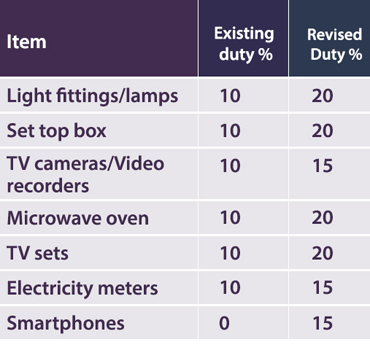

The government’s move to hike import duty of retail electronic items (see table), is likely to create a level playing field for domestic players against cheap imports besides garnering non-tax revenue for the Government, said economists.

Madan Sabnavis, chief economist, Care Ratings said, “Overall India’s import basket saw a sharp increase this year and one component which was a major contributor was retail electronics. The measure has a dual purpose – to curb growth in imports and provide support to domestic industry in a limited manner. It is industry specific and is aimed at helping domestic players to compete in an environment where strengthening the rupee has made imports cheaper.”

Aditi Nayar, principal economist, ICRA said "The move aims to address the trade deficit created by the fast growing imports of consumer items. It remains to be seen to what extent import growth is affected by the increase in import duty. The sensitivity of demand to the increase in pricing, needs to be seen. Setting up manufacturing units in India is an option but it would involve some time lag."

Make in India

The move in the long run is likely to help the government implement “Make in India” policy better, said experts. Sunil Kumar Sinha, principal economist, India Ratings said “By and large electronics industry despite all efforts has only been doing assembly of products here because of cheap imports. Somewhere, the whole objective of Make in India is not taking off and also most of the domestic producers have been complaining that cheap imports are making them uncompetitive.

By increasing duty, the Government certainly wants to not only support domestic producers from cheap imports but also ensure that Make in India becomes a reality. In that process, if they realize higher import duty collections, that’s a bonus. If the government increases duty on chip making, imports of chips will still happen, because a certain critical mass and expertise is required. But import of mobile phone chargers is price elastic and can be produced here easily, besides generating jobs.”

Ease of doing business

Experts observed that the Government of India has taken all steps to ensure ease of doing business in India but many state level issues were yet to be addressed.

“A large part of the clearances are to be obtained at the state level, the centre has nothing to do with it. Real reform has to happen there and that is where the challenge lies. Some states have done better than others. Issues such as time taken to give construction permits – states whether they like it or not, are taking it seriously. Even if rankings of states have not improved, their scores have improved significantly in the last one year,” said Sinha.

The World Bank’s ease of doing business index measures a country’s ranking based on the average of 10 sub-indices namely starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting investors, paying taxes, trading across borders, enforcing contracts and resolving insolvency.

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily represent the views of the publication.