It was a bull run on the equity markets on Monday as the benchmark indices pole vaulted nearly 4 per cent after exit polls suggested the Narendra Modi-led National Democratic Alliance government would comfortably win more than half of the seats in the Lok Sabha elections.

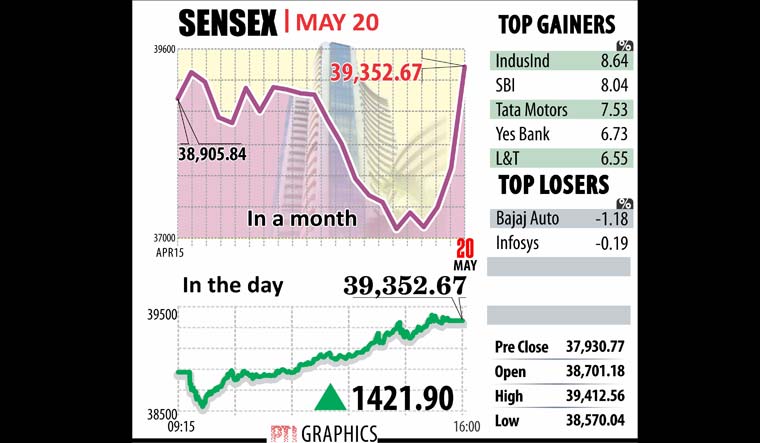

The BSE Sensex accelerated 3.8 per cent or 1,422 points to close the day at 39,352.67 points and the wider NSE Nifty 50 index jumped 3.7 per cent or 421 points to end at 11,828.25 points.

In the run up to the election there were efforts by several regional opposition parties to stitch a coalition. With the Congress and its allies also becoming aggressive, there were concerns that no political party would get a majority. Investors don’t like uncertainties, and a huge sigh of relief was evident from Monday’s rally, with the exit polls predicting a decisive mandate to the incumbent government.

“If exit polls are correct and the NDA returns to power with a majority, then we would expect policy continuity,” said Sonal Varma, chief India economist at Nomura Securities.

Devang Mehta, head, equity advisory at Centrum Wealth Management also noted that the market had started to price in the end of uncertainty on the debate around political stability post elections.

“If the actual results are close to exit polls, we may see a revival in domestic and foreign investor sentiment towards Indian equities,” said Mehta.

In a broad-based rally on the markets, 28 stocks out of the 30-share Sensex ended in the green. Banking stocks were among the biggest gainers, with IndusInd Bank surging 8.6 per cent. State Bank of India, Yes Bank, Axis Bank and ICICI Bank rose 4 per cent to 8 per cent.

Auto stocks were also on the move, with Tata Motors accelerating 7.5 per cent, Maruti Suzuki and Mahindra & Mahindra surging more than 5 per cent and Hero MotoCorp also gaining 3.3 per cent. Bajaj Auto, however, defied the trend; the Pune-based motorcycle maker’s shares fell 1.2 per cent as investors were concerned over margin pressures.

If the NDA does come back to power, investors would seek continuity in the reforms announced by the government.

“What would help the markets sustain the momentum is factors that are fundamentally important, like decisive policy initiatives from the new government, faster land and labour reforms, and also the unfinished task of quick consolidation and reorganisation of the banking system,” said Joseph Thomas, head of research at Emkay Wealth Management.

Nomura’s Varma said that rural reflation, infrastructure spending, streamlining of the goods and services tax, direct tax reforms and the consolidation of public sector banks are likely to be the key priorities.