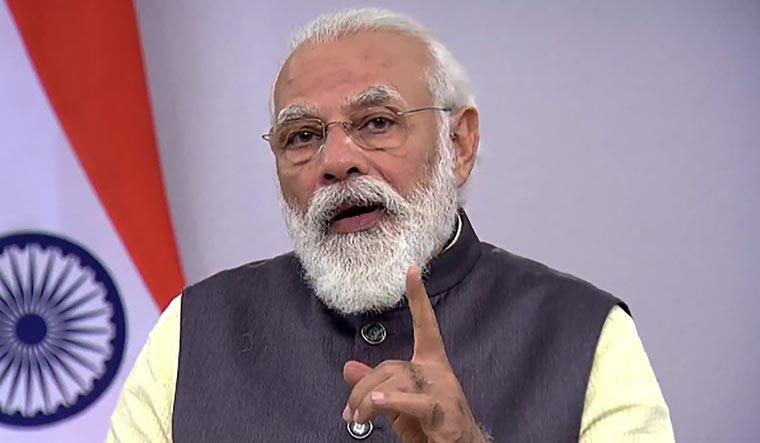

Prime Minister Narendra Modi on Wednesday asked the banks to be more discerning when it comes to dealing with the proposals. He asked them to be able to identify viable proposals to help the people and make sure that they don’t suffer because of past NPAs.

Modi held a meeting with the heads of the banks and NBFCs to review the progress made so far in engaging with the customers to revive the economy, steely hit by the COVID-19 pandemic.

Sources said the progress of schemes like emergency credit line for MSMEs, additional KCC cards, liquidity window for NBFC and MFI was also reviewed. While it was noted that significant progress has been made in most schemes, banks need to be proactive and actively engage with the intended beneficiaries to ensure the credit support reaches them in a timely manner during this period of crisis.

Modi’s review meeting came after the government had extended Rs 20 lakh crore package, mostly to introduce liquidity into the system. Despite the government saying that it will stand guarantee for people taking loans, there were instances where banks were reluctant to extend loans fearing NPAs. PM’s review meeting attended by heads of various banks, and finance minister, and senior officials was to push the banks for faster implementation of the schemes.

“The crucial role of the financial and banking system of supporting growth was discussed. It was noted that the small entrepreneurs, SHGs, farmers should be motivated to use institutional credit to meet their credit needs and grow. Each bank needs to introspect and take a relook at its practices to ensure stable credit growth,” the statement from the Prime Minister’s Office said.

“Banks should not treat all proposals with the same yardstick and need to distinguish and identify bankable proposals and to ensure that these don’t suffer in name of past NPAs,” the statement added.

The banks were assured of government support and were told that it was “firmly behind the banking system. The government is ready to take any steps necessary to support it and promote its growth”.

Sources said that during the meeting, banks were told that they should adopt fintech like centralised data platforms, digital documentation and collaborative use of information to move towards digital acquisition of customers. “This will help increase credit penetration, increase ease for customers, lower costs for banks and also reduce frauds.”

The country has built a low cost infrastructure to help people use digital payments as the main means of transaction. “Banks and financial Institutions should actively promote the use of RUPAY and UPI amongst its customers,” the PMO statement added.