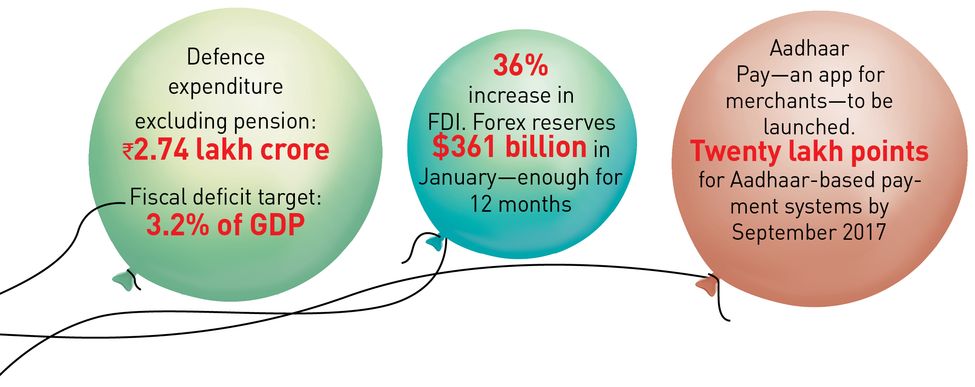

Hardly had Finance Minister Arun Jaitley left Parliament after presenting Union Budget 2017-18, when the Sensex zoomed up by 485 points. It was not unexpected, as Jaitley had made an earnest effort to nourish his prime minister’s pet schemes, embarking on huge government spending but maintaining the fiscal deficit at 3.2 per cent of the gross domestic product and without throwing away freebies. Be it the huge allocation for agricultural credit or the big push to digital economy, Narendra Modi’s favourite projects have all received the money they need to grow, flower and fruit by 2019.

A day earlier, the Economic Survey said the demonetisation would shave off 0.25 to 0.5 per cent of the growth in GDP. “The longer-term costs of demonetisation are yet to be assessed and therefore some uncertainty remains about economic and policy climate,” said Chief Economic Adviser Arvind Subramanian. Jaitley, however, sounded optimistic. He said the pain would be temporary and the surplus liquidity in the banking system would lower interest rates.

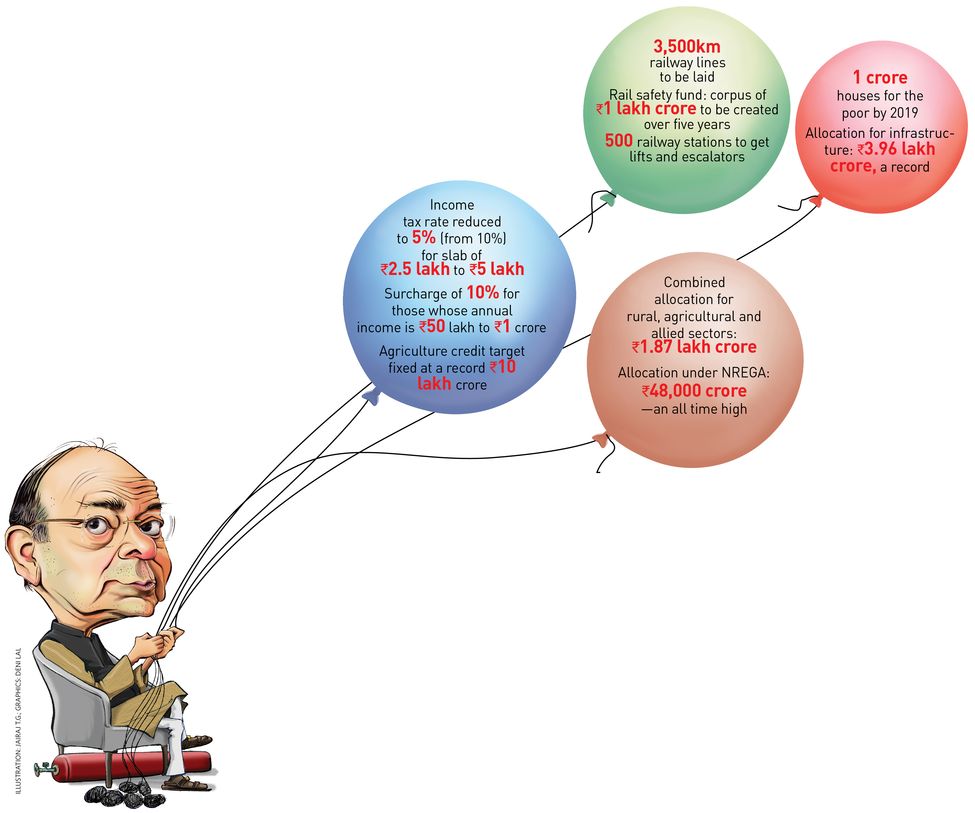

The political discourse during the first month of demonetisation was around the small number of income tax payers, and they were expected to be rewarded in the budget. It came in the form of a 50 per cent cut in the lowest income tax slab and a rebate of Rs 12,500 for all tax payers.

Also, the budget gave teeth to the prime minister’s talk on black money by stipulating that a political party can receive no more than 02,000 in cash from one donor. Higher donations will have to be by cheque or digital payment.

Jaitley seems to have got his numbers right. “Limiting revenue deficit to 2.1 per cent of the GDP and pegging fiscal deficit for 2017-18 at 3.2 per cent while focusing on rural India and infrastructure, the budget has drawn a road map for bringing the economy back on track and accelerating it in the medium term,” said S.C. Ralhan, president, Federation of Indian Export Organisations.

Those who expected freebies in the budget, especially because of the assembly elections in five states, were in for a disappointment. Not because the finance minister wanted to avert a run-in with the Election Commission, but the goodies had all been announced on the New Year’s eve by the prime minister.

Digital push

The allocation for Bharat Net has been hiked to Rs 10,000 crore, and 1,55,000km of optical fibre has so far been laid under the project. Started by the UPA government, it aims to provide high-speed broadband in 1.5 lakh panchayats at low tariffs.

Aadhaar-based payments facility for merchants, excise duty exemptions on point-of-sale machines, iris readers to encourage digital payments, a payment regulatory board in the Reserve Bank to regulate electronic payments, and withdrawal of service charge on railway e-tickets will add flesh and muscle to Digital India. “The convenience of digital payments will spur on the consumers to spend more and it is a positive sign for us,” said Manu Agarwal, founder and CEO of e-tailer Naaptol.

Village first

With the aim of doubling farmers’ income by 2022, Jaitley allocated a record Rs 10 lakh crore for agriculture credit and an additional grant of Rs 47,000 crore for National Bank for Agriculture and Rural Development. He increased the allocation for the Mahatma Gandhi National Rural Employment Guarantee Scheme to Rs 48,000 crore from Rs 38,500 crore, and the Pradhan Mantri Gram Sadak Yojana aims to build 133km of road a day. “The focus on rural infrastructure and rural electrification will improve demand and boost employment,” said Rathin Roy, director, National Institute of Public Finance and Policy.

Manufacturing boost

Small and medium enterprises that mostly use cash for business have been hit hard by the demonetisation. Taking note of this, Jaitley reduced corporate tax burden on firms with an annual turnover of less than Rs 50 lakh by 5 per cent, to 25 per cent. Banks were also allowed relaxation on their non-performing assets limits for allowing better flow of credit to smaller industries. A financial relief package and a separate employment package were announced for textiles and leather goods sectors.

“The decision to make India a global manufacturing hub for electronics would go a long way in creating jobs in the sector,” said C. Salunkhe, president, SME Chamber of India.

A bigger benefit to the sector could be the reduction in the lowest income tax slab. “SMEs will benefit from it,” said Manika Premsingh, economist and founder of Orbis Economics. “There need to be more avenues for encouraging consumption as well as encouraging growth and business.”

Trade challenges

A demand increase in European and US markets and the dual rate hike by US Federal Reserve have renewed trade hopes for Indian exporters. Cross-border trade picked up in the last month from its lows of a negative terrain. The budget relies on the hope that the export markets will improve with demand uptake in developed economies. Jaitley has also announced that presumptive tax on SMEs and small merchants with an annual turnover of Rs 2 crore or more will be reduced from 8 per cent to 6 per cent. “A status quo in service tax and excise duty largely is indicative of the fact that we are on course to introduce Goods and Services Tax in this fiscal,” said Ralhan.

He said that while the reduction in current account deficit (from 1 per cent last year to 0.3 per cent this year) was impressive, it would have been better with an increase in exports. “The global challenges highlighted in the budget are very much real and it requires us to be on our toes and revisit our strategy to push exports in such volatile global conditions. It is disappointing that an aggressive marketing strategy by setting up an export development fund did not see the light of day in this budget,” he said.

Promise to the youth

Because of the slowdown in business and the impact of demonetisation in the informal sector, jobs have been shrinking. The recent data released by the Labour Bureau indicated that the most distressed workers were in the farm sector, where about 40 per cent jobs were lost in the past year. This might be the reason Jaitley has stuck the employment mantra to many initiatives. Emphasising that energising the youth through education, skills and jobs was one of the 10 key focus areas of the government, he extended the skill development scheme to 600 districts through the Pradhan Mantri Kaushal Kendras.

A new scheme called Skill Acquisition and Knowledge Awareness for Livelihood Promotion Programme (SANKALP) will be launched for providing market-relevant training to 3.5 crore youth. Another programme, a skill strengthening initiative for industrial value enhancement, will be launched in 2017-18 to improve the quality and market relevance of vocational training provided in Industrial Training Institutes and to strengthen apprenticeship programmes through industry-cluster approach. Training in foreign languages will also be encouraged at 100 ITIs.

In an online survey that the finance ministry conducted among Twitter users, a large number of youth said job creation should be the priority of the budget. Experts, however, say that Jaitley could have done more for job seekers. “Job loss is a global phenomenon and an immediate fallout of increased adoption of automation. India is also witnessing it in employment,” said Richa Gupta, senior economist at Deloitte Touche Tohmatsu.

Banking repair

The finance minister has been not too kind to banks looking for additional government funds to repair their damaged balance sheets. He allocated Rs 10,000 crore for refinancing banks, which keeps with the last year but was below expectations. However, there is renewed optimism in the sector that it will get money from the government after the RBI formally writes off Rs 500 and Rs 1,000 notes as legal tender.

“Going ahead from the budget, banks will still have a lot to be optimistic about. There would be enough opportunities for them to benefit out of demonetisation as well as boost to digital economy through the JAM (Jan Dhan, Aadhaar, mobile) model,” said Pinaki Chakraborty, professor at National Institute of Public Finance and Policy. “Already with housing interest rates coming down this quarter it is expected to see a pickup in banks’ retail financing.”

A good thing about Jaitley’s budget is that it has maintained a continuity from his last one. But its impact will fully unravel only when the country moves into the GST regime.