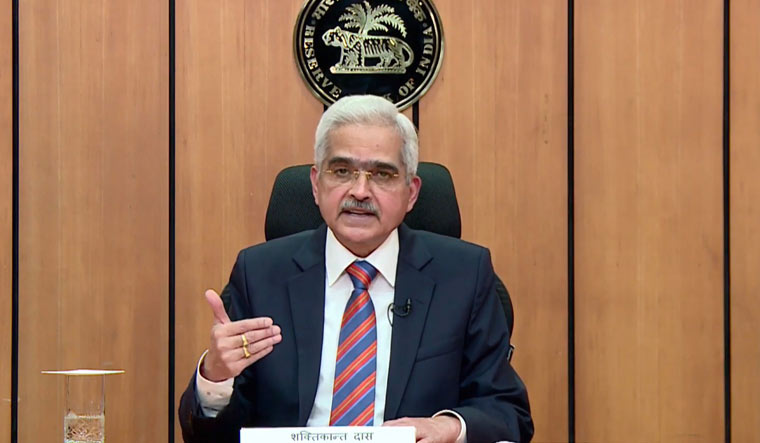

The Reserve Bank of India will continue to support innovation, but will also expect the ecosystem to adhere to governance and regulatory frameworks, Shaktikanta Das, Governor, said on Tuesday.

"I wish to assure the fintech community that the RBI will continue to encourage and support innovation. At the same time, we would expect the ecosystem to pay attention to governance, business conduct, regulatory compliance and risk mitigation frameworks," said Das.

Das' comments can be seen in the backdrop of stringent guidelines issued by RBI on digital lending recently after a number of complaints that were raised with respect to coercive practices followed by some of the firms engaged in digital lending.

"The way digital lending has taken off in the recent past was phenomenal. While it has served the needs of various segments, it has also raised several concerns which manifested itself through spate of complaints regarding usurious interest rates, unethical recovery practices and data privacy issues," Das stressed.

He said that while innovations are welcome, they need to be responsible and should enhance the efficiency and resiliency of the financial system while benefitting the consumers.

"The need of the hour is to ensure assurance of safety after following a process of green-lighting (whitelisting) and due-diligence by the regulated entities," pointed Das.

He said RBI, in association with other relevant agencies, is taking steps to address this issue and take further steps as may be necessary.

Speaking at the Global Fintech Fest, Das said that one of the most transformative roles that can be played by fintechs is in the area of credit delivery in partnership with traditional lenders, especially in rural and semi urban areas.

The RBI has recently set up a innovation hub as a subsidiary in Bengaluru. The hub, which has eminent board members drawn from the private sector and domain experts is undertaking several important projects, said Das.

The Reserve Bank Innovation Hub has designed an end-to-end digital process for seamless and quick access to rural credit.

A pilot project based on this innovation has been launched in Madhya Pradesh and Tamil Nadu in partnership with the Union Bank of India and the Federal Bank respectively, for both new Kisan Credit Card (KCC) loans and renewal of such loans up to Rs 1.60 lakh per borrower, disclosed Das.

Based on the learnings from the pilot project, the digitalisation of KCC loans is proposed to be expanded to all districts of these two states as also to other states, he added.

"Our desire is to develop and operationalise an integrated and standardised technological platform to facilitate frictionless credit to all segments of society for the whole country, with special emphasis on rural and agricultural credit.," Das said.

In the Budget this year, Finance Minister Nirmala Sitharaman had said the RBI will introduce its digital currency using blockchain and other technology in 2022-23.

Das said Tuesday that it will be launched in a phased manner.

"The RBI is now actively working towards a phased implementation of Central Bank Digital Currency (CBDC) in both wholesale and retail segment," said Das.

The RBI Governor launched three key initiaves on Tuesday—RuPay credit card on UPI, UPI Lite and Bharat BillPay cross-border bill payments.

RuPay Credit Cards will be linked to a the UPI ID, directly enabling safe, and secure payment transactions.

Customers of Punjab National Bank, Union Bank and Indian Bank will be the first to be able to use RuPay Credit cards on UPI with the BHIM app.

With UPI Lite enabled on BHIM App, users will be able to make small-value transactions in a near-offline mode.

"UPI Lite will reduce the debit load on the core banking system, thereby improving the success rate of transactions further, enhancing the user experience, and taking us one step closer to processing a billion transactions a day on the UPI platform," the National Payments Corporation of India said.

Bharat BillPay Cross-Border Bill Payments facility will help non-resident Indians to undertake utility, water, and telephone-related bill payments on behalf of their families in India.

Federal Bank, with UAE's Lulu Exchange will be the first to go live with Bharat BillPay Cross-Border Bill Payments.