Suren Saini can now empathise with investors who have been duped by Ponzi schemes. An astute corporate trainer from Delhi, Saini got caught in a fraud relating to cryptocurrency—encrypted digital currency. Though initially unsure, Saini invested in Bitcoin (the most popular cryptocurrency) last year on a friend’s insistence. It went well and his Bitcoins appreciated in value.

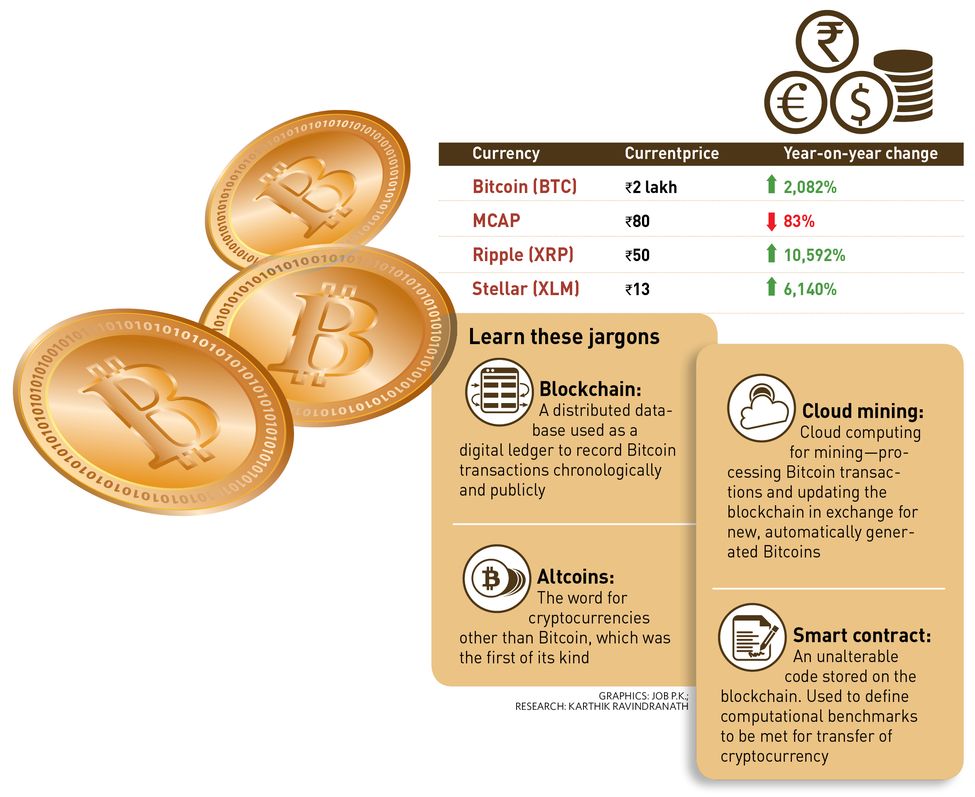

Then someone advised him to invest in cloud mining (see graphics). He approached a company, Gain Bitcoins, which specialised in Bitcoin mining. It offered him 1.8 Bitcoins for each one he invests with it over an 18-month period. Plus, he would get a one-time referral incentive and a monthly mining bonus from referral accounts. It sounded great, and Bitcoins kept flowing in for the first four months. But after that, it stopped. When Saini asked the company, it said that it could not issue new Bitcoins to him, but could instead offer him a new cryptocurrency called MCAP. He accepted the offer, as MCAP’s value was increasing. But it fell soon and has not risen since then. Saini’s money is stuck. He cannot get out now.

“Had I kept it in Bitcoins, I would have made millions today,” says Saini. He does not think investing in Bitcoin is risky—in fact, he is planning to buy again—but says schemes which trap people should be monitored.

The meteoric rise in Bitcoin prices has seen a whole host of retail investors rushing in to buy cryptocurrencies—some informed, some uninformed. Bitcoin experts say a herd mentality is at play and a lot of them are entering because of the fear of missing out.

But investing without understanding can be a waste, as is evident from the case of Raghav Rastogi from Allahabad. He was on the look out for new avenues to invest in. Most of his investments, which he made on someone’s advice, have worked for him. On one such recommendation, Rastogi invested in Ripple, a cryptocurrency. He had no idea about blockchain or other important aspects of cryptocurrencies. In August this year, Ripple became extremely volatile, and Rastogi exited the currency at a loss. But now he regrets doing so as its value has increased manifold.

Ajeet Khurana, from Mumbai, who invests in and mentors startups, says people, especially those who are not investment savvy, should not buy cryptocurrencies just to make a quick buck. “Like any other asset class, there is substantial price volatility, but there is no need to panic,” he says. “Bitcoin or any other cryptocurrency is meant to be a long-term investment.”

Like in all long-term investments, considerable thought and effort have to go into investing in cryptocurrencies. Dinesh Gahlot, who runs an animation firm in Delhi, dedicates two hours daily to his investments in cryptocurrencies—what to buy, what to sell, researching on which ones are performing better and so on. He says that he has made big gains from some of the currencies.

He invested in Ripple when it was priced at 65 paise and in Stellar at Rs 1 and both have earned him big returns. Gahlot does a lot of research on companies that are coming up with cryptocurrencies. In the case of Ripple, he learned that Google Ventures was planning to invest in the company. That was a validation of its quality. He invested prior to Google coming in and the price shot up after that.

“I mostly invest for three to six months but I keep observing the price trends,” he says. “One should not be too greedy. If there is a good appreciation, one should get out without waiting for more returns. I keep buying more, ploughing in the same money.”

Cryptocurrencies, in some ways, work exactly like equity markets. Bitcoin, the most traded of cryptocurrencies, is least risky because it has a large pool of investors. This is very similar to a blue-chip stock which has the least chance of going belly up.

Then there are newer and smaller cryptocurrencies coming up every day. Some of them are designed to dupe investors. They collect money, the price is pushed up for sometime giving investors hope that it will increase further, and then it crashes, locking investors’ money. This is true of penny stocks in equity markets. (Penny stocks have a small set of investors and are available cheap. Operators drive up the prices and then bring them down, earning money in the process.)

“For beginners, it is best to invest in a popular cryptocurrency such as Bitcoin and start with a small amount,” says Madhur Todi, a certified financial planner and founder of Mera Money Advisors. “One has to remain invested for at least a year or even longer to get handsome returns.” Todi is convinced that blockchain technology is the future of transactions as it is much more secure and verifiable.

“People don’t need to buy one complete Bitcoin,” says Vishal Gupta, CEO of SearchTrade and cofounder of Digital Assets and Blockchain Foundation of India. “They have the option to buy only parts. For example, investors can buy 0.2BTC. You don’t need a million dollars to participate; even Rs 50,000 would be enough to get started. The focus may be only on Bitcoins now, but an entire market of altcoins—1,600 to 1,800—has been created. Out of those, only 20 to 30 are viable.”

The debut of futures contracts for Bitcoin on Chicago Board Options Exchange will further aid its growth. “It is a landmark step because now all the mutual funds, pension funds and family offices in the US which were earlier not allowed to invest in Bitcoin, can do so,” says Saurabh Agarwal, cofounder, Zebpay, India’s first Bitcoin exchange. “They have huge amounts of funds which will bring greater liquidity in Bitcoin which makes it easy for people to buy, sell and store Bitcoins.” Agarwal, however, feels that there will be some volatility now given that prices surged so fast. “The prices will move up in long term but as of now, I see it getting very volatile,” he says.

With small-time investors joining the fray, regulators across the globe are taking note of development in this technology-based investment class. The government constituted an inter-disciplinary committee in April comprising nine representatives from the Reserve Bank of India, State Bank of India, NITI Aayog and the department of financial services, ministry of finance. After examining the existing framework on cryptocurrencies both in India and globally, the panel has submitted a report to the department of economic affairs on measures for dealing with issues relating to consumer protection and money laundering. The ministry of finance, though, has so far not come out with a regulation. For investors such as Saini, it becomes all the more important to have a regulation with a consumer protection framework built in. “I am clueless,” he says. “I don’t know where to go and which regulator will help me.”