Natarajan Chandrasekaran, the former chief executive officer of Tata Consultancy Services, formally took over as the chairman of Tata Sons on February 21, outlining his priorities including leveraging collective strength of the group companies and focusing on capital allocation and shareholder returns.

The holding company of the $100 billion plus conglomerate has been embroiled in a bitter boardroom battle, which led to the ouster of Cyrus Mistry as chairman in October. The group zeroed in on Chandrasekaran after a short global search. Chandra, as he is fondly called, will be the first chairman to not have any links to the Tata family and also the first non-Parsi to head the diversified group. He has, however, been a Tata insider, spending his entire working life at TCS, where he joined as a trainee in 1987.

“I will focus on three strategic priorities: bring the group closer together to leverage its enormous collective strength, reinforce a leader’s mindset among the operating companies and drive world class operating performances across the group and bring greater rigour to our capital allocation policies and deliver superior returns to our shareholders,” said Chandrasekaran at the first board meeting he chaired.

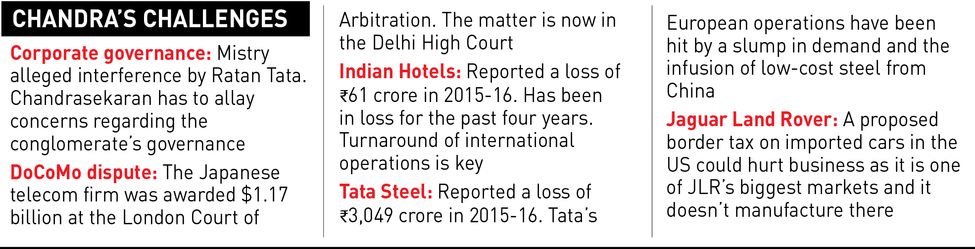

In a statement issued in November, Tata Sons had accused Mistry of weakening the group’s financial performance and increasing its debt. Over the last four years, the group’s debt rose by more than Rs 69,000 crore to Rs 2,25,740 crore. Mistry, in a letter written to the Tata board soon after he was sacked, had warned that the group was staring at potential write-downs worth $18 billion because of business decisions taken during Ratan Tata’s tenure. He had also raised corporate governance issues, and had complained about constant interference from his predecessor Ratan Tata.

Shriram Subramanian, managing director of proxy advisory firm InGovern, said the biggest challenge for Chandra would be to address concerns over corporate governance. “He will have to allay governance concerns of Ratan Tata being a back-seat driver,” said Subramanian. “He will have to create terms of preference between the operating companies, Tata Sons and Tata Trusts (which holds 66 per cent of the holding company). His challenge will also be to work towards better shareholder returns.”

The boardroom battle between the Tatas and Mistry is now being played out in the National Company Law Tribunal. On February 20, the tribunal reserved its order till March 6, on a plea by family firms of Cyrus Mistry alleging mismanagement of Tata Sons and oppression of minority shareholders.

A major point of difference between Ratan Tata and Mistry was that Mistry looked to sell some of the underperforming assets acquired during Ratan Tata’s tenure, like the UK steel business and some of the overseas hotels run by Indian Hotels. It will be interesting to see how Chandra deals with some of these issues.

Chandra, a man who loves marathons, spent three decades at TCS, a company Tata Group heavily depends on. TCS and Tata Motors, which owns the luxury Jaguar Land Rover unit, together accounted for more than half of the group’s total revenues, 69 per cent of the operating profit and almost 100 per cent of net profit in 2015-16. But elsewhere, there are problems aplenty.

The group’s telecom arm Tata Teleservices is embroiled in a bitter breakup battle with NTT DoCoMo. The Japanese firm has sought compensation for its stake in Tata Teleservices, and the London Court of International Arbitration had last June ordered Tata to pay $1.17 billion for breaching an agreement. It has since moved courts in India to get the order implemented and the Tatas have deposited Rs 8,000 crore with the Delhi High Court, till the matter is resolved.

Tata Steel, another company facing problems, recently agreed to sell its specialty steels business in the UK to Liberty House Group for about $124 million. In 2015-16, the company had reported a consolidated net loss of Rs 3,049 crore. Indian Hotels, which runs the Taj Group of luxury hotels, has also been paring assets overseas, like the Taj Boston hotel in the US. The company has reported consolidated losses for last four fiscal years.

At Tata Motors, JLR has been a bright spot, accounting for almost 90 per cent of the company’s consolidated profits. It, however, faces uncertainties in the US, where the Donald Trump administration has proposed a new border tax on imported cars. JLR so far doesn’t have any local manufacturing unit in the US. In the domestic passenger vehicle business, the latest offering Tiago hatchback has been successful, but it still needs to be seen if the company can replicate the same success in future models. While the company still remains the leading player in the commercial vehicle business, it has lost market share to rivals in recent times.

Ratan Tata, however, is confident that Chandrasekaran will bring a lot of value to the leadership. “I welcome Chandra, who has successfully displayed his leadership in his career at TCS. I am sure he will bring considerable value to his leadership role,” said Tata.

According to experts, being the ultimate insider, Chandra would know all the nuances of the group, which would lead to less friction. “Chandrasekaran is steeped in the Tata tradition and values, and knows them as well as anyone,” said Morgen Witzel, who wrote the book Tata: Evolution of a Corporate Brand. “He also has the advantage of having run TCS, the most internationally focused of all the Tata group companies. That gives him an international perspective.”

This is a sentiment echoed by others as well. “Chandra has been at TCS and Tatas for nearly three decades, which makes him an insider who understands how the Tatas work,” said Amit Chandra, who is on the board of Tata Sons.

However, market observers point out that he must be given some time to address the challenges. “The Tata group consists of a large number of companies and disparate businesses. Chandra will have to understand the key drivers at each company, compare their performance with industry peers, carry a thorough evaluation and only then can he suggest measures for improvement,” said Ajay Bodke, CEO of Prabhudas Lilladher, a stock broking firm. “It is a fairly elaborate exercise that will take time and so one needs to be patient.”