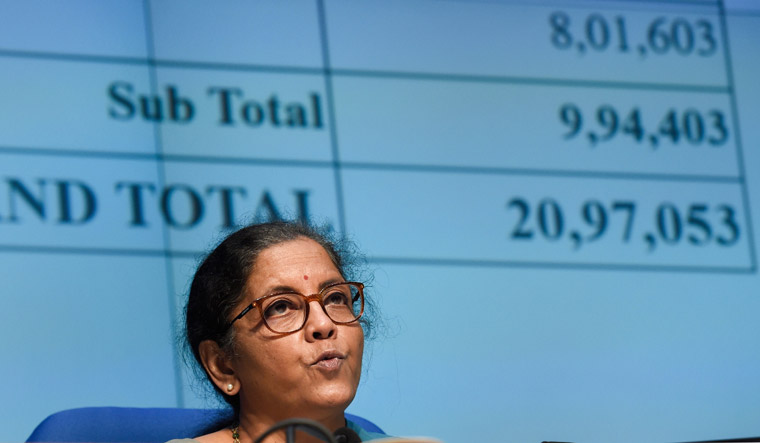

Prime Minister Narendra Modi's Rs 20 lakh crore ($277 billion) 'Aatma Nirbhar Bharat' package, aimed at reviving the economy, has elicited mixed reactions from economists and analysts. While there is consensus on the long-term benefit of the various measures announced, most of the experts also nod in agreement that the stimulus has fallen short of addressing the near-term stress and lack of demand in the economy.

The major fiscal measures announced by Finance Minister Nirmala Sitharaman include free food for the poor, including the non-card holders, direct cash transfer, money for rural job guarantee scheme MNREGA and credit guarantees to MSMEs.

While a financial task force was appointed by the prime minister early in April, India was a tad late to join the fiscal stimulus party as major developed and emerging economies around the world had already begun announcing relief measures.

Almost all the major central banks across the world have slashed lending rates and taken steps to add more liquidity into the market. However, here are the major fiscal stimulus packages announced by a few important economies of the world:

United States

The US has so far announced $2.8 trillion worth of fiscal stimulus and $4 trillion worth monetary stimulus measures.

1. Approximately $310 billion will be used to refresh the Paycheck Protection Program (PPP), which offers forgivable government-backed private loans, provided companies retain their workforce. PPP loans of up to $10 million to cover eight weeks of expenses do not have to be paid back if at least 75 per cent of the money is spent on rehiring and keeping employees. Otherwise, the loan comes with a 1 per cent interest rate and must be repaid within two years.

2. $75 billion to reimburse providers for the cost of treating COVID-19 patients. This includes funding to provide diagnosis, testing, and care of these individuals.

3. Additional 1 per cent committed to the Families First Coronavirus Response Act (FFCRA), which was created to expand paid leave options for employees effective from April 2 through December 31, and supplemental budgetary allocation made thereafter. The major steps under FFCRA include, providing money for families who rely on free school lunches in light of widespread school closures, mandate companies with fewer than 500 employees provide paid sick leave for these suffering from COVID-19, as well as providing a tax credit to help employers cover those costs. Further, nearly $1 billion in additional unemployment insurance money for states, as well as loans to states to fund unemployment insurance and funding and cost waivers to make COVID-19 testing free for all were also announced as part of FFCRA.

United Kingdom

The Bank of England (BOE) has launched a number of lending and asset-purchasing programmes to extend credit during the crisis. The UK's fiscal policy includes a tax cut for retailers, cash grants to small businesses, a mandate to provide sick pay for people who need to self-isolate and a subsidy to cover the costs of sick pay for small businesses.

1. The country has expanded access to government benefits for the self-employed and unemployed.

2. The UK has also included another programme to issue grants to companies covering up to 80 per cent of worker's salaries if companies keep them on payrolls rather than lay them off. It will be up to $3,046 a month per person. The programme has been backdated to March 1, and will last three months unless it is extended. It is expected to cost $95.1 billion.

3. $8.5 billion to increase the tax credits for the poor and unemployed, giving each person roughly $1,200 more a year.

4. Additionally, $1.2 billion in additional funds has been set aside to increase the low-income housing benefit.

5. The country also deferred the next quarter of Value Added Tax.

6. In a separate announcement, the country has also given cash grants of up to $3,080 for self employed people making up to $61,600 a year. The payments will continue monthly for at least three months.

Brazil

After lowering the benchmark interest rates, the Brazilian central bank in March announced a series of measures that would add $227 billion in liquidity to credit markets. In terms of fiscal spending, the country has decided not to relax its fiscal limits. So the package is made up of deferrals, payments that are moved up in the year, and money that will need to be moved from elsewhere in the budget.

1. In March, Brazil announced it would pay $120 a month for three months to informal workers, the unemployed, and self-employed people who are part of low-income families.

2. In addition, the import duties on medical supplies were reduced to zero.

3. Low-income families to be exempted from paying their electricity bills for three-months on April 8.

4. It also allocated approximately $7.5 billion for housing credits, incentives to renegotiate mortgages, and cover 90-day mortgage deferments.

5. A 90-day deferment on installment payments was extended to people who are behind on taxes.

Canada

Canada has cut its benchmark interest rate three times since early March 2020. The following are the major fiscal measures by Canada:

1. Sending a monthly $1,420 payment for the next four months to people who have lost their income due to COVID-19.

2. One-time $284 payment to low-income individuals.

3. Allowing lenders to offer payment deferrals for up to six months for government-insured mortgages.

4. A programme lasting from March 15 to June 6, 2020, covering 75 per cent of wages up to $600 a week for businesses that have suffered a revenue decline of 15 per cent or more.

5. A 10 per cent wage subsidy for small businesses not eligible for the above subsidy.

6. 75 per cent rent relief for small businesses that have had to close or lost 70 per cent of their revenue from COVID-19.

7. Deferred sales tax and import duty payments until June 30, 2020.

Japan

1. One of the prominent provisions was a $930 payment that any resident of Japan can apply for.

2. Small and medium-sized businesses, as well as freelancers, can apply for payments of up to $18,534 if their incomes have been significantly affected by the virus.

3. The package also included $241 billion in tax deferments for businesses and increased funding for medical supplies.

China

As of April 30, 2020, according to the IMF, an estimated $367 billion in fiscal measures or financing have been announced by China.

1. Reportedly, many local governments in China have been giving out prepaid spending vouchers to boost consumer spending, but the amounts are reportedly relatively small.

2. Subsidies for auto purchases, raising the cap on the number of cars that can be owned in each locality.

3. Banks being asked to give forbearance on mortgage and other personal loans, are the other measures taken by the bank.