Less than three weeks to go for salaried persons and pensioners to file their annual income tax returns! The process has become progressively easier in recent years, thanks to e-filing and Internet—though the actual steps are not noticeably simpler, thanks to government piling up new things it wants you to declare, with every passing financial year.

If past years are a guide, the official Income Tax department website tends to slow down or act up, in the days before the July 31 deadline. But thankfully, government has authorised some e-filing websites, operated by private agencies.

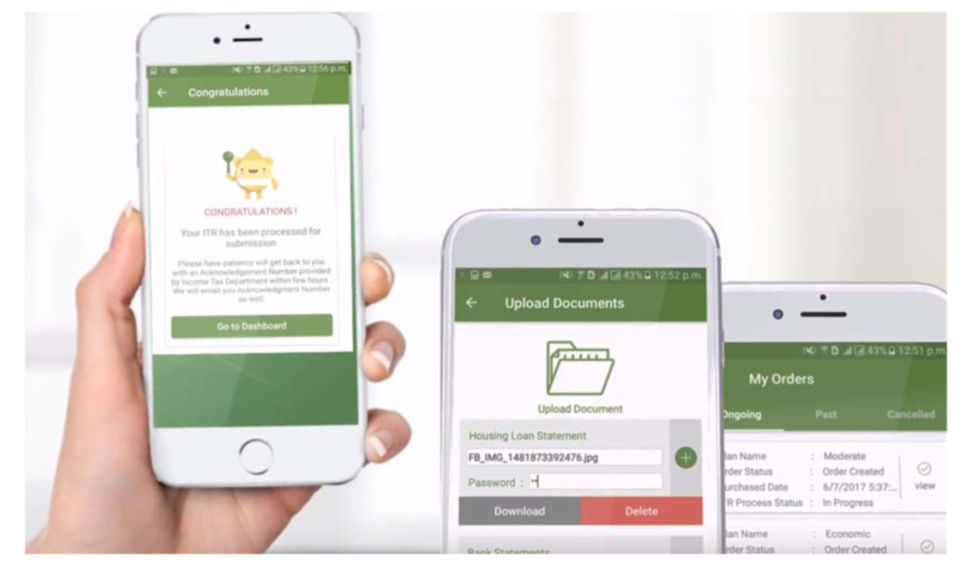

We are not saying it's the only one of its kind, but we found All India ITR to be a clean and simple interface, with a helpful process flow where can ask basic questions, get your doubts cleared, before self-calculating your payable IT, after uploading the Form 16, containing details of any tax that might have been collected at source. You can also generate necessary documentation like rent receipts if you like so many have not done so earlier.

If you are OK with calculating your tax, you can file your returns at AllIndiaITR for free. But if you need help from a chartered accounted, that is available for the modest fee of Rs 499. You can also use the site subsequently to track any refunds you might accept.

Particularly if your return is straightforward, you can chose to do it entirely from your mobile phone, having downloaded the app from the Google Play Store (Android) or the App Store (iOS) for free.