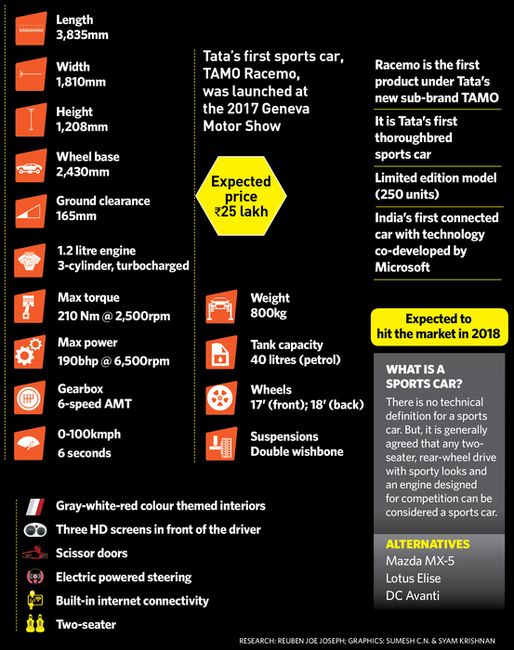

The Geneva International Motor Show is one of the most prestigious events of the automobile industry. What better venue then for homegrown Tata Motors to unveil its biggest disruption yet—a sports car concept called Racemo, under its recently unveiled sub-brand TAMO.

Tata Motors has unveiled several concept cars in the past. Unlike some of those, which took years to reach production, the Racemo, unveiled on March 7, is expected to hit the road some time next year. It is what Tata Motors CEO and managing director Guenter Butschek called “the emotional, unexpected leap into the future”.

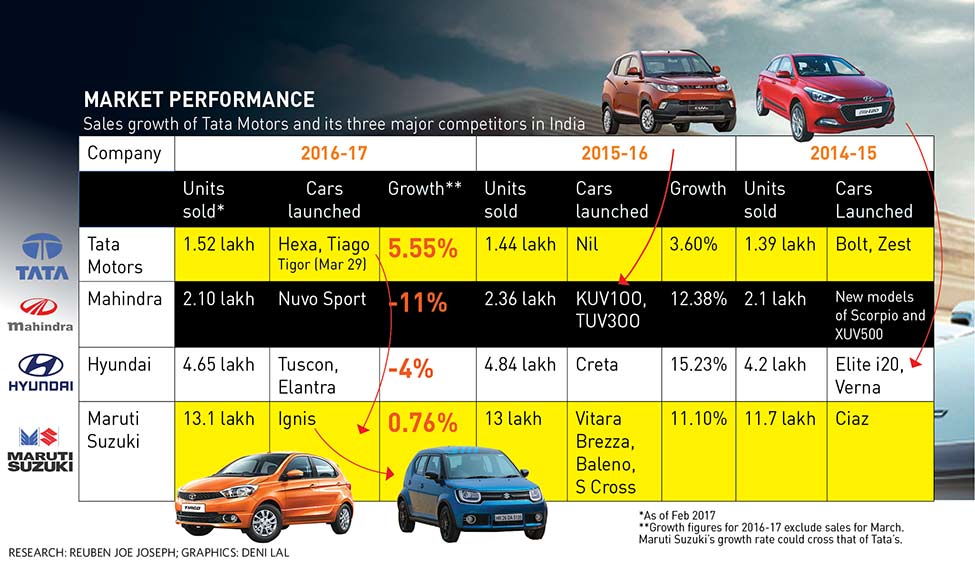

Amid increasing competition, Tata Motors has struggled to maintain its passenger vehicles market share over the last few years. That seems to be changing with the launch of the Tiago hatchback in 2016, which has helped Tata Motors clock a 17 per cent rise in passenger vehicle sales at 1,37,718 units so far this fiscal year.

The Tiago was followed up by the Hexa, a premium, feature-packed crossover, which the company claimed had a good initial response.

The Racemo is the boldest move yet from Tata Motors, which also owns British luxury carmaker Jaguar Land Rover. It is the company’s way to display its technological prowess and show that it can do much more than just trucks.

“It has been a worthwhile journey so far. The cars were fantastic,” said Ratan Tata, chairman of Tata Trusts, on the company’s products in Geneva.

Racemo, the two-seater, mid-engined sports car, is meant for the adventure loving, digitally native, mobile technophiles of India. It will also be, as the company claims, India’s first connected car. It will have advanced navigation, predictive maintenance, remote monitoring, and over-the-air updates using Microsoft’s cloud-based technologies, including advanced analytics, internet of things (IoT) and machine learning powered by Microsoft’s Azure platform.

It has been placed under TAMO, which was launched in February as a platform that would offer “future-ready mobility solutions”.

“To secure our future in a rapidly changing environment, the advanced mobility solutions space is of utmost importance,” said Butschek, a former Airbus executive. “The introduction of TAMO will help us co-design India’s automotive footprint by taking new technologies and mobility concepts as a new ecosystem to the market.”

The Racemo was conceived just 22 months ago and designed completely in-house under Tim Leverton, president and head, advanced and product engineering at Tata Motors. “Symbolising the change that is taking place at Tata Motors, Racemo is the proving ground of the TAMO family of vehicles and will drive the future of India’s connected generation,” said Butschek. “From styling and design to driver experience and technology, Racemo is an extension of customers’ personality, as part of their digital ecosystem, and will break the ice with a radical new presence and pique the interest in the parent brand.”

Industry experts said Tata Motors needed such a product to shake up its passenger vehicle business. “You have to create, you have to be thinking out of the box to be relevant in today’s marketplace,” said Abdul Majeed, partner at consulting firm Price Waterhouse. “You have to take the risks and can’t just sit back and expect things will happen in a world where you will also be competing with technology companies.”

Today, the competition is not just with traditional car makers. Tech giants like Google and Tesla are ushering in big disruptions in the industry. To give itself more firepower to take on the market, Tata Motors has also taken another bold bet by exploring a partnership with Volkswagen, the world’s largest car maker, and its Czech unit, Skoda, to jointly develop products.

The partnership is key for both players to succeed in a market dominated by Maruti Suzuki, which sells almost half of the cars sold in India. “We strongly believe that both companies, by working together, can leverage from each other’s strengths to create synergies and develop smart innovative solutions for the Indian and overseas market,” said Butschek.

A pact with Volkswagen, which is spending close to ¤12 billion on research and development, will give Tata Motors access to advanced technology. Tata Motors spent Rs 2,217 crore on research and development in 2015-16.

Sources said the companies were expected to share Tata Motors’ future Advanced Modular Platform (AMP), while looking at sharing components and technologies. “Today the compulsions are such that it is all about survival, with challenges from companies like Apple and Google. You also may not have the market reach. So its best to align, share platforms and take it from there,” said Majeed.

Being able to work on the product, aftermarket and distribution strategy, and supplementing each other’s strengths would be key for both companies. “This is a very good strategy by Tata Motors,” said Shrikant Akolkar, senior research analyst at Angel Broking. “Maruti Suzuki has upped the ante in terms of new launches. So, in terms of bringing in premium products, Tata needs someone like Volkswagen, which has a strong presence across global markets, along with strong R&D. But what products they launch and what segment they launch in will be key.”

Tata Motors has begun pre-booking for its upcoming ‘styleback’ Tigor and will also launch the Nexon compact SUV later this year. The Nexon will be Tata’s entry into the competitive SUV segment, which has seen a lot of recent launches like the Renault Duster, the Hyundai Creta, the Honda BRV and the Mahindra TUV300.

According to the Society of Indian Automobile Manufacturers, between last April and this February, SUV sales went up 31 per cent to 6,84,306 lakh units, while car sales went up by just 3.4 per cent to 19,12,931 units.

While new cars rolled out from the assembly line, Butschek also talked about overhauling the supply chain, which he had earlier called a legacy issue. Tata Motors had about 1,300 suppliers, a number that is being significantly cut down under Butschek. Quality would be a key parameter. The number of platforms on which its products are based is also being reduced to two from the earlier six. All this should make Tata Motors leaner and more agile to adapt to the rapidly evolving market dynamics and make it more cost efficient.

But the key concern remains the Nano, which has failed to meet sales expectations, despite multiple refreshes and even an automated manual transmission version. Former Tata Sons chairman Cyrus Mistry, who was sacked in October 2016, has alleged that the Nano project was loss-making from the beginning and it was not being shut down only because of emotional reasons. For Butschek, taking a decision on the Nano would be really tough.