India’s equity markets bounced back from their five-month lows on Tuesday, on expectations of the Reserve Bank of India reducing its benchmark repo rates further in its upcoming monetary policy on August 7 and a foreign brokerage upgrading India’s markets on improved valuations.

The rupee also stabilised on Tuesday as China took steps to limit the yuan's slide. Amid deepening trade tensions with the US, China on Monday had allowed the yuan to fall past 7 to the US dollar. This had raised fears of the trade war escalating into a currency war, dampening market sentiments world wide. The rupee too had crashed by 113 paise, its biggest single-day drop in six years, to close at 70.73.

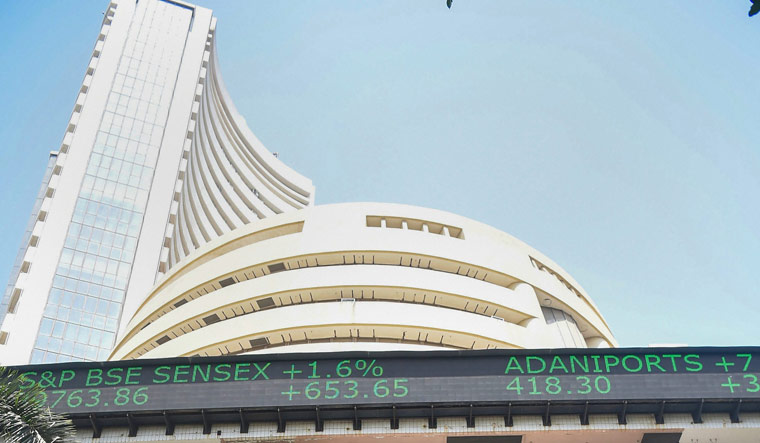

The BSE Sensex, which had cracked over 400 points on Monday, surged 277 points or 0.75 per cent on Tuesday to close at 36,976.85. The broader NSE Nifty50 index rose near 86 points or 0.8 per cent to close at 10,948.25 points.

“Today we saw massive short covering in fundamentally weak companies, which have fallen more than 25 per cent in last three months, implying short term bottom for the market is in place,” said Shrikant Chouhan, head of technical research at Kotak Securities.

Credit Suisse upgraded India to "small overweight" from "market weight" citing improved valuations of India's equity markets relative to the rest of the region.

The Reserve Bank of India will announce its third bi-monthly monetary policy of the financial year ending March 2020 on Wednesday. Most economists are expecting that the central bank will reduce its benchmark repo rate by at least 0.25 per cent to boost a slowing economy, while inflation remains in check.

Finance Minister Nirmala Sitharaman stating on Monday that economic affairs secretary Atanu Chakraborty would hold discussions with representatives of foreign portfolio investors (FPI) to hear them out, also sent positive signals.

FPIs pulled out Rs 12,419 crore in July and a further Rs 7,693 crore so far in August, concerned over the finance minister’s proposal in the Budget to levy a higher surcharge on the super-rich. Weak corporate earnings and a deepening economic slowdown have also worried investors.

Since the Budget was announced on February 5, the 30-share Sensex has crashed more than 7 per cent from 39,908.06 to 36,976.85 points.

Deepak Jasani, head, retail research at HDFC Securities, told THE WEEK recently that there could be some more pain across the board.

“The markets are roiling under lot of negatives, chief among them is the economic slowdown. Earnings recovery has also been postponed again and again and the rural distress continues,” he said.

Jasani expects the economic slowdown to continue for three-four quarters; the equity markets should start recovering in a couple of quarters, he added.

“Stocks will continue to get cheaper and then bottom-fishing will emerge,” he said.

In the backdrop of the economic slowdown an interest cut is now crucial, Pritam Deuskar, fund manager at Bonanza Portfolio told THE WEEK. “How much will RBI cut interest rates needs to be seen. Market may not like a rate cut below 0.50 per cent,” he said.

Deuskar also believes that market has yet to reach a bottom. In the current scenario, there are few stocks investors can choose from and their valuations are high.