The Modi government today announced an infusion of Rs 2.11 lakh crores into public sector banks (PSB) in a bid to strengthen them, and revive investment, leading to “New India take-off.” Finance Minister Arun Jaitley said that the focus of the government was enhanced job creation.

While it would be wrong to describe the Modi government as "beleaguered", it has lost its sheen on account of economic slowdown and unemployment, with less than 18 months to go for the Lok Sabha elections

The Cabinet also approved huge public investment in infrastructure and housing, all aimed at creating jobs.

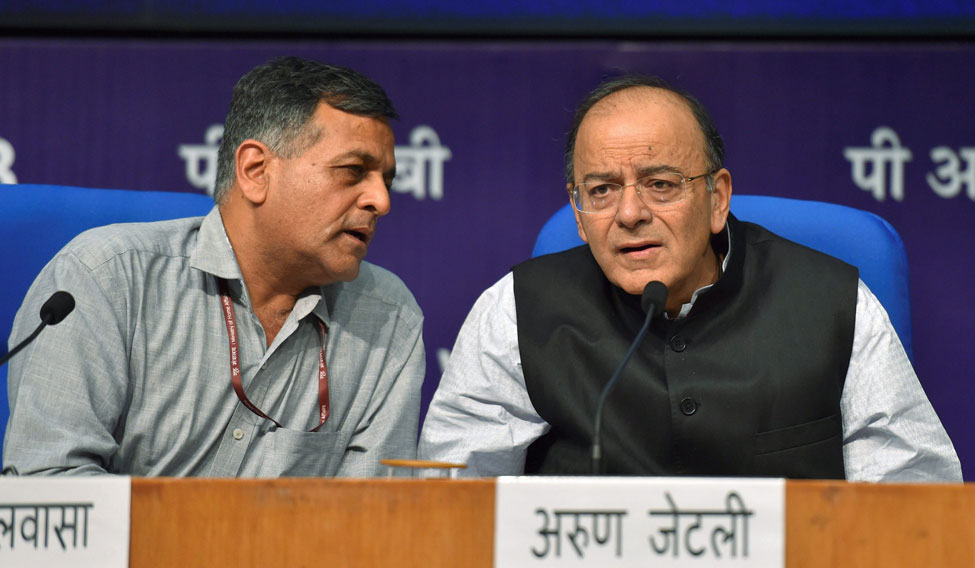

In a "top-heavy" press conference where Jaitley shared the dais with Chief Economic Advisor Arvind Subramanian, Revenue Secretary Hasmukh Adhia, and Finance Secretary Ashok Lavasa among others, Jaitley refused to give an estimate of the jobs that government aims to create. But he said it stood to reason that such a huge push in infrastructure and MSMEs would naturally lead to job creation.

PSB Recapitalisation

Part of the “unprecedented” amount being infused into the PSBs, Rs 1.35 lakh crores will be raised through front-loaded recap bonds and Rs 76000 lakh crores through budgetary support and equity issuance.

The infusion would be based on a "differential approach" by which banks will get more or less depending on their ethos, culture and credibility. This was also aimed to make the banks, focus on their HR practices, make them globally competitive, prudent in credit advancing for the deserving, leading to faster MSME growth and job creation, said Rajiv Kumar, Secretary, Department of Financial Services, Ministry of Finance.

Kumar added that the recapitalisation of banks would lead to more jobs, more growth and more investment. Jaitley said this would be followed by banking reforms that will be unveiled over the next two months. The government will determine the nature of the recap bonds, which will be a part of the issuing agency's debt, he said. The bonds will be in the larger interest of the economy, he emphasized.

CEA Subramanian said this infusion would not lead to an inflationary trend and could boost private investment. Jaitley said the infrastructure expenditure had been factored into the fiscal deficit.

Officials from the finance ministry explained that the fundamentals of the Indian economy were strong, and the outcomes of the decision to recapitalise banks will in way, wipe out the non performing assets (NPAs) that accounted for 82 per cent of the banks' finances.

Through the process of recapitalisation PSBs, having a market share of 70 per cent in the banking space, would be propelled towards greater growth which will lead to enhanced credit off-take. The finance ministry assert that with these developments, the stage has been set for the ‘MUDRA Protsahan’ campaign to kick in and deliver growth in MSMEs thereby creating more jobs.

Infra Push

Speaking about the public expenditure on infrastructure, Finance Secretary Ashok Lavasa said Rs 11.47 lakh crores out of 21.46 lakh crores earmarked for the current fiscal, had been spent until Sept 2017.

Specifically, the top bureaucrat in the finance ministry said the government today cleared a public expenditure of Rs 6.92 lakh crores to build 83,677 kilometres of roads in five years, generating 14.2 crore man days of work.

The infrastructural investment would carried out through schemes like Bharat Mala, under which 34,800 kilometres of road will be constructed, connecting all highways across India which passes through major business centres.

Other projects like Sagar Mala, Pradhan Mantri Gram Sadak Yojana among others will also get share of the newly announced plan.

The finance ministry expressed its optimism about stronger economic growth ahead. “As per IMF’s assessment in October 2017, India’s growth is expected to be at 6.7 per cent in 2017 and 7.4 per cent in 2018. IMF has also projected that India’s growth would increase to 8.2 per cent by 2022. China’s growth in 2016 was 6.7 per cent and is expected to be at 6.8 per cent and 6.5 per cent in 2017 and 2018 respectively. We expect strong growth rebound in the quarters and years ahead – may be better than even IMF’s projections,” a press release by the finance ministry stated.