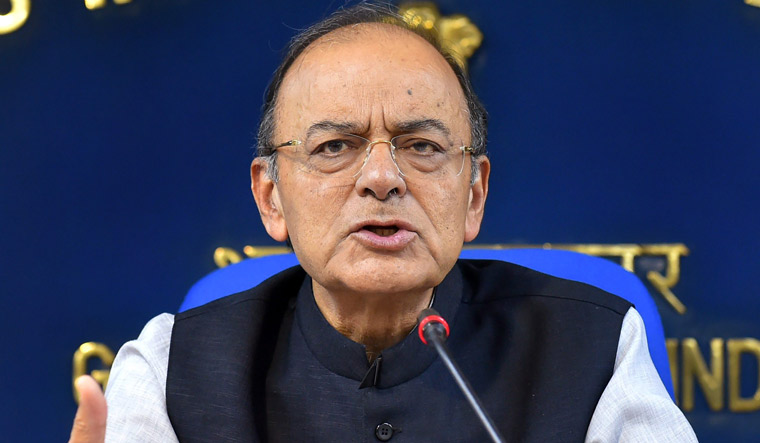

Union Minister Arun Jaitley today dismissed the idea of a single GST slab being advocated by Congress President Rahul Gandhi as flawed, saying that it can only work in a country where the entire population has similar and high capacity to spend.

The minister, in an article on 'The GST Experience' on completion of the first year of rollout of the Goods and Services Tax (GST), also exuded confidence the GST Council would look into rationalisation of the taxation structure after stabilisation of the collections.

Jaitley, who was the Finance Minister when the GST was introduced, is currently minister without portfolio, and is recuperating from a kidney transplant operation.

Rahul Gandhi has been advocating a single slab GST for India. It is a flawed idea. A single slab GST can function only in those countries where the entire population has a similar and a higher level of paying capacity.

Being fascinated by the Singapore model is understandable but the population profile of a state like Singapore and India is very different. Singapore can charge 7 per cent GST on food and 7 per cent on luxury goods. Will that model work for India?, the Minister questioned.

Since the GST is a regressive tax, the poor have to be given a substantial relief, he said, stressing that most of food items agricultural products and the Aam Aadmi used products have to be tax exempt while some others have to be taxed at a nominal rate.

The others could be taxed higher. Eventually, as the collections improve, many more items from the 28 per cent category can possibly come down. Only sin products and luxury goods can remain there.

There would also be a scope again, depending on the collection going up, to merge some of the mid category slabs but for that we have to see the progress of the new tax regime and the possible upward movement in the collections, the minister said.

Observing that there is always scope for improvement, he said key areas of future action will include further simplifying and rationalising the rate structure and bringing more products into the GST. I am confident that once revenue stabilises and the GST settles, the GST Council will look into these carefully and act judiciously.

Referring to the issue of levying GST on petroleum products, Jaitley said that while the UPA kept petroleum products permanently outside GST, we brought them back into the Constitution as levyable to GST and can gradually impose the GST when the GST Council so decides.

For this I would continue to make my earnest efforts and hopefully when the states are more comfortable with the revenue position, it would be an ideal time to strike for a consensus between them.

He further said that while Gandhi and former Finance Minister P Chidambaram have repeatedly demanded that petroleum products be forthwith brought within the GST, the finance ministers of the Congress-ruled states were against it.

When I speak to the Congress Finance Ministers' in the states, they don't seem to be ready for it. But what was the UPA's own track record on petroleum products in the GST? The Constitution amendment proposed by the UPA permanently kept all petroleum products outside the GST, he said.

Jaitley further said that he used the inclusion of petroleum products as a bargaining issue with the states while conceding the Central Sales Tax (CST) and compensation payment to the states.

I worked out a formulae that petroleum products would be included in the Constitution amendment providing for the GST but the council can decide the date from which to bring them into GST. The states agreed, he said.

He further said that when the GST was to be launched on July, 1, 2017, the government was advised by the Congress to postpone it.

A reluctant government can never take reformist decisions. We went ahead. At the initial stage, we fixed the first set of rates. A large number of requests started coming from trades, industry and, therefore, we started rationalising the rates, he added.

The minister took comfort from the fact that the country witnessed the smoothest switch-overs in one of the largest tax reforms in the country. All the check-posts disappeared overnight. The system of input tax credit ensures that disclosures are made.

The GST has encouraged enormous voluntary tax registration. Detailed calculations done in this year's Economic Survey show that as of December 2017, about 1.7 million registrants were those who fell below the GST threshold but nevertheless chose to be part of the GST. Similarly, more than 50 percent of those who could have chosen to opt for the simpler composition scheme chose to register under the regular GST scheme, the Minister said.

As regards the all powerful GST Council, Jaitley said, it is India's first experience at cooperative-federalism based decision-making authority. We cannot afford to risk a failure and, therefore, it is functioning as to arouse confidence amongst all states. The meetings have always been consensus based.

The only area where unanimity seems to be lacking is the television bites that some ministers' give after the meeting, which may be necessary for their own political position. I am willing to live with the experience of a healthy debate and unanimity within the Council and a show of dissent outside the Council meetings, Jaitley added.