Ever since GST rates have been announced, potential buyers of passenger vehicles have been intrigued by the question―whether they stand to gain or lose, if they buy one in the GST era.

Here’s demystifying how the automobile sector fares based on the rates declared by the GST Council.

Taxes we pay today

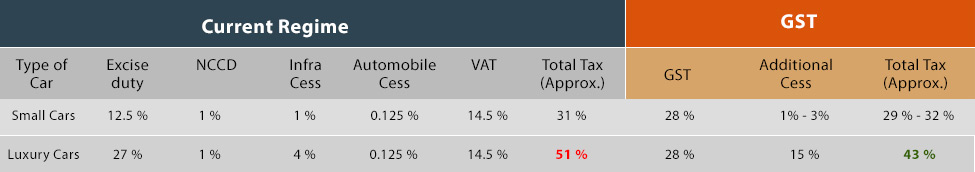

Presently, automobiles attract excise duty―ranging from 12.5 per cent to 27 per cent (based on the engine capacity and car size), additional duties of excise i.e. National Calamity Contingent Duty (NCCD) at 1 per cent, automobile cess at 0.125 per cent, infrastructure cess―ranging from 1 per cent to 4 per cent (based on car type) and finally VAT at 14.5 per cent on an average, which too differs from state to state.

UNDER GST

Motor Vehicles

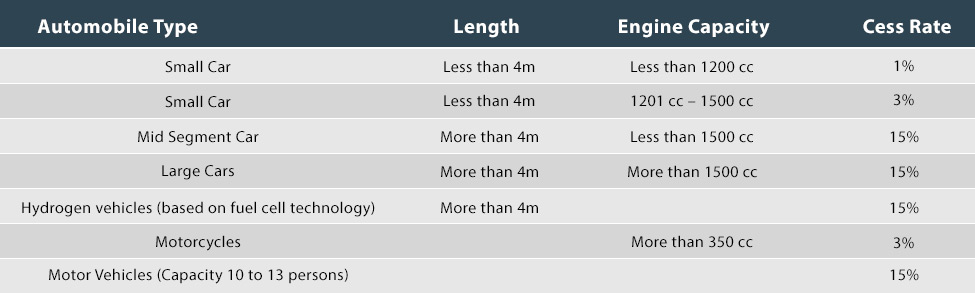

Under GST, all taxes currently levied on motor vehicles will be subsumed under a single tax rate of 28 per cent, bundled with an additional cess―in the range of 1 per cent to 15 per cent, which has been defined by the GST Compensation Cess rules, as follows:

At an initial glance, it does come across as if the taxes have gone up. But we do a quick comparison of the rates levied on motor vehicles, between the current regime and GST:

Due to the cascading nature of taxes in the current regime, a buyer of a small car was subject to almost 31 per cent of tax, while that of a luxury car was subject to almost 51 per cent of tax. However, in the GST era, taxes will no longer cascade, and in spite of being bracketed under the highest tax slab, buyers of small and mid-sized segment automobiles will continue to pay almost the same rate of tax. The real boost, however, will be for those aspiring to go for luxury vehicles, and could enjoy a potential reduction of almost 8 per cent points in the tax rates―and it will indeed be no surprise if we start spotting more Audis and Mercs flooding the Indian streets, in the time to come.

Hybrid Vehicles

Given that hybrid vehicles run on a mix of electric power and conventional fuel i.e. petrol or diesel―it is actually a bit surprising that hybrids have been placed at the highest cess rate of 15 per cent, irrespective of capacity. The fact that both mid-segment hybrid vehicles (less than 1500 cc) as well as high-segment hybrid vehicles (more than 1500 cc) will now effectively fetch a tax of 43 per cent―has not gone down well, with most hybrid vehicle manufacturers as well as consumers planning to go hybrid.

Electric Vehicles

It is interesting and encouraging to note that a differential rate of GST has been introduced for electric vehicles, which have been taxed at 12 per cent under GST. Electric vehicles have conventionally borne a reduced excise duty of 6 per cent, and also enjoy reduced VAT rates of 5 per cent in most states. And the benefit will definitely continue in the GST era. Overall, a reduced GST rate, should provide an impetus to electric mobility across India, and is a clear sign of the Government encouraging environmentally friendly technologies.

Tejas Goenka is the executive director of Tally Solutions