There’s a German saying, “Better a horrible end than horror without end.” In 2016, the Germans took the saying literally, with low interest rates and the prospect of fees on bank deposits compelling them to end their tryst with the banking system. Many of them left the security of savings banks and put their cash in home safes. They were just following what Japanese had done at the beginning of last year. Germany’s safe producing companies are struggling to meet the demand. The biggest safe company—BURG-WÄECHTER—posted a 25 per cent increase in sales through the first half of the year.

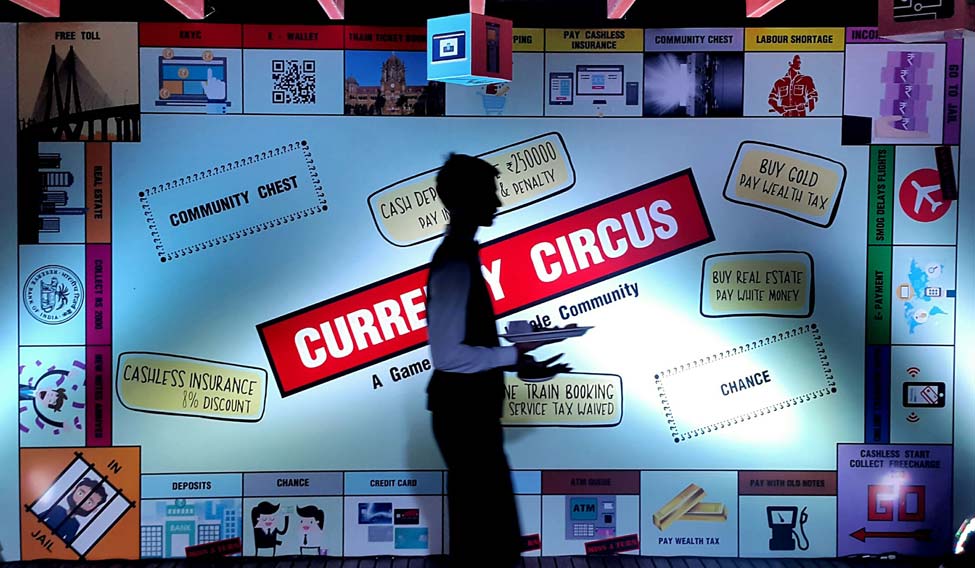

Addressing a rally at Ghazipur, six days after the demonetisation speech on November 8, Prime Minister Narendra Modi said, as a result of demonetisation, the poor were sleeping in peace and those who had stashed ill-gotten money were running from pillar to post, buying sleeping pills. He justified the withdrawal of Rs 500 and Rs 1,000 notes saying it would help end corruption and unearth black money. Through demonetisation, India removed 86 per cent of the currency from circulation. People started to queue outside banks to exchange currency and withdraw money. A photograph of an elderly man, a veteran soldier, breaking down after missing his spot in a queue at a Gurgaon bank, went viral on social media—with the caption, ‘They said only the rich will cry’. Within 20 days of demonetisation, more than 50 per cent of the recalled notes in circulation returned to the banks, creating confusion among the policy makers on the benefits of demonetisation. By December 30, more than 90 per cent of the demonetised notes were deposited in the banks, forcing the government to change the primary objective of demonetisation—from the fight against black money to adopting a cashless economy.

State Bank Of India managing director Arundhati Bhattacharya said, "In my entire career, I have never seen this kind of deposit flow. We were growing at something like 8 to 10 per cent. Suddenly, we were growing at 22 to 25 per cent, which is huge.” It was the prime achievement of the currency recall, that the currency in circulation came back into the banking system which gave it a much-needed boost. The government introduced schemes to promote digital economy, with the schemes mainly aimed at bringing the poor, lower middle class and small businesses into the digital payment fold. But, in recent weeks, changes made by some private and public sector banks have the power to push back the government policy.

The latest in this was from state-owned SBI, which has decided to increase—by several times—the minimum balance required to maintain a savings account. The monthly minimum balance requirement has been increased to as high as Rs 5,000 for branches in six metros. Failing in maintaining the minimum balance will invite a penalty ranging from Rs 20 (rural branches) to Rs 100 (metros). From April 1, SBI will permit savings bank account holders to deposit cash three times a month free of charge. Beyond that, it will charge Rs 50 plus service tax for every transaction. SBI will charge Rs 10 for more than five ATM withdrawals, and Rs 20 for more than three withdrawals from other banks. It will not charge ATM withdrawals if the account holder maintains a balance of Rs 25,000, and Rs 1 lakh in the case of other banks. The move will affect 31 crore depositors, including pensioners and common people. Account holders are already criticising it as a pro-rich policy. The government has asked the SBI to reconsider its decision to hike the minimum balance.

SBI was following what other private banks like ICICI Bank, Axis Bank and HDFC Bank announced for their customers. Axis Bank announced a minimum fee of Rs 95 for more than five transactions every month, including deposits and withdrawals. HDFC Bank will levy Rs 150 per transaction, beyond four free ones each month, including deposits and withdrawals. The new charges would apply to savings as well as salary accounts. ICICI Bank announced that there will be no charge for first four transactions a month at branches in home city, while Rs 5 per Rs 1,000 will be charged thereafter subject to a minimum of Rs 150 in one month. For non-home branches, ICICI Bank would not charge for first cash withdrawal of a calendar month and Rs 5 per Rs 1,000 thereafter subject to to a minimum of Rs 150. For cash deposit anywhere, ICICI Bank would charge Rs 5 per Rs 1,000 (subject to a minimum of Rs 150) at branches, while deposit at cash acceptance machines would be free of charge for first cash deposit of a calendar month and Rs 5 per Rs 1,000 thereafter.

Until the digital economy campaign by the government, India was a cash-centric economy, where cash accounted for 95 per cent of transactions, 90 per cent of retailers lacked means to accept digital payments, 85 per cent of workers were paid in cash and half of the population did not have bank accounts. Then came the digital economy drive by the government. India’s biggest e-payment provider, Paytm, reported a three-fold increase in the number of users. In October 2016, ATM withdrawals amounted to Rs 2.55 lakh crore; after demonetisation it declined to Rs 85,ooo crore in December 2016. But, after the RBI removed the ATM withdrawals limit in January 2017, withdrawals reached Rs 1.52 lakh crore. It is a clear sign that people were withdrawing as much cash as possible and hoarding it.

A study conducted by German economic research institute ZEW in 2016 found that Deutsche Bank had the highest potential capital shortfall of as much as €19 billion—a capital gap that comes close to DB’s entire market cap. Deutsche Bank was on the cusp of a crisis. It faced a 7 per cent decline in its net interest income, the most important pillar of bank earnings in Eurozone, after the bank followed European Central Bank’s policy of negative interest rate on bank deposits. European Central Bank introduced negative interest rate to encourage banks to lend to businesses rather than hold on to the money. It was a move to limit the savings among the amount holders. A quote, which came in ZeroHedge, says, “The moment the bank tells me I have to pay interest on my deposit, I’ll take my €50,000 or whatever it is and put it under my pillow, or buy a safe and stick the money inside.” The Germans were losing faith in banks—the possibility of having to pay fees on deposits has turned the savers' world upside down.

When Uber came to India, India was the only country where it accepted cash. In India, 70 per cent of the online shoppers preferred cash-on-delivery options. Introducing negative interest rates is like ‘the entire banking system trying to stand on its head'. Instead of urging savers to spend, central banks in Japan and Germany forced them to not only pull their cash out of the bank, thereby further slowing the flow of money, but also save even more. In India the banks have played its part.

ECONOMY

Will Indians lose faith in banks, like the Germans?

This browser settings will not support to add bookmarks programmatically. Please press Ctrl+D or change settings to bookmark this page.

Topics :

#Demonetization

| #economy