India’s second and third largest telecom operators Vodafone and Idea Cellular have announced that they will merge, thus creating a behemoth with a revenue of Rs 80,000 crore, eclipsing the market leader Bharti Airtel. This is undoubtedly the largest shakeup in the telecom industry which had already begun consolidating amid high costs; the disruptive launch of Reliance Industries’ Jio had accelerated the process.

“The merger solves two objectives—giving Idea a new lease of life by making available incremental spectrum and allowing Vodafone Plc to de-consolidate its India operations and create a strong market leader, which is self-sustaining,” said Vivekanand Subbaraman, analyst at brokerage firm Ambit Capital.

The merger of Vodafone and Idea will create a giant with around 400 million subscribers, a revenue market share of 41 per cent and a subscriber market share of 35 per cent. Bharti Airtel will have 320 million subscribers, including that of Telenor.

“We don’t have a single circle where we have below 10 per cent market share [after merger], which means you can make money and reinvest it in other circles,” said Vittorio Colao, chief executive, Vodafone Group.

Idea and Vodafone said that the combination of their networks and spectrum holdings would accelerate pan-India expansion of wireless broadband services on 4G/5G technologies to build capacity. It could then build substantial mobile data capacity and utilise the largest broadband spectrum portfolio, the two added.

After the merger, the two companies will have an overall spectrum holding of 1,850 megahertz across multiple bands, giving them combined spectrum market share of 24 per cent, above Bharti Airtel’s 21 per cent and Jio’s 19 per cent, according to analysts. “The combined company will have the scale required to ensure sustainable consumer choice in a competitive market and to expand new technologies—such as mobile money services—that have the potential to transform daily life for every Indian,” said Colao.

The intense fight in the telecom market has already affected operators. Bharti Airtel’s net profit more than halved in the quarter ending December 31. Idea Cellular also reported its first ever quarterly loss in the same period. Vodafone lowered the value of its India unit by five billion euro last November.

While Vodafone has a significant footprint across urban markets, Idea is strong in semi-urban and rural areas. “The merged telco should benefit from operational synergies which will allow it to curtail some expenses such as co-location rentals and energy costs, customer acquisitions and support teams and reduced expense on branding and advertising,” said Harsh Jagnani, VP-sector head, ICRA. The cost savings should boost profitability of the merged entity over the long term, he added.

Synergy gains from the merger could drive a compounded EBITDA (earnings before interest, taxes, depreciation and amortisation) growth of 18 per cent over fiscal 2018-2022 and EBITDA margin touching 36 to 39 per cent in fiscal 2021-2022, helped by backend, network, IT and other cost synergies, said Aliasgar Shakir, analyst at Motilal Oswal Securities.

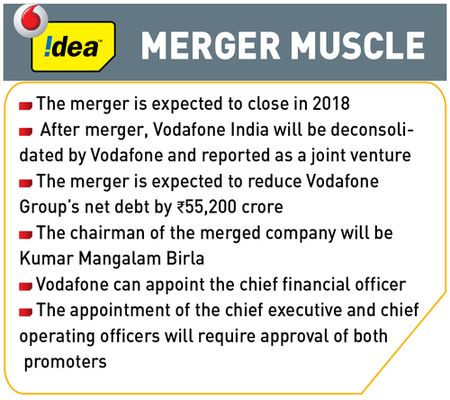

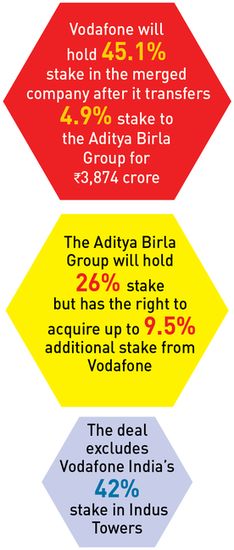

The merger of Vodafone and Idea follows a wave of consolidation in the industry over the past year. Last month, Bharti Airtel announced it would acquire the Indian assets of Norwegian telecom company Telenor. Anil Ambani’s Reliance Communications and Aircel, promoted by Malaysia’s Maxis Communications, agreed to merge in September 2016. On March 20, Reliance Communications said it had received the green light from the Competition Commission of India for merging its wireless business with Aircel. RCom is also expected to close the merger with Sistema Shyam Teleservices this year.

Sunil Mittal, chairman of Bharti Airtel, had said recently that the consolidation in the telecom industry was inevitable. “You don’t want one or two healthy operators, one or two struggling operators and three or four in the ICU...,” he had said in his keynote address at the Mobile World Congress last month. “You really want a few sustainable solid operators who can put up the investments that are required for new technologies.”

Analysts say that once the market consolidates, some sanctity will return to pricing over the long term and companies will start focusing more on the overall products than on just price.

“We might see rationalisation of pricing happening across operators,” said Rishi Tejpal, principal research analyst at technology research firm Gartner. “I don’t see a cut-throat pricing war happening in the near future. It is not going to be sustainable for any of them. So, we will see a healthier competitive environment.”

The merger with Vodafone will help provide strong offerings across digital entertainment (music, movies and games), Voice over Internet Protocol (VoIP) and cloud and storage services, Idea said. It will also lead to deeper penetration in the enterprise segment across multinational corporations, large, small and medium enterprises.

“The consolidation in the telecom industry through the Idea-Vodafone merger, acquisition of spectrum from other operators by Bharti Airtel and market share gains by Jio would ensure competitive and demanding times for telecom operators but the consumer is having the last laugh at their expense, at the current juncture,” said Mayuresh Joshi, fund manager, Angel Broking.