Paytm, the brand synonymous with mobile wallets, is planing to invest Rs 18,000-20,000 crore over a period of five years, its founder Vijay Shekhar Sharma said today. A part of the money has already come over the last two years and the rest will come in the next three years. The amount will be invested across Paytm’s wallet, banking and e-commerce ventures. Paytm formally launched its payments bank today, although it has been functioning since May 2017.

This takes the total number of payment banks in the country to four – Airtel, India Post and FINO are the other three. Paytm has launched a Zero Balance account, and will offer an interest rate in the range of 4-7 per cent. The company will issue RuPay debit cards for every account holder and will be launching cash withdrawal points with business correspondents across the country. It plans to have one lakh ATMs by March 2018.

Paytm will also offer small and micro-loans from partner banks, mainstream banks, private sector banks, for as low as Rs 2000. “Our average ticket size is Rs 2000, and will go as high as Rs 20,000. We should do one crore businesses with loans across 600 districts by 2018,” said Sharma. It is targeting 500 million customers and Rs 1000 crore of deposits by the year 2020.

The founder also said that Paytm’s wallet business has attained positive contribution margin, which means it makes money on every transaction. However, it has not reached break-even and EBIDTA positive stage (profitability) because the business is still in an investment phase. “We are investing lot of money on people and cloud”, he said. The major investors in Paytm include SoftBank and Alibaba.

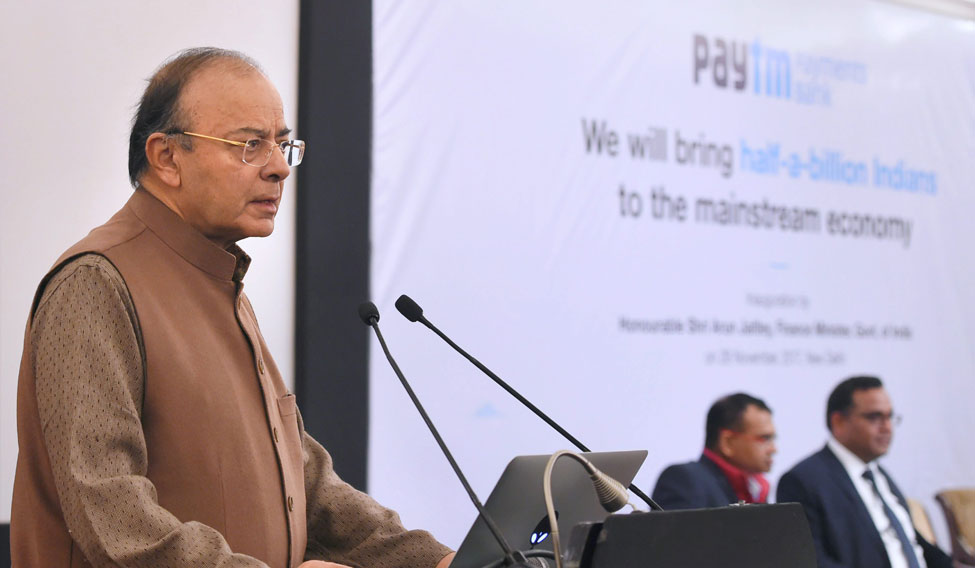

Finance Minister Arun Jaitley termed the launch as a great tribute to entrepreneurship in India. “All this actually means that the idea of cash being predominant, is gradually changing. These initiatives are leading to greater formalisation of Indian economy. Today, nobody can legitimately complain that they don't have access to banking services,” he said.