The Union cabinet approved an ordinance to raise the ceiling on Goods and Services Tax cess for luxury vehicles and SUVs from the current 15 per cent to 25 per cent.

Exactly two months after the roll out of the mother of all financial reforms, the Goods and Services Tax, the government dealt with a major matter of detail, in terms of the fallout. There will apparently be course correction as the GST engine chuggs along.

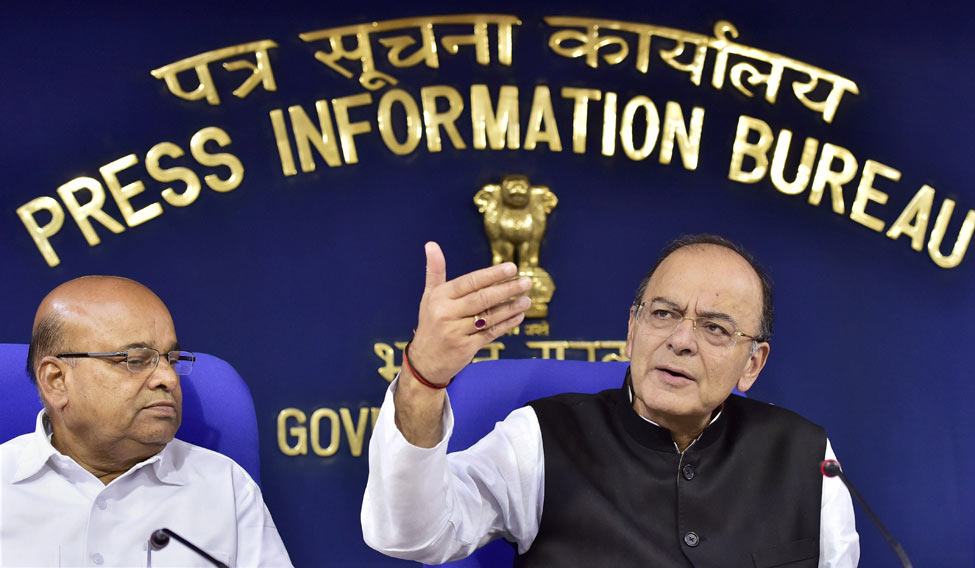

"It can't be that luxury becomes cheaper, and items used by the common man costlier," commented Finance Minister Arun Jaitely, as they found the price of luxury vehicles had reduced, while those of the small cars remained unchanged, post GST roll out. GST, over a period of time, is expected to bring down prices of goods and services used by the common man.

To correct this, the Union cabinet on Wednesday gave its nod to the finance ministry that sought to promulgate an ordinance that will enable the GST council to slap a higher cess and balance the price of luxury in relation to the vehicles used by the common man. While the "compensation cess" was capped at 15 per cent hitherto, it will now be 25 per cent.

This will apply to vehicles falling under the headings of "8702 and 8703" in the government list, and comprise top end luxury vehicles. "It does not mean that the cess will be charged at 25 per cent, it can be anywhere upto 25 per cent", Jaitely explained, saying the ordinance will provide "scope for setting a balance".

Briefing reporters after the cabinet meeting, Jaitley said it was decided to recommend to President Ram Nath Kovind to promulgate an ordinance in this regard.

The GST council had apparently wanted room for such negotiation, and in its meeting earlier this month, taken note of the fact that post the GST, the total incidence on motor vehicles (GST plus compensation cess) had come down compared to the pre-GST price. The council had recommended an increase in the maximum rate at which the compensation cess can be levied on these vehicles.

The compensation cess charged goes into a compensation fund that is used to ensure that state governments do not lose out under the GST regime. Talking about cigarettes post the GST, the finance minister remarked, "The object was never that cigarettes be made cheaper. It would be a mindless policy if it does that ".