Every time the Centre releases money to the state government for a development project, the funds come but go back as “unspent money” into the Central coffers. But not before making some babus and officers richer by a few crores. And, development? Nil.

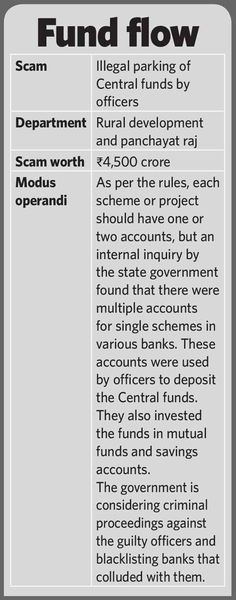

Karnataka woke up to illegal parking of funds by officers when a scam was unearthed in the rural development and panchayat raj (RDPR) department last April. An internal probe by a four-member committee—headed by Punati Sridhar, executive director of Mahatma Gandhi Institute of Rural Energy and Development—revealed misappropriation of funds by RDPR officials, who deposited Rs.4,500 crore in 1,128 bank accounts between 2009 and 2015. The committee submitted its report to the state recently.

RDPR minister H.K. Patil, who unearthed the scam following a tip-off, called it “a total collapse of fiscal prudence”. “The funds in excess of Rs.4,500 crore meant for the various development schemes were found diverted to various bank accounts illegally by corrupt officers,” he said. “If the money deposited in banks without spending on projects accounted for Rs.1,335.68 crore, another Rs.3,008 crore had been invested in unreconciled accounts by the Karnataka Rural Infrastructure Development Ltd [KRIDL].”

The modus operandi of the corrupt officials has shocked the minister, too. Every year, the RDPR department gets large grants from the Centre and the state government. The rulebook states that every scheme or project should have a single account or two accounts—programme account and support activity account. But in many cases, officials opened multiple accounts for the same project. In KRIDL, both the salary and project funds were deposited in the personal accounts of engineers and the transaction was not even recorded.

The unspent money has to be surrendered to the government at the end of every financial year or when the tenure of the finance commission ends. But, the officials illegally parked the unspent money as deposits in multiple accounts in various banks, and submitted false utilisation certificates. Thus, they pocketed the interest accrued on the deposits. The officers deposited funds in private banks, opening multiple bank accounts for a single scheme using personal names (and not the official designations). They also invested the funds in financial instruments like mutual funds or in savings bank accounts, all in gross violation of the norms. Over the years, the balance sheets showed increasing amounts as unspent money. At some banks, MoUs were signed to earn 8 per cent interest on deposits. But no interest was remitted to the government. The state government is now considering criminal proceedings against the guilty officers and blacklisting banks that colluded with them.

Karnataka, however, is not alone. In 2015-2016, as many as 37,525 projects under the National Rural Drinking Water Programme across 27 states filed expenditure reports though they had made no physical progress. Over the last three years, Karnataka has seen 60,767 works for which expenditure is incurred but no physical progress is shown, according to the rural development ministry. The inquiry panel has recommended social audit of all works carried out under various schemes, and transaction audit of the funds both spent and unspent, apart from computerisation and real-time update of project status with photographs.

But such scams are not limited to societies, agencies and government departments implementing the Central schemes. Last August, the Bengaluru Development Authority (BDA) reported a multi-crore mutual fund scam involving money collected from site allottees. Funds in excess of Rs.2,202 crore were transferred to temporary bank accounts of officers and later invested in mutual funds between 1999 and 2004. The CID arrested Indian Civil Accounts Service officer Sandeep Dash, who was the financial member of the BDA during that period, accusing him of giving oral instructions to banks to transfer money from the BDA account to temporary accounts. Later, the money was invested illegally in mutual funds through pay orders and banker’s cheques. M.N. Sheshappa, who succeeded Dash, too, was arrested for illegally diverting money to mutual funds and corporations.

Even a bankrupt Bruhat Bengaluru Mahanagara Palike (BBMP) had 960 bank accounts (many undisclosed) till recently, before it was brought down to 25. The Comptroller and Auditor General had noted that the BBMP had increased its borrowings owing to lack of financial discipline and creation of multiple accounts. Mooting reforms, the BBMP has converted its current accounts that fetched no bank interest into savings accounts to earn 4 per cent interest.

At a time when state governments are demanding a relook at the cut in Central grants by the NDA government, the Centre is pointing to a large chunk of unspent money in its exchequer that states have failed to utilise. As on December 31, 2014, as much as Rs.5,129.48 crore was lying unspent in the rural development ministry, Rs.4,524.94 crore of it under the Backward Region Grant Fund, as per a report by the standing committee on rural development. On the other hand, the Centre has slashed grants to the states as it has hiked the states’ share in the Central tax pool from 32 per cent to 42 per cent from 2015-16 to 2020-21.

A worried chief minister, Siddaramaiah, has ordered a scrutiny of all schemes to tackle illegal parking of funds. “Fund crunch is hampering development schemes in the state,” he said. “Karnataka’s share in Central taxes is Rs.24,790 crore [Rs.8,230 crore more than last year]. However, the Centre has cut Central grants from Rs.3,509 crore to Rs.1,772 crore, while reducing funding for the Central sector schemes, from Rs.16,626 crore to Rs.8,146 crore. This has created a fund gap of Rs.1,970 crore. Unless the state monitors projects and submits utilisation certificates, Karnataka cannot hope for additional Central grants.”