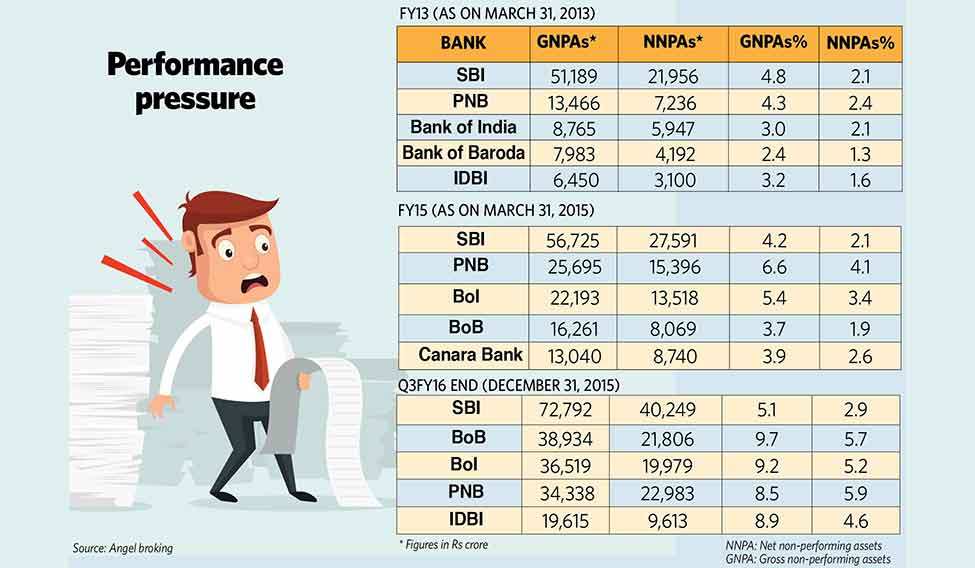

Alarm bells went off in board rooms of public sector banks when Bank of Baroda posted a loss of Rs 3,342 crore in the third quarter of financial year 2016, the highest ever by any Indian bank. Soon, State Bank of India, India's largest bank, reported a dip of almost 62 per cent in its net profit; its bad loans rose to Rs 72,792 crore. Central Bank of India, Dena Bank, Allahabad Bank and IDBI Bank also posted losses during the last quarter. Non-performing assets were blamed and experts say the trend will continue for the next year.

With NPAs climbing, share prices of banks have dropped, leaving investors worried. “Accumulation of bad assets forces banks to set aside money, and this affects their profitability and ability to lend more. This is a worry for investors,” says Adhil Shetty, CEO and co-founder, BankBazaar.com. In the case of public sector banks, the government holds majority stake. While banks might soon tighten lending norms, the Reserve Bank of India and the government are considering giving them more powers to recover NPAs.

Many research analysts say that the asset quality of public sector banks has deteriorated sharply in the last few quarters, because the sectors to which the banks had lent have been witnessing severe pricing pressure and lower utilisation levels.

Siddharth Purohit, senior research analyst at Angel Broking, says, “Metals, infrastructure [largely power], textiles and other commodities now account for nearly 75 per cent of restructured loans.” Public sector banks have higher exposure in these sectors than private banks.

Another reason for the spike in NPAs, Purohit says, is that earlier “most banks had not recognised some of the large and weak accounts as NPA”. After these accounts started being treated as NPAs, “SBI’s gross NPA increased by 95 basis points to 5.1 per cent from 4.15 per cent; Bank of Baroda's rose by 412 basis points to 9.68 per cent from 5.56 per cent.”

THE SUBSTANTIAL RISE in loan outflow has affected the capital adequacy ratio—ratio of a bank's capital to its risk—of most banks; many banks are looking for immediate capital infusion. Raising funds through bonds and equity would be tough as capital markets are volatile. So, ultimately, the government will have to provide the capital.

Market analysts say most bad loans came from corporate lending during 2011-2013 and the restructuring of loans during 2012-2014. The rise of bad loans also questions the credit appraisal system of the banks.

Banks that have been performing well are doing so because of their sectoral mix. Nikhil Rungta, lead analyst (banking and financials) at AnandRathi Institutional Research, says banks lending to individuals and small and medium enterprises have done well because the “slippages ratio [fresh bad loans] is very low compared with the corporate segment”. And, loan amounts are much smaller in these sectors. Even in the case of a default, the impact is minimal.

Banks with higher exposure to large corporates include the top five public sector banks, IDBI Bank and ICICI Bank. The stress is maximum in sectors like steel, power and roads. Small and medium public sector banks with exposure to these sectors, too, have the same vulnerability; their stressed asset ratio is close to 20 per cent.

M.S.R. Manjunatha, director (ratings), Brickwork Ratings, says corporate borrowers could have been affected by local issues like project delays, project stalling and delay in legal and environmental clearances to international issues like fall in commodity prices and dumping from China. In such a climate, he says, banks need to “safeguard their asset quality by increasing the contribution of the borrowers in projects, and reducing their own stake.”

Manjunatha says, “Banks have erred by not looking at overall gearing of large corporate groups, and accepting project-level gearing. Most large business houses have borrowed at multiple levels—holding company, intermediate company and operating company. In many cases, they borrowed by pledging the very shares which banks have considered as equity contribution. So, when corporates book their losses, the promoters’ equity vanishes quickly and the banks are left holding the baby.”

The RBI's strategic debt restructuring scheme and the new bankruptcy guidelines need judicial support to become effective. “Banks that are performing well also have a robust system for collection and recovery,” says Jimeet Modi, CEO, Samco Securities. “Prior to loan sanction, proper due diligence and verifications are carried out. They prioritise loans for working capital, instead of project financing.”

RECENTLY, RATING AGENCY CRISIL declared that the intensifying asset quality problem in public sector banks can impair their credit risk profiles. CRISIL is expecting the asset quality of these banks to worsen further. Over the past 18 months, the agency's outlook on ten out of the 25 public sector banks has been negative. It is no surprise, because public sector banks account for around 85 per cent of the weak assets in the banking system.

CRISIL director Rajat Bahl says, “The provisioning requirement of public sector banks will increase further and render their pre-provisioning profits inadequate, leading to a significant deterioration in earnings profiles. The government will have to provide more capital to the banks than what was committed under Indradhanush.” A Union finance ministry scheme, Indradhanush was launched to improve functioning of public sector banks.

India Ratings and Research, a credit rating firm, says that banks may need up to Rs 1 trillion over and above their Basel-III capital requirements to manage the concentration risks arising out of their exposure to highly leveraged and stressed corporates.

BANKING ANALYSTS SUCH as Vaibhav Agrawal, vice president (banking), Angel Broking, refuse to pin the entire blame on public sector banks. “Large-scale projects got delayed due to several issues, including [delayed] clearance from the government. This led to cost overruns and the resultant inability of the corporate to service their debt,” he says.

Agrawal says private banks kept their NPAs low by avoiding exposure to large projects and those with a long gestation period. For example, HDFC Bank focused on the retail segment; its NPAs are among the lowest in the industry. This also begs the question: if no one funds big projects, how do you expect the economy to grow?

Agrawal expects the government to up its capital allocation to public sector banks from Rs 25,000 crore to Rs 35,000 crore in FY17. This will help clean up the banks' balance sheets, meet credit growth and empower the banks to meet future challenges, he says.

Modi of Samco Securities wants a comprehensive bankruptcy code which will speed up the recovery process. “Professionalisation of the boards of public sector banks will minimise favouritism and corruption,” he says. “Merit should take precedence for commercial transactions.”