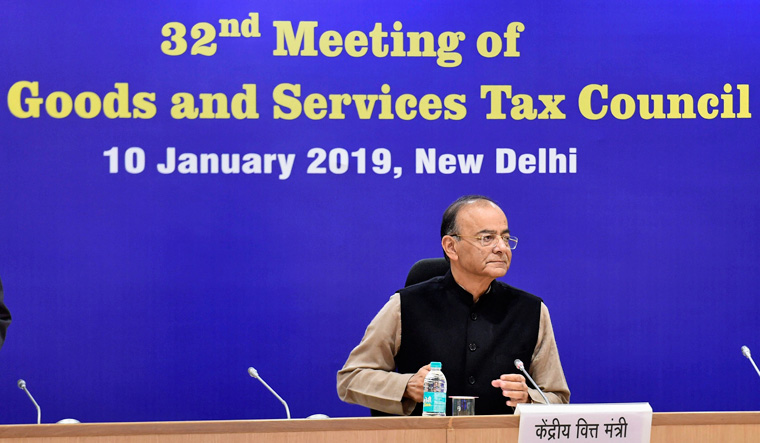

The GST Council on Thursday announced more relaxations to taxpayers in the small and medium industry sector, before the Union budget in February. The benefits of these decisions would be available to taxpayers from April, 2019, a month before the parliamentary polls.

The Council doubled the GST exemption limit and raised the threshold for availing the composition scheme.

Earlier, the exemption was given for businesses with a turnover of up to Rs 20 lakh from paying the tax. Now, this has been hiked to Rs 40 lakh. For northeastern states, where the exemption limit was earlier at 10 per cent, the same is now allowed for businesses having a turnover of Rs 20 lakh.

Businesses would also be allowed to 'opt-up' or 'opt-down', i.e. to pay and take benefits of GST tax credits or stay out of paying GST. “This is a one-time exemption being granted by the Council and it is recorded as such,” said Arun Jaitley, Union finance minister and chairman of GST Council.

For starters, the exemption limit for participating under the GST composition scheme, which allowed small traders pay a uniform rate of 1 per cent GST on their produce, was earlier set at a turnover of Rs 1 crore. This limit for the scheme has been hiked to Rs 1.5 crore, allowing even mid-sized traders to take advantage of a low GST regime.

The decision brings the GST regime at par with the earlier excise scheme, which too, allowed businesses with a turnover of up to Rs 1.5 crore an exemption from paying the indirect tax.

For those businesses availing the composition scheme, the GST Council decided to allow them to reduce their burden for compliance with the tax. The Council decided that traders would be allowed to file only one annual return instead of four required now. They, however, would still need to pay up their GST on a quarterly basis as earlier.

One of the important decisions taken by the Council on Thursday was to announce a composition scheme for services and those selling goods and services. So far, these two categories of business were not able to take advantage of the composition scheme.

"Services and goods plus services category of business with a turnover of up to Rs 50 lakh will be entitled to benefits of composition scheme. Composition rates for services have been fixed at 6 per cent by the Council," said Jaitley. So far, all services providers, irrespective of their size are taxed under the 18 per cent slab of GST.

“Each one of these benefits allowed is intended to help the SMEs," Jaitley added.

The report of a ministerial panel, that was earlier formed to look into Kerala government's plea for allowing it to charge a 1 per cent cess on GST, was also approved by the Council. “Kerala is now allowed to impose a maximum of 1 per cent cess for a maximum of 2 years on the intra-state sale of goods,” said Jaitley. The Council had earlier decided to allow cess in case of a natural calamity.

The Council deligated the contentious issues on including real estate and lottery tickets under GST to two separate ministerial panels. Rate rationalisation of cement, a primary building input, from 28 per cent to 18 per cent along with other building materials was also not taken up for discussion by the highest indirect tax body.