The Indian economy is likely to grow between 7 - 7.5 per cent in the coming year but market investors need to be extra vigilant going ahead, the annual Economic Survey tabled in Parliament said.

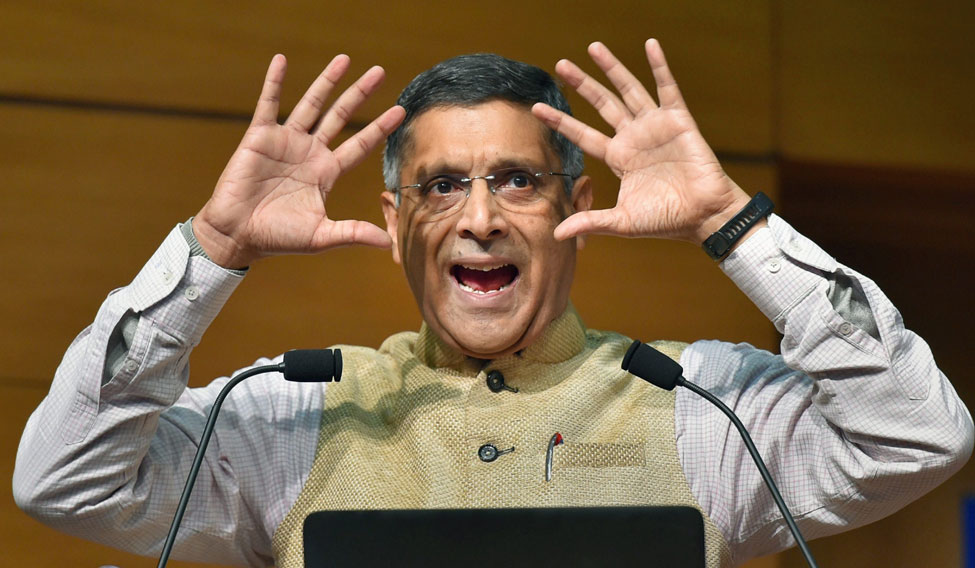

"This year the real GDP growth is likely to be 6.75 per cent, higher than the CSO's estimate of real GDP growth (of 6.5 per cent for 2017-18)," Arvind Subramanian, chief economic adviser said, while presenting the annual survey to media persons.

Indicating that growth has picked from 6.5 per cent in the first quarter of the year to about 7 per cent in the third quarter, the CEA said that going ahead the economy would become more robust.

"We see the GDP (real) growth next year to be between 7 and 7.5 per cent in the next year," he said.

First, the good news. On the upside, the CEA is positive on the launch of GST (transformational), decisions tackling double balance sheet problem to banks' NPA challenges and the upgrade of sovereign ratings and Ease of Doing Business rankings.

Now, on the downside, the CEA points towards a hike in oil prices. "We had committed a mistake in earlier years and thought that shale oil prices will remain at $55 per barrel. Things have changed from there," Subramanian said, indicating that the Economic Survey this year, went by projections on oil prices by IMF and other multi-lateral agencies.

Arvind Subramanian, an ace free market economist, also sounded caution on the stock market. "There are chances that there could be sudden corrections in the stock prices," he said, on a day when Indian stock indices have continued to rise surpassing past week's record highs.

"I think we need to be extra vigilant going ahead. Stock market vigilance needs to be heightened," he said. The CEA perhaps have caused headache to his boss, Finance Minister Arun Jaitley, by proclaiming in the Survey that there could be a "sudden stall" in capital flows of emerging markets.

"These situations might need the government to tighten its macro-policy, in a classic duality of revival versus risk saga," he said.

For 2019, the Survey prescribes that the government's focus should be on supporting agriculture, stabilising the GST regime, action by the Indian Bank Council on resolution of bad assets, privatise Air India and to come out quickly from macro-economic pressures of high oil prices, which could stall investments.

The Chief Economic Adviser said that the way Indian corporates have been viewed over the years need to change.

"In the last 50-60 years in India, the attitude towards private sector has changed from crony socialism to what we call a stigmatised capitalism, after scams during government's infrastructure drive some years back," said Subramanian.

He said this mindset would need to change to better India's prospects as an investment destination, something which the Economic Survey, 2018 prioritises, for bettering an all-time low national savings rate.

The survey indicated that India could be at the receiving end of a globalisation backlash across the world and also be afficted from a human capital regression.

This time, taking a keen eye on the issue of climate change, the Survey said that climate change is driving the fate of farmers in the irrigated and non-irrigated parts of India. "Climate change to be hotter, drier and more extreme. Agricultural income could decline by about 25 per cent," Subramanian said.

This year, acreage under both kharif and rabi season MSP crops have shrunk drastically despite good rains. The survey mentions the need to have mechanisms for protecting farmers from distress sale at lower than MSP or farmgate prices, following higher output.

Talking of the need for post-harvest solutions in agriculture, the survey urges for government focus on TOP (Tomato, Onion and Potato). The survey also raised concerns about a decline in farm wage rates from staying robust in years following the adoption of NREGA.

"The decline is wages is mostly due to lower acreage. I think more people should be out of agriculture and doing more productive ventures in villages or cities," Subramanian said.

When THE WEEK asked whether the Economic Survey addresses concerns related to lower demand and lesser number of jobs, the Chief Economic Adviser replied, “Are you from JNU, my friend!”

He then went on to say that the deficiency in demand is changing. "Demand deficiency is changing and to an extent related interest rates are also coming down. Global demand is also picking up. In that context, lower demand is less compelling in the last 8 to 9 months," he added.

Subramanian admired the GST Council's approach towards cooperative federalism. It is a technology for reform in many other areas, the CEA said.

According to the Economic Survey, the 'twin engines' of Indian economy's growth post-2000 – exports and investments – are continuing to run below take-off speed. "Though most of the parameters are back to pre-demonetisaton levels, I would say we are still at a level below our potential."

Though savings and investment rates of individuals and corporates have fallen drastically to a 22-year-low of 29.5 per cent, the Economic Survey proclaims that the government should focus more on promoting investments.

"Re-igniting investment is more important than raising savings," it said. Going ahead to budget 2018, one can expect Jaitley to stay put on the scale of government investments to complete the ongoing infrastructure projects.