The global market is keenly monitoring any hint of hike in interest rate by the Federal Open Market Committee (FOMC), the monetary policy-making body of the US Federal Reserve. The FOMC chair Janet L. Yellen will make a policy announcement on Wednesday at 2.30pm ET (12midnight in India).

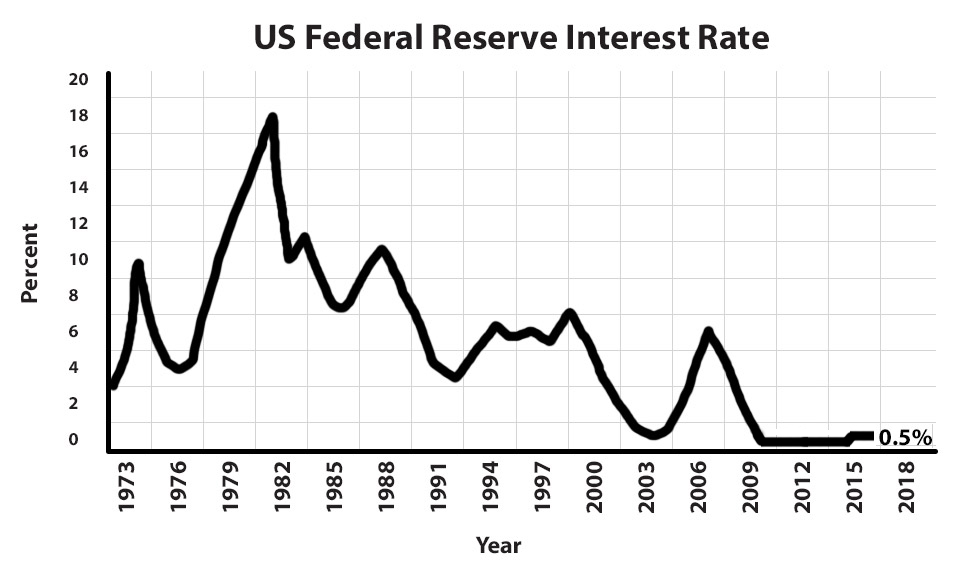

The interest rate was hiked by 0.25% in December 2015 after years of record lows. This was the Fed's first rate increase since June 2006. The world financial markets have become even more integrated in the recent years. So a change of Fed interest rate can have a global impact.

As the world still awaits to hear Yellen's speech in Washington, the Bank of Japan has decided to keep its interest rate unchanged at negative 0.1 per cent. However, the Japanese central bank will take a slew of measures to boost its ailing economy. These steps are aimed at broadening its monetary base to achieve a steady inflation rate above 2 per cent.

Most people do not expect the US central bank to raise interest rates in September. They say the hike will come by the end of this year. But even if the interest rate is not raised in September, it may prepare ground for an increase when the FOMC meets next time in December. So the Fed decision achieves significance.

How will the Indian market respond to a possible hike in US interest rate?

A Fed rate hike in the US means capital will go back to the US putting pressure stock markets and currencies of rising economies like India. The rate hike could be marginal but can lead to further hikes in the near future causing more outflow of funds from these countries.

The US rate hike can tempt Foreign Institutional Investors (FIIs) to route back their assets from Indian debt markets to a safe investment like the US treasury bonds. Nervous pull downs also can create volatility for shorter period in their domestic stock markets and currencies.

Recession times

Following the recession of 2008, people had very little purchasing power as job market had crashed. The US central bank reacted by lowering the Fed interest to pump more dollars into the business. As a result, depository institutions like banks and credit unions could lend their reserve balances to other depository institutions at the lowest federal interest rate. So the US banks gave sufficient loans to customers at near zero interest rates. These dollars were later invested in debt markets—government bonds and securities—of the developed countries as they assured better returns than in the deflationary market in developed countries.

Since the economy was on right track, the Fed policy makers intended to raise rates step by step. Gradually raising the Fed rates can help deviate from a near zero interest line which the FOMC has been maintaining throughout the recession years. Thus it safely provides enough room to manage possible recessions in the future.

Hike or hold

Now a hike expectation, though marginal, is based on the US economic revival in terms of growth in the labour market from seven-year-old recession time. However, the central bank may put off a hike for now, as the latest round of economic figures were not good as expected.

Finally, if the monetary policy decision makers at FOMC agree for a hike, it is likely to see an exodus of foreign capital by institutional investors. And its squeeze will be felt in the rising economies of the world.