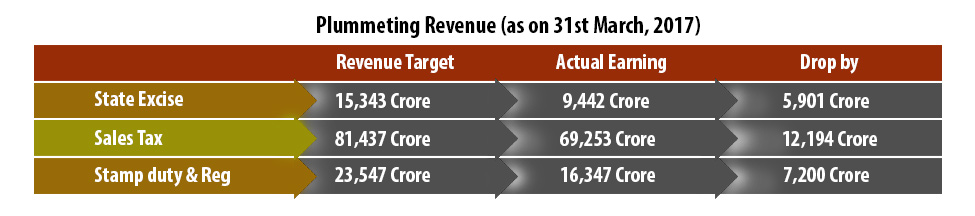

Maharashtra government has succeeded in pacifying the protesting farmers by announcing a loan waiver encompassing all, irrespective of the landholding patterns. Chandrakant Patil, revenue minister and chairperson of the Group of Ministers (GoM) formed to negotiate with the farmer leaders, had announced, "We have in-principle agreed to waive the loans of all farmers in Maharashtra. We will soon announce the criteria and conditions for the eligibility of the waiver." But the dried-up coffers of the state government, owing to a huge drop in the revenue earnings, has put the government in a fix. According to the economic survey and budget estimates as on the 31 March, 2017, revenue for the government was plummeting under all heads.

Moreover, the Supreme Court order directing the government to shut down liquor shops, bars and permit rooms close to the highways is expected to further lower the state excise revenue earnings. Sachin Sawant, Congress spokesperson, said, "Government has been beating drums of achieving success on all fronts and that the economic growth is unprecedented. Now these figures expose the complete failure of government on every front."

He pointed out that right from the day when the loan waiver was agreed to, the government had been planting stories about how this waiver could delay the implementation of the seventh pay commission. “This way, the government is pitting their employees against farmers in distress. Their social media wing is carrying out a propaganda against the loan waiver in urban areas," Sawant said.

Diwakar Raote, Shiv Sena minister and a member of the GoM, and the farmer leaders had requested the government to provide Rs 10,000 as an immediate help to all farmers in debt so that they could buy seeds for the pre-monsoon sowing. Government agreed to give it as a part of loan waiver only to the farmers in debt, but with conditions. The conditions were officially finalised in a government resolution (GR) and said that the waiver will be given to only one person in a farmer family. Having a four-wheeler, any one member of the family employed with the government or any one taxpayer member in the farmer family would be considered an ineligibility.

GoM held another meeting with the farmer leaders to finalize the eligibility conditions and criteria for the loan waiver on 19 June. During the meeting, Chandrakant Patil said, “A maximum loan waiver of Rs 1 lakh will be given to all the farmers in debt up to March, 2016. The conditions set for the help of Rs 10,000 towards buying seeds will also apply for the loan waiver.” This made the farmer delegation furious as in the first meeting, Patil himself had agreed to a deadline of March 2017. “Maximum number of suicides, over 3600, happened during March 2016 and 2017. The droughts of previous two years and the drop in prices due to demonetisation had pushed farmers into indebtedness. Despite knowing this, govt took a U-turn and decided on the indebtedness until March 2016,” said Dr Ajit Nawale, Kisan Sabha president. He added that the debt of farmers growing grapes or sugarcane was far more than the farmers producing Soybean or pulses. “Rain fed farmers do not get loans more than Rs.20,000 for an acre but irrigated farmers get upto a lakh of rupees an acre and the drought, hail storms and untimely rains had ruined their produce for the last 3 years,” Nawale said. A loan waiver of Rs 1 lakh helps the irrigated farmer to repay hardly 20 per cent of the total loan and keeps him ineligible for any further loan as 80 per cent loan remains unpaid.

The eligibility conditions will reduce the loan waiver burden to Rs 5000 crore but almost 80 per cent ineligible farmers in distress will spoil the image, reputation and the credibility of the government forever and they are in a dilemma of balancing the act of maintaining its image while not taking a huge financial burden.