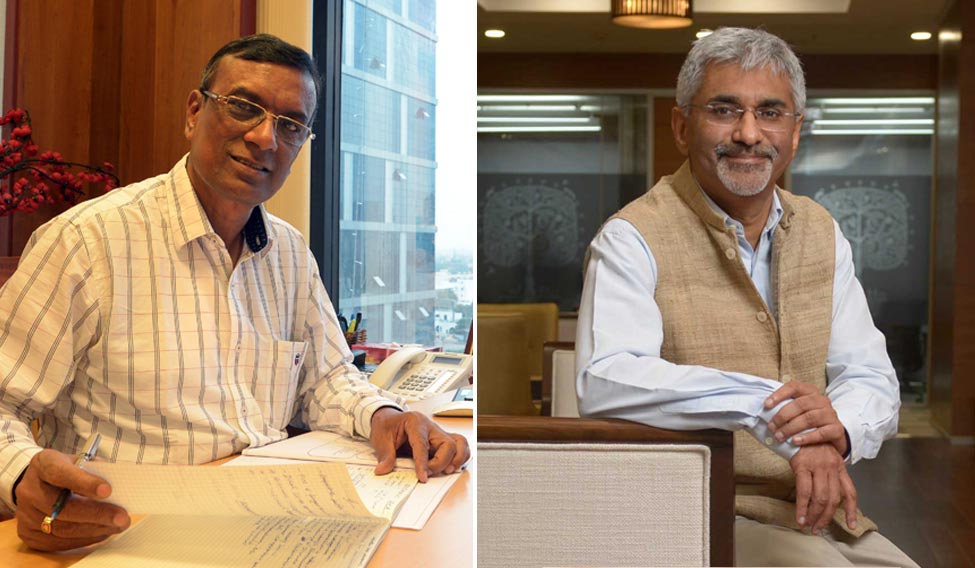

Chandra Shekhar Ghosh, who founded Bandhan Bank a year ago, says people these days walk up to him to greet him at conferences and events, something that never happened during the 15 years he ran a successful microfinance company. He is happy about the performance of his bank in its first year, and was overwhelmed when President Pranab Mukherjee congratulated him on the foundation day of Bandhan.

From the borrowed bicycle that he rode to college in Bangladesh (his family moved to India in 1971) to a Land Rover Discovery, Ghosh has come a long way. But there is still a long way to go for him to emulate his microfinance success story in the banking sector.

Unlike Ghosh, Rajiv Lall is a veteran in banking, with tenures at the World Bank, Asian Development Bank and Warburg Pincus. He joined IDFC in 2005. When he started IDFC Bank a decade later, it seemed a natural progression of the illustrious career.

While Ghosh and Lall took different paths to where they are now, the job they have on hand is the same. In an environment of slow macro growth, there have been doubts whether these two new banks will be able to get a firm standing in the market. Bandhan Bank and IDFC Bank have so far proved the sceptics wrong. “Both of them seem to be focusing on retail, an area that is already well served by existing private banks. If they are able to create a dent on the deposit side, it would be a great achievement for them,” said a consultant with one of the big four consultancies.

The transition—from a microfinance player for Bandhan and a corporate lender for IDFC—has not been easy. Bandhan had served only bottom-of-the-pyramid customers, and IDFC only corporate borrowers. Being a universal bank required presence in the entire spectrum.

As a microfinance institution (MFI), Bandhan borrowed from banks at 14-16 per cent and lent to small borrowers at 18-20 per cent, making a good profit margin. A banking licence meant that it could not continue with that model. It needed to raise low-cost deposits.

Raising deposits for a new bank is not easy—customers need to have a comfort factor to park their money and the bank has to offer something extra for them to change their preferred bank. Bandhan, thanks to its reach in the eastern part of the country, has been able to mobilise Rs 16,000 crore in a year. About 90 lakh customers have deposited their money in its branches, of whom 8 lakh are new.

“Our strength has been great customer service by offering them personalised services and doorstep banking,” said Ghosh. “The depositors understand that their money is safe and will be utilised for the betterment of poor. Plus, we are offering a little higher interest rate, which has attracted customers.” The bank opened 701 branches in a year. About 70 per cent of these branches are in the unbanked, rural areas. Its non-performing assets are just 0.16 per cent, the lowest in the industry.

"In banking, what one doesn’t do is more important than what one does. The challenge before Ghosh is to refrain from doing too many things in the excitement of running a universal bank,” writes Tamal Bandyopadhay in his book Bandhan: The Making of a Bank.

IDFC Bank has been shaping up in an entirely different way. While large corporate lending has been an area of strength for the bank, it is trying to move away from that. It is maintaining a cautious stance on fresh lending to big corporate groups and trying to get a bigger chunk of the retail market. It currently has 70 branches and is acquiring about 18,000 new customers every month.

IDFC Bank recently acquired Grama Vidiyal Microfinance, which has 309 low-cost branches. It is planning to install micro ATMs at these banks, which will work as mini branches where customers can open accounts, and deposit, withdraw and transfer money.

It has not been easy for IDFC Bank when it came to deposits. A recent JP Morgan report estimated its CASA ratio at 8 per cent by 2018, which is nothing great. In the last quarter, its gross non-performing loans reached Rs 3,029 crore, which is about 6.09 per cent of its gross advances.

“IDFC seems to be little confused, trying to figure out what exactly it wants to be,” said an expert at a rating agency. “Its corporate book is under stress and retail is not happening at a pace it had expected it to be. It is trying to do everything—like an ICICI or HDFC, making itself a me-too player. There does not seem to be a differentiated strategy.”

In the case of Bandhan Bank, experts are concerned about the pressure on its interest margins, and they say it will remain so for a while because of the huge capital outgo for branch expansion and investment in technology. As an MFI, its dependence on technology was small. As a bank, however, it had to understand and invest in technology. The strong rural presence made it all the more difficult. There were branches with low connectivity where VSAT cables were put up. But monkeys would chew them up. Also, it had to integrate the human resources of its MFI to the new structure. “Training them and mixing them with people specifically hired for bank was a big task,” said Ghosh.

Bandhan had experience dealing with just one class of customers—the poor. It is now a bank for everyone, which required a huge change in the approach. Also, its geographic presence is limited mostly to eastern India and it will need to look down south and west if it has to expand its depositor base.

One thing is clear—these banks are not going to have it easy. Convincing a customer to change the preferred bank will require something more than just minor tweaking of interest rates. “It is tough being a new bank, especially in an environment where credit growth has slowed down. The NPA numbers look worse when combined with credit growth numbers. And amid all this, banks have to be careful about liquidity management. Mobilising low-cost deposits will be key for the new banks,” said Bharti Gupta Ramola, markets leader at PricewaterhouseCoopers India.

And, the competition is going to get tougher only. The Reserve Bank recently came up with norms for on-tap licensing. The number of banks is expected to go up as many financial services providers are keen on getting a banking licence. Also, in the next few days, small finance banks and payment banks are expected to be launched. “Payment banks will have very limited offerings but small finance banks will bring disruption in the market,” said Kalpesh Mehta, partner at Deloitte Haskins and Sells. “Whoever has a large customer connect will win.”