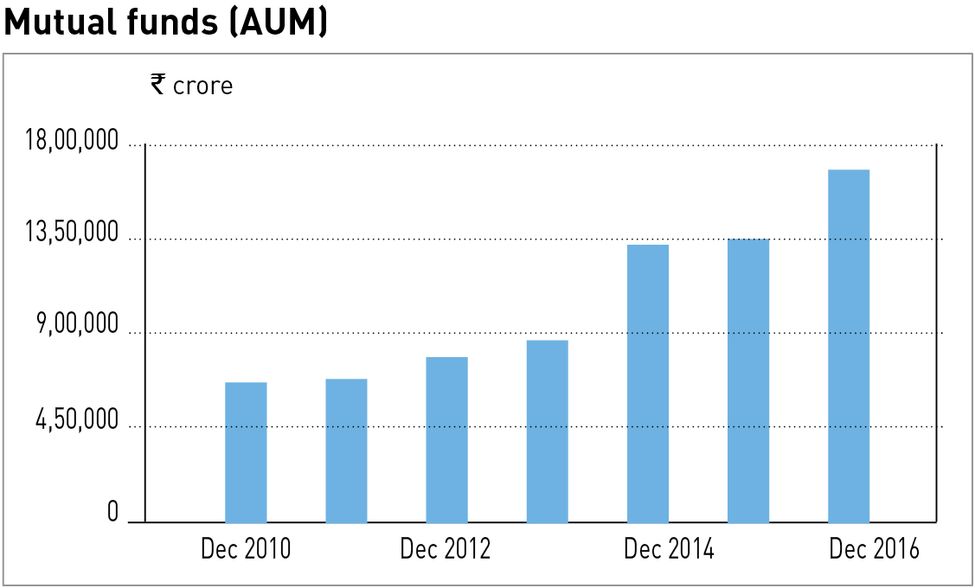

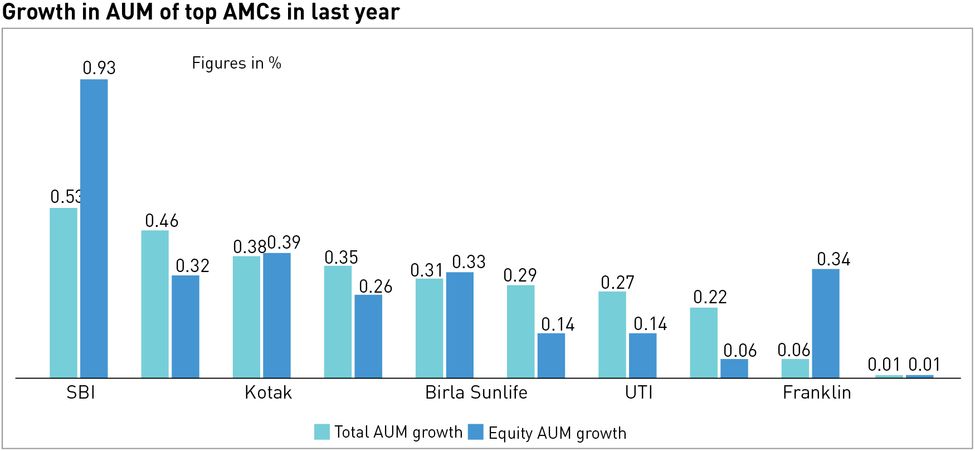

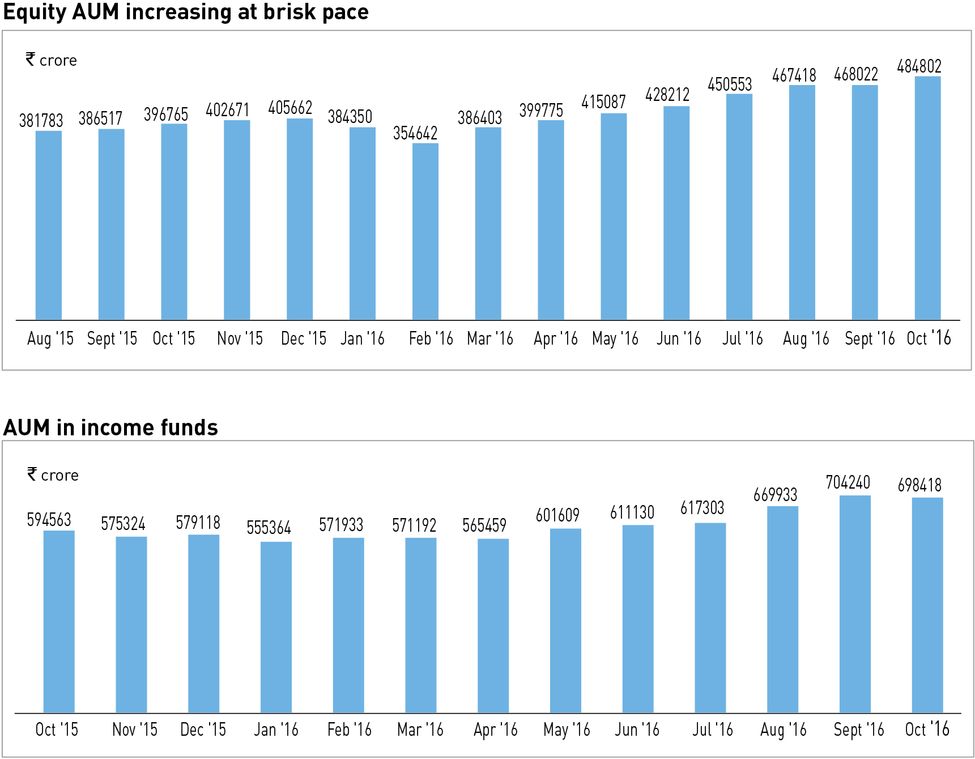

Fund houses invest the garnered pool of money into debts, equity and money market instruments and accordingly launch various mutual fund schemes. During the first seven months of FY17, the mutual fund industry witnessed an inflow of Rs 2,66,898 crore, of which Rs 31,627 crore (~11.8 per cent of total inflow) came into equity and ELSS funds and income funds were able to collect Rs 1,52,304 crore (~57 per cent of total inflow) during the same period. Total AUM by the end of October 2016 was Rs 1,62,8976 crore, which rose by 23 per cent YoY, and of which 46 per cent was held by income funds and ~30 per cent by equity funds.

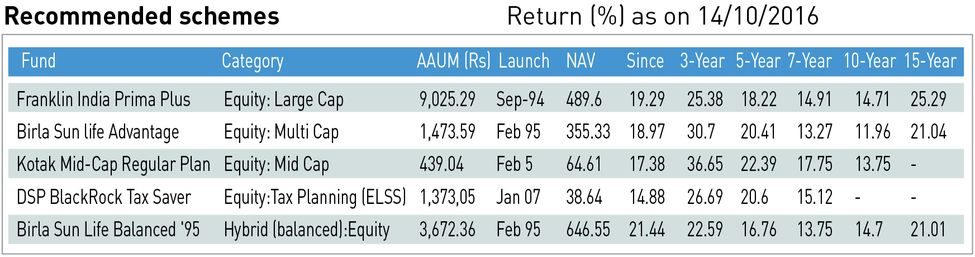

RECOMMENDING INVESTMENTS IN MUTUAL FUNDS

We believe that mutual funds are a one-stop solution for all investment needs, whether one wants to generate above inflation return, put away money for one's child's higher education 10 years from now, save tax or get regular income in retirement.

Mutual funds are designed as well as diversified investment portfolios managed by professional fund managers, who warrant rigorous investment discipline. The fund managers are generally able to allocate more time and resources to monitoring investments than an individual could, and tend to react less amid volatility in equity markets. We are of the view that mutual funds offer the best option for retail investors to invest in financial instruments.

RATIONALE BEHIND MUTUAL FUND INVESTMENTS

The Indian equity market is currently trading at P/E ratio of about 18 times 12-month forward earnings, which is higher to its long-term average—between 13.5 and 16.5 times. High multiple does not mean that the valuation is expensive. While the premium for Indian market has increased owing to various factors, including progress on the policy front, improved macro-economic fundamentals and large market size, global factors have also played out in India’s favour. The decline in crude oil price has reduced the country's imports bill, current account deficit and inflation. And, as India's economy is consumption driven, the prevailing slump in the global economy has limited impact on it. Thus, the country has become one of the preferred investment destinations, which is seen in the increasing overseas fund flows. In FY16, FDI increased by 29 per cent from $30.93 billion to $40.0 billion. After two years of drought, a normal monsoon this year has improved the inflation outlook, which could mean more easing of interest rates. The implementation of 7th pay commission, One Rank One Pension, and easing inflation will positively reflect on demand for sectors like FMCGs, auto and financial. The passage of key crucial bills such as bankruptcy code, GST bill and real estate bill will improve the ease of doing business in the country. Also, the government has increased the allocation for infrastructure development by 22.5 per cent YoY to Rs 22,000 crore for FY17.

Global rating agencies and financial institutions are bullish on economic growth. In the latest economic outlook report, where the International Monetary Fund was sluggish on world economic growth for two years, it mentioned India as a sweet spot and expected a growth of 7.6 per cent in 2017, which could further increase to 8.1 per cent in 2018.

Moreover, the government’s move to abolish high-denomination notes will strengthen the banking system as deposits increase, thereby cutting the cost of funds, which will pave the way for more interest rate cuts. Further inflation will ease as unnecessary demand generated by the unaccounted money will be wiped out from the system. Besides improving inflation outlook, higher deposits and weak credit growth would prompt banks to cut interest rates. Meanwhile, a sizeable amount mobilised will be parked in government securities, which is likely to bring down bond yield. Bonds with higher duration would witness strong capital appreciation from lower interest rates (~1 per cent fall in interest rate will boost capital appreciation by 5 to 6 per cent for a 10-year bond while 9 to 10 per cent for a 20-year bond). Moreover, fall in cost of capital would boost the fair value of equity. Fiscal deficit, which widened to 83.9 per cent of budget estimate during the first half of FY17, is likely to witness significant improvement because of the higher dividend from RBI on the back of reduction in liabilities and rise in the other income. As more money comes into the system, tax to GDP ratio (10.5 per cent in FY16 versus 11.9 per cent in FY08) will improve, and the overall development of organised sector will boost the business outlook of the country. Last but not least, the move will take the country on the digital money path.

After a strong rally since February, we expect some consolidation at this level for the short term. Furthermore, global events like high probability of United States Fed rate hike by December and uncertainties over policies to be taken by US president-elect Donald Trump can weigh on investor sentiments. Meanwhile, with the strong growth momentum in the economy, the outlook for the Indian equity market is very bright. In the easing interest rate scenario and after demonetisation, people will invest more in equities that ensure above inflation return over time. In the medium to long run, the domestic market is on the cusp of starting a big rally.

DEBT MARKET PRESENTS A STRONG OUTLOOK

The prospects of the Indian bond market are also looking bright, given the latest initiatives taken by the government like the bankruptcy code, easing interest rate cycle and improving business conditions in the country.

According to the World Bank, resolving insolvency proceedings in India takes approximately 4.3 years on average; it takes six months in Japan, eight months in Singapore, one year in Malaysia and the United Kingdom and 18 months in the US. The recently enacted insolvency and bankruptcy code 2016 will deepen bond markets. Furthermore, with better certainty of outcome and faster resolutions expected after the implementation of the code, the interest of both domestic and foreign investors in lower-rated paper will increase over a period of time.

The government has set inflation target of 4 per cent(+2 per cent/ -2 per cent) for the next five years and will frame the monetary and fiscal policies in a way to meet the inflation target. Furthermore, the outlook of inflation has also improved as prices of food articles as well as fuel are likely to remain under check. Likelihood of low inflation as well as demonetisation will ease interest in the economy, prompting many corporates to issue bonds at low interest rates.

Outlook—Over the years, equity shareholding has witnessed strong shifts in favour of large institutional investors like insurance companies and banks. Nevertheless, this transition also brings hot money from the global hedge funds and creates volatility in Indian equity markets, scaring the common man, who has started looking at equity as a financial asset. Equity is a strong asset of wealth creation and domestic institutions have realised this. Going forward, volatility in the Indian equity markets is likely to decline as sharp outflow by foreign institutional investments will be offset by buying by domestic institutional investments and thus will build more confidence among Indian people to channelise more savings into equity. Furthermore, we recommend the people invest in mutual funds through systematic investment plans to adequately leverage the return opportunities arising from the volatility in equity markets.

Assets under management of mutual funds, which has risen to ~Rs 17 lakh crore (~15 per cent of GDP) till November 16, is expected to double within the next three years as people will no longer be investing in real estate and gold, and would rather put their money in capital markets, including mutual funds.

KEJRIWAL IS PRESIDENT, BROKING AND DISTRIBUTION, CHOICE INTERNATIONAL LTD.