Equity markets are likely to witness more volatility this year, if the trend post the Karnataka election verdict is anything to go by. The uncertainty around who will form the next government in the southern state has made investors jittery, while macro worries also persist.

The BJP falling short of required numbers to form a government, and the rivals—the Congress and the JD(S)—cashing in on the opportunity by joining hands, could be a harbinger of reshaping political equations in the run up to the Parliamentary elections next year, warn analysts.

“Whether or not the BJP forms a government in Karnataka, the swift alliance between Congress and JD(S)—to keep the BJP out of power—is a stark reminder of the coming threat from a third front coalition of disparate regional parties in the 2019 general elections. Because of the heavy election calendar, we expect political uncertainty to rise,” said analysts at Nomura Securities.

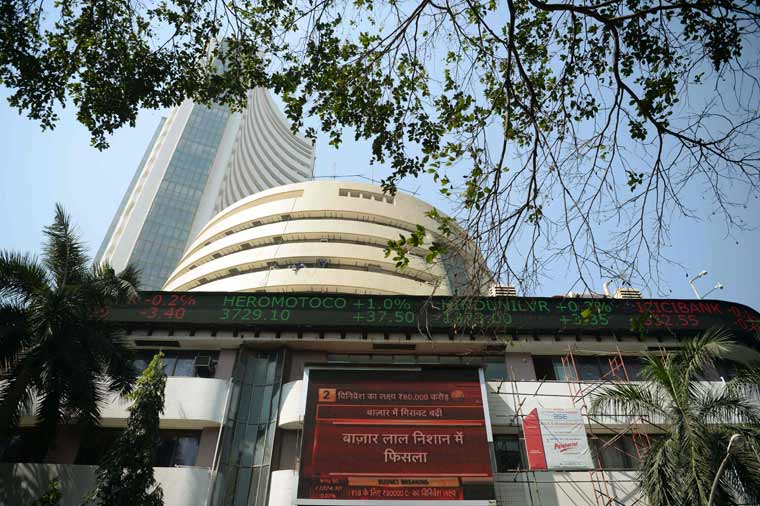

The benchmark BSE Sensex swung over 500 points on Tuesday as the BJP first looked to be sealing a victory, but ran out of steam in the later part of the counting as a hung assembly picture emerged. On Wednesday, the Sensex closed 156 points or 0.4 per cent lower at 35,387.88 and the NSE Nifty50 was also down 61 points or 0.6 per cent at 10,741.10.

“The market will draw comfort from the BJP's gains in Karnataka and the continued popularity of leader Prime Minister Narendra Modi. However, Indian politics could become a real-life 'Game of Thrones' if the Karnataka state election results are anything to go by, and with the general elections and several state elections due over the next 18 months,” said Sanjeev Prasad, co-head at Kotak Institutional Equities.

Post Karnataka, there are multiple assembly elections in the second half of 2018, culminating in the general elections, sometime in 2019, and the results—alliance formations among other things—will be closely tracked by investors, said Arshad Perwez, analyst at JM Financial.

But, beyond the political developments, there are many headwinds for markets, particularly on the macro front, which will be a focus once the dust over Karnataka settles, adds Perwez.

After easing for three months, India's retail inflation shot up to 4.58 per cent in April, which may turn the Reserve Bank of India more hawkish. India's trade deficit has also risen, with merchandise trade deficit touching $156.8 billion or 6 per cent of GDP in 2017-18. The rupee has also depreciated against the US Dollar, trading close to the 68 mark.

“The market focus will increasingly shift to macro and earnings. India's macro has weakened considerably in the past few months. We note that India will have to likely contend with a weaker macro in calendar year 2018/ FY2019, versus calendar 2017/ FY2018, given likely higher inflation, interest rates and possibly higher current account deficit and weaker currency,” said Prasad.

Even as macro worries persist, analysts remain bullish on a recovery in corporate earnings over the next two years. Consumer goods makers are already seeing strong volumes growth and global commodity tailwinds (rising crude, metal prices) should aid oil and gas and metal companies. The depreciating rupee will also boost earnings of pharma and software services firms. However, much of the strong earnings recovery may have been factored in by the rich market valuations, feel analysts.