The Reserve Bank of India (RBI) on Thursday left its key repo rate unchanged at 5.15 per cent, citing an uncertain inflation outlook. However, it did announce measures, like Long Term Repo Operations that it hopes will ensure system liquidity and thus, better transmission of the rate cuts already announced by the central bank in 2019.

The decision to maintain a status quo on interest rates was largely expected given inflation pressure. Retail inflation in December 2019 had shot up to 7.35 per cent, well above RBI’s medium-term target of 4 per cent, due to skyrocketing food prices.

The monetary policy committee of the central bank noted that inflation had “surged above the upper tolerance band” around the target in December, primarily due to the unusual spike in onion prices. It does expect onion prices to ebb as supply conditions improve. But the effects on headline inflation may be tempered by hardening of prices of other food items like pulses and protein, it added.

Furthermore, there is a cost-push pressure to retail inflation, excluding food and fuel, as telecom companies raise tariffs. “Overall, the inflation outlook remains highly uncertain. Accordingly, the MPC will remain vigilant about the potential generalisation of inflationary pressures as several underlying factors appear to be operating in concert,” RBI said.

It has raised its retail inflation projection upwards to 6.5 per cent for the fourth quarter of 2019-20, while it is likely to trend in the 5.4-5.0 per cent range in the first half of the year ending March 2021.

India’s economy has sharply slowed over the past 12 months, but is gradually expected to improve. The central bank has projected a GDP growth of 6 per cent for 2020-21, versus 5 per cent it had forecast for 2019-2020. In the last MPC meeting in December, it had forecast GDP growth in the range of 5.9-6.3 per cent for the first half of 2020-21.

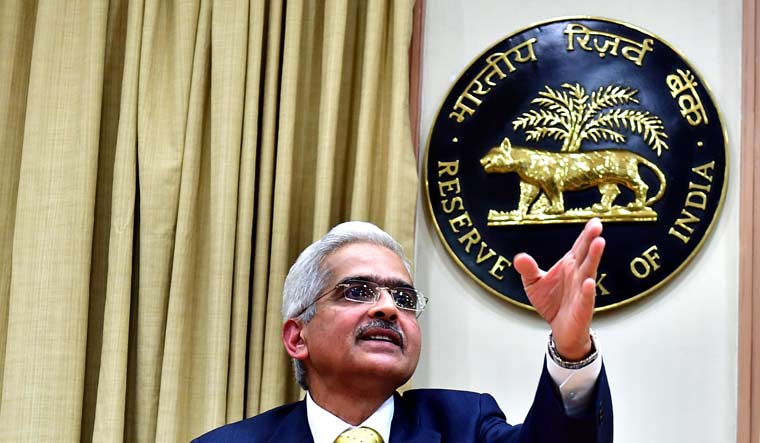

In this backdrop of a sluggish economy, the central bank has retained its “accomodative” stance and will take rate action at an appropriate time, it said. “I would like to emphasize there is policy space available for future action. This space needs to be used appropriately and should be suitably timed to optimise its impact on growth,” said RBI Governor Shaktikanta Das.

The RBI cut repo rate by 135 basis points between February 2019 and October 2019. However, its transmission by banks has been slow, even as the transmission in money markets has improved significantly.

For instance, the transmission to various money and corporate debt market segments up to January 31, 2020 ranged from 146 bps in the case of overnight call money market to 190 bps for three-month commercial papers of non-banking finance companies (NBFCs). For five-year and ten-year government securities, the transmission stood at 73 bps and 76 bps respectively.

In contrast, the marginal cost of funds-based lending rate (MCLR) of banks declined by 55 bps between February 2019 to January 2020. While the weighted average lending rate on fresh rupee loans by banks fell 69 bps, the same on the outstanding loans had declined only 13 bps between February 2019 to December 2019, RBI noted.

Therefore, while this time around the monetary policy action was constrained due to inflation uncertainties, Das said there were several other measures it could take to ensure further transmission of interest rates.

One such measure it has taken in the past was to link bank interest rates to an external benchmark like the repo rate. Most banks have now linked their new home loan, personal loan and loans to micro and small enterprises to the repo rate, which has to an extent improved monetary policy transmission on fresh loans. The central bank has now decided to link pricing of loans by scheduled commercial banks for the medium enterprises also to an external benchmark effective April 1, 2020.

The central bank also wants to ensure adequate liquidity in the market, which will reduce cost of funds for banks, and thus, will lead to further transmission of rates. So, from the fortnight beginning February 15, 2020, the RBI shall conduct term repos of one-year and three-year tenors of appropriate sizes for up to a total amount of Rs 1 lakh crore at the policy rate. Details of these long-term repo operations are to be issued separately.

“You (banks) get the funds at the current repo rate of 5.15 per cent, whereas the average cost of funds taking into account deposits is much higher,” said Michael Patra, deputy governor.

also read

- Normal monsoon predicted for 2024. Is it enough to bring down inflation?

- Climate change poses challenges for monetary policy, says RBI report

- RBI governor calls for for greater participation of banks in rupee derivatives in India, abroad

- With inflation likely to cool and growth strong, shallow rate cuts likely in the second half of FY25

The RBI is also incentivising bank credit to specific sectors. As a part of this move, scheduled commercial banks will be allowed to deduct the equivalent of incremental credit disbursed by them as retail loans for automobiles, residential housing and loans to MSMEs, over and above the outstanding level of credit to these segments as at the end of the fortnight ended January 31, 2020 from their net demand and time liabilities for maintenance of cash reserve ratio (CRR).

“Linking credit to medium industries to external benchmark, removal of CRR requirement on fresh retail housing and auto loans and credit to MSME are positive steps. These steps may marginally reduce the interest rates on such fresh loans,” said Sujan Hajra, chief economist at Anand Rathi Shares and Stock Brokers.

Deepthi Mary Mathew, economsit at Geojit Financial Services said while keeping rates on hold was an expected move, it will take time for the RBI to revive the rate cuts with the inflation breaching the upper band.

Hajra is not expecting any rate cut this year, as the hike in minimum support prices in 2019 will likely keep food inflation elevated, despite softening of onion prices.