Petroleum Minister Dharmendra Pradhan was forthright about the government's reluctance to pass on the sharp decrease in crude oil prices to consumers. “The government is not just keeping money in its coffers,” he said. “We are spending it on welfare. People also need good roads and drinking water. Should we provide this facility by taking loans or through government’s own savings?”

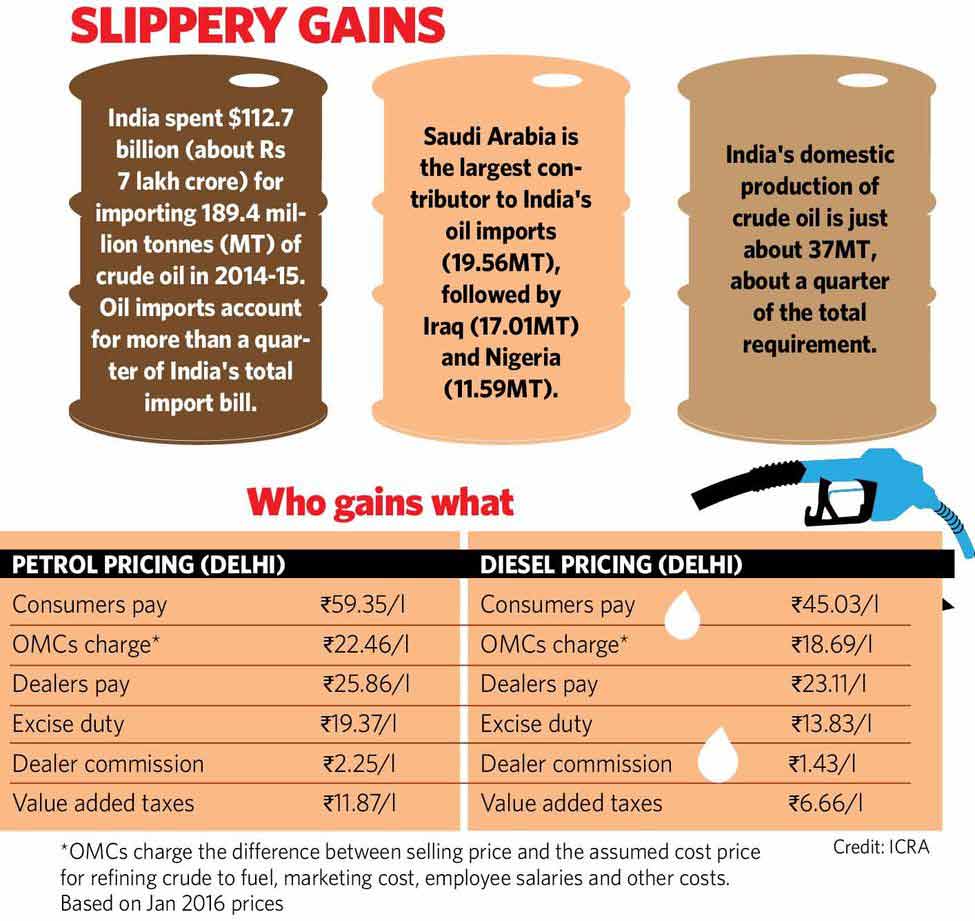

The government has hiked central excise duties on petroleum products nine times since May 2014. Last month alone, the duties were hiked three times. Since June 2014 global oil benchmark Brent crude has fallen by 75 per cent, from $110 a barrel to less than $30. However, domestic petrol prices have come down by only 15 per cent, from Rs 71.5 a litre in June 2014 to Rs 60 a litre (in Delhi). The retail price of diesel has come down by 19 per cent, from Rs 57 a litre in June 2014 to Rs 46 a litre. On the other hand, the duty on petrol has risen from Rs 9.48 a litre to Rs 19 a litre, and on diesel from Rs 3.65 a litre to Rs 10.6 a litre.

Like Pradhan, the finance ministry says a lower global oil price coupled with a higher tax collection from oil sales has helped reduce the gap between spending and earning. The government had budgeted for an average crude price of $70 a barrel for the financial year. It is estimated that if the average price of $60 a barrel in the first four months (April-July) is sustained, it would save Rs 65,000 crore in import bill and Rs 9,000 crore in the subsidy bill.

The under-recoveries (the difference between the sale price and notional market price of petroleum products) of oil marketing companies came down from Rs 139,869 crore in 2013-14 to Rs 72,314 crore in 2014-15 owing to the deregulation of diesel price and the rollout of direct benefits transfer scheme for LPG. In the current financial year, the government has budgeted for a petroleum subsidy bill of Rs 30,000 crore—Rs 22,000 crore on LPG sales and the rest on kerosene. The government might now be able to save Rs 10,800 crore of this because of the decline in crude oil rates.

Had not the government raised duties on oil imports last year, consumer price of petrol should have been lower by Rs 10.02 a litre, and diesel by Rs 9.97 a litre, said a research report by Capital Global. Though the difference in prices is entirely on account of various taxes, the Centre alone cannot be blamed. “We are not the only one to hike taxes,” said petroleum and natural gas secretary K.D. Tripathi. “States, too, have increased taxes several times last year. The falling crude oil prices is an opportune time for forging new partnerships on both the demand and supply side.”

The windfall is expected to bring Rs 80,000 crore to the government coffers in the current fiscal. “Our fiscal deficit target at 3.9 per cent seems more manageable now,” said chief economic adviser Arvind Subramanaian. “Hopefully, with oil prices staying where it is we can lower the target even further in the coming year.”

Oil marketers say, with the price pooling mechanism in place, they are getting reasonable margins. “Lower crude oil prices will reduce the under-recovery burden of OMCs substantially,” said B. Ashok, chairman of Indian Oil Corporation. “Our debt levels are down by Rs 30,000 crore this year and we are aiming for investment plans of Rs 15,000 crore as capital expenditure every year.”

Most oil refiners, in fact, are looking at good earnings, and are planning heavy investments in refining facilities over the next few years. And, with relatively softer oil prices, they are making higher profits on other market-priced products, such as lubes, naphtha and fuel oils. Also, the lower debt burdens and interest costs will improve their profitability.

The picture, however, is not so rosy for upstream companies (those in the exploration and production sector). Oil and Natural Gas Corporation and Oil India have witnessed lower gross realisations owing to weaker crude prices. Sales volumes are likely to remain flattish as oil refiners refrain from stacking up, fearing inventory loss.

ONGC and Oil India have written to the government demanding relief from the burden of subsidy. The two companies partly bear subsidy that helps fuel retailers, such as Indian Oil, Bharat Petroleum and Hindustan Petroleum, sell kerosene and cooking gas at rates decided by the government. ONGC, which was the most profitable company in 2014, is now flirting with the possibility of a loss. “This may be a fact but ONGC will never come on record about this,” said an ONGC spokesperson. As a long-term impact of low oil prices and low realisations by upstream companies, domestic investments into exploration and production could slow down.

“With oil prices in the basement, the capital available for exploring new basins is tightening and makes it a daunting task for India to reverse the investment trends in upstream sector,” said Anand Sahu, executive director (exploration & development directorate), ONGC, at the Petro India Conference organised by the India Energy Forum and Observer Research Foundation. “The investment levels over the next several years in the oil sector will be significantly lower than the previous 10-year annual average in view of fall in oil prices and relationship between oil prices and upstream investment.”

Upstream companies have also complained about the high volume of cess payable to the government. It is levied on domestic crude oil production as a duty of excise. The current level of cess of Rs 4,500 a tonne of crude was imposed in 2012 when the crude price was about $114. It has to be borne by the oil producers.

The cess now constitutes 30 per cent of the Brent crude oil price, making production from numerous marginal fields or small discoveries uneconomical. A spokesperson for Cairn India, the only private oil producer in the country, said the industry players had jointly written to the government to align cess charges with the oil prices. The industry expects the cess to be levied on ad valorem basis at 8 per cent.

Pradhan has sought an ‘in-principle’ revision of cess levied on domestic oil producers, and has discussed it with Jaitley and revenue secretary Hasmukh Adhia. “Time has come to revisit the oil cess issue. We want it to be on an ad valorem basis. I want this to be a win-win for all stakeholders so that the government revenue does not suffer greatly. At the same time, the companies also should not suffer much,” Pradhan said after meeting officials in North Block.

So, where do consumers stand in this equation? “Global oil price has averaged at $55 a barrel until October and is estimated to be in the $40-45 a barrel range for the rest of FY16,” said K. Ravichandran, senior vice president (research), ICRA. “As per our estimates, there is a further possibility of increase in excise duty. There is room for the government to opt for another round of duty hike, given the deficit in disinvestment proceeds and tax collections. However, some benefit could still be passed on to consumers as the decline in crude price has been sharp.”