Economy-wise, Kerala is in a bad shape – the state is going through a financial crisis owing to a decrease in tax revenues, government departments spend lavishly whatever money they get without bothering about the consequences and the large-scale return of non-resident Indians has aggravated the financial depression. Amidst the state of affairs, Kerala is preparing itself for the next budget.

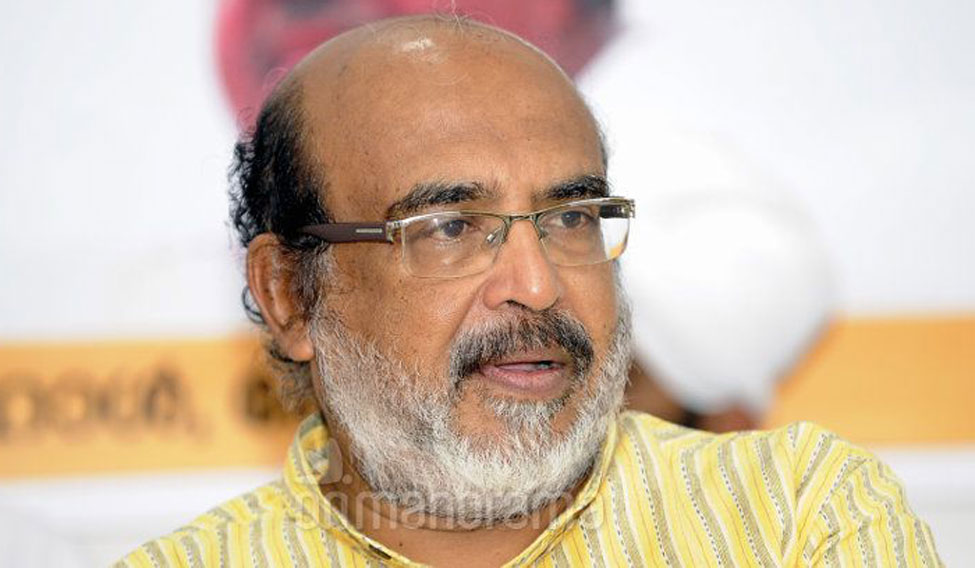

In an interview, Finance Minister Thomas Isaac speaks about the states' economic condition and the upcoming budget.

Government departments are splurging on whatever they get as allocation. Can’t the finance ministry do something to stop this?

There existed a situation until the financial depression set in that it was all right to spend extravagantly. Expenses go up when anything is done in a celebrative fashion. These unnecessary spending can certainly be curtailed.

A strong message has been sent to the bureaucrats and other officials that the squandering cannot be continued. The coming years will witness tightening of the purse-strings.

Government departments are buying cars needlessly. Thousands of posts are being created without taking into account the financial burden they put on the exchequer. Why can’t these objectionable practices be stopped?

There must be restrictions on buying cars. Many organisations need no car at all. Cars can be rented when needed. Buying cars, maintaining them and appointing drivers entail huge expenses. Malayala Manorama did a great thing by publishing a series of articles on the extravagance being indulged in by government departments and government agencies since pressure from the public is required to force the spendthrifts to mend their ways. Extravaganza is unacceptable, and the demand for reform must emanate from public opinion. However, implementing reforms requires the cooperation of those concerned.

Can suggestions to curtail expenses be expected in the budget?

Certainly. The budget that I will present in the Assembly on February 2, 2018, will be one that allows spending only in keeping with the revenues and also curtails deficit. Strict curbing of deficit would mean curtailing needless expenses. Restrictions on spending can be eased if and when there is a rise in revenues. I do not intend to meet expenses with borrowed money. However, this does not mean cutting any concessions to the poor. Sufficient money will be spend on developing the sectors of education and health.

Is it not true that the entire money borrowed is used to pay salaries and pension?

Those who demand reduction in expenses suggest that the salaries and benefits given to government employees must be cut. It is true that these expenses must be kept within a fixed percentage of the revenues, and posts have to be created accordingly. But the government wants the employees’ performance to improve perceptibly.

What can be expected in the coming budget?

The state had lost its powers to make changes in taxes with the introduction of GST. Hence, any discussions on a possible increase or decrease in prices of various products is irrelevant. Steps will be taken to increase revenues. This government will continue to focus on welfare and security as it did in the last two budgets.

Projects costing Rs 20,000 crore announced under Kerala Infrastructure Investment Fund Board (KIIFB) will move towards implementation in the forthcoming financial year. Those who point out the delay in implementing projects under the KIIFB should understand that projects that use Nabard loans have a delay of three years. The KIIFB came into being only one and a half years ago. The first loan that the KIIFB will take is for Rs 5,000 crore at an interest of 8 per cent. A decision has already been taken regarding this.

Though your prediction on the effects of demonetisation has been right, your observation that GST revenues would go up did not come true. You have had to face criticism on this count in party conferences.

Demonetisation was absurd, but GST was not. The biggest harm that the GST had done is that it took away states’ powers over taxes. VAT had curtailed states’ powers over taxes. In the VAT system, states’ powers over taxes became very limited even though the powers remained with the states formally. It was in this context that the Council of State Finance Ministers, chaired by West Bengal Finance Minister Asim Dasgupta, had begun discussions on moving towards the GST. Though all the states had initially agreed on introducing the GST, but it was blocked at that time since the BJP had backed out. The Council of State Finance Ministers had then discussed various issues related to the GST in order to safeguard the powers of the states.

However, when Asim Dasgupta stepped down as chairman of the council, there came a change in the line of thinking on the GST. The general framework that is in place today had been recognised when I joined the council a second time. I never thought that the GST would be implemented in such a hurry. The GST portal has not been made error-free even after six months of implementation. This has led to huge leak in taxes, resulting in Kerala’s tax revenues not rising as was expected.

I have come to know from Delhi that the next meeting of the GST Council will discuss stamp duty and registration. Kerala will protest strongly against this move, and will resort to legal action, if necessary. The GST Council has no authority to take away states’ powers in such a manner.

I stand by my opinion that Kerala’s GST revenues will go up by 20 per cent, but we will have to wait one more year for that.

This article was originally published in the Malayala Manorama daily on January 12, 2018