Kerala has been a fertile land for banks since the turn of the 20th century. In the 1920s and 30s, banks sprang up in Travancore and Kochi like sprouts in the monsoon. Most of them, however, did not last long, often owing to the lack of experience of the promoters. This did not deter a young lawyer from Mookkannoor, near Kochi, from realising his dream of running a bank.

K.P. Hormis did not start a bank. In 1944, he got the controlling stake in Travancore Federal Bank at Nedumpuram near Thiruvalla, using Rs 2,000 he borrowed from his father. It was a deft move—the defunct bank's price suited his budget and it saved him the tedious process of starting from scratch. Within a year he increased the authorised capital of the bank 25 times and constituted a new board of directors. Then he shifted the bank to Aluva, and, two years later, changed the name to Federal Bank.

Hormis was just 30 years old then. In the following three decades he was at the helm, he made the bank one of the most recognisable brands in the state. It was one of the growth engines of the state’s economy. “The bank played a very important role in financial inclusion in Kerala, which has perhaps the highest bank branch density in the country,” said C.J. George, managing director of the financial services provider Geojith.

While most old-generation private sector banks that escaped nationalisation in 1969 struggled to get out of the bounds of the regions and communities that promoted them, Federal Bank did not fall into that trap. Hormis wanted his bank to have a professional leadership and a national outlook, and he had started branches in most big cities in the country. Four years after he retired, the bank brought in V.K. Shyamasundaran, who was with the Reserve Bank of India, as chairman and chief executive in a bid to accelerate growth.

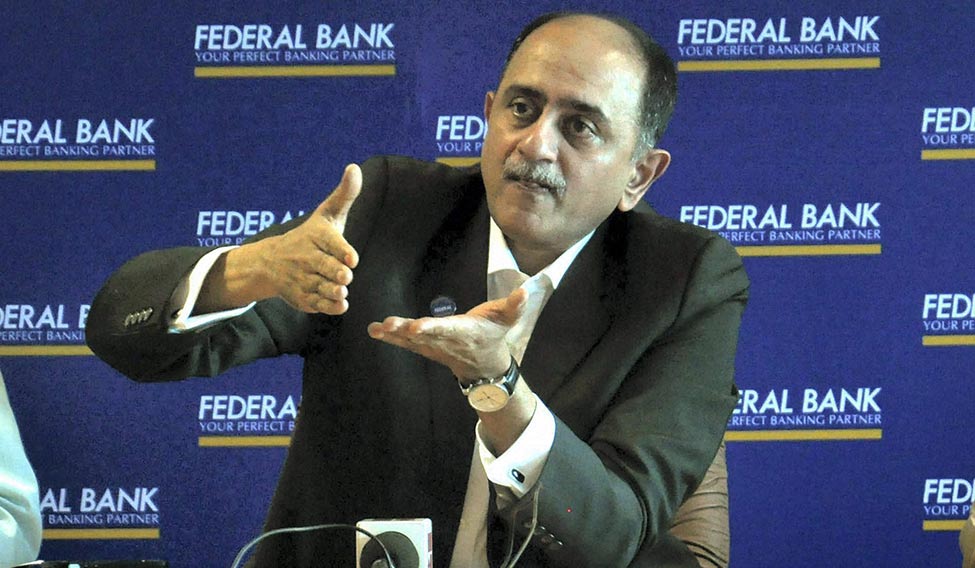

The growth, however, has never been reckless. And, the focus has always been on creating value. “Now we are the 10th largest bank by market capitalisation,” said Shyam Srinivasan, managing director and CEO of the bank. “There are giant public sector banks which are valued less than Federal Bank. What it means is that we have created value for the customer, for the employee and for the shareholder. Size does not matter; it is the value you create. We are well on course to become meaningfully big.” Srinivasan was at Standard Chartered before he joined Federal Bank in 2010.

This affinity with value has put the bank in an advantageous position when most public sector banks are struggling to deal with bad loans and lack of capital. On the other hand, many new-age private players that grew leaps and bounds in the past two decades are burdened by the heft. While Federal Bank’s current growth rate is faster than that of the industry, it has a balanced mix of retail and corporate loans, which mitigates the risk of bad loans.

Though nimble, Federal Bank by no means is a minnow. It has 1,252 branches and 80 lakh customers. Its market capitalisation, at Rs 22,881 crore, is bigger than public sector giants like Canara Bank, Bank of India and Union Bank. And, Srinivasan knows the need to grow. “In the past five-six years we accelerated faster than any bank of our size,” he said. “Both organically and inorganically we should scale up.”

State-run banks, with a market share of around 70 per cent, dominate the industry, and new-age private banks follow with a quarter of the pie. Old private sector banks have about 4 per cent of the market share, and it has been on the decline for a long time. The big banks’ big growth, however, had been on the back of big loans to infrastructure projects and corporate houses—the main reason for their bad loan mess. This seems to be an opportunity for Federal Bank, which is well capitalised and has comparatively low non-performing assets.

The bank seems to be up to it. Its service efficiency matches that of new-age banks, and it has not lost the personal touch in customer relations that community banks were known for. The biggest asset the bank possesses, however, is the technological capability. As early as 2000, it started 'anywhere banking' in Bengaluru, connecting all branches in the city. It started internet banking with the support of Infosys the same year, and ATM services the next year.

“Our theme is ‘Digital at the fore, human at the core’,” said Srinivasan. Technology has enabled the bank to offer any service that a big bank provides. “We cannot become a State Bank of India in terms of size; we do not want to be one,” he said. “But we can give any service that SBI offers.”

In the financial year that ended in March 2017, Federal Bank’s deposits grew 23 per cent to Rs 97,662 crore, and advances 27 per cent to Rs 74,086 crore. Profit after tax went up 74 per cent in the same period to Rs 853 crore. No wonder the bank’s stock has been a peach; its price doubled in a year.

Armed with technology and funds, Federal Bank is set for expanding its national footprint. “Of all the banks that want national branding, Federal Bank is ahead of the race with its forward-thinking MD and CEO, Shyam Srinivasan,” said brand expert Harish Bijoor. “The bank can add bigger value to what it has attempted to date. National branding is not just about the cosmetics; it is a deeper process.”

Challenges, however, are plenty. The industry is set for a change with the consolidation drive prompted by the government. But Srinivasan is unfazed. “Conceptually consolidation is good at one level, but there will be equal opportunities for fleet-footed, medium-size players,” he said. “It is not like only the big would survive and all the small will fall apart. Those who are fit, efficient and well-capitalised will survive.”