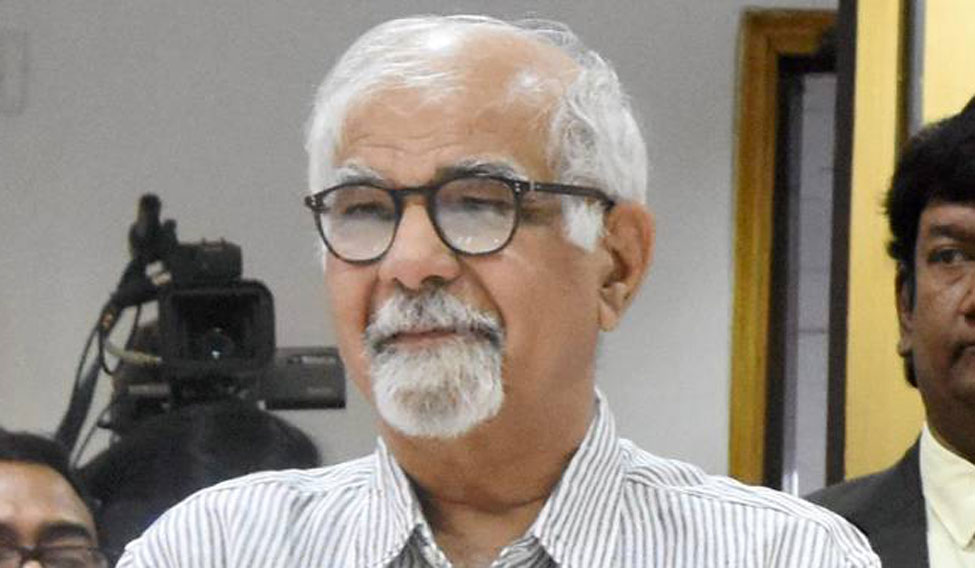

India is likely to stick to its fiscal deficit target of 3.2 per cent of GDP, and may accelerate sales of government stakes in lenders and other companies as part of an effort to recapitalise banks, said Surjit Bhalla, a member of Prime Minister Narendra Modi’s Economic Advisory Council.

Many policy makers in New Delhi, including the head of a government policy think tank have suggested fiscal stimulus is needed to boost economic growth but the central bank has warned that missing the target could hit macro-economic stability.

Indian stocks slid last month on reports that a stimulus package worth up to Rs 50,000 crore ($7.7 billion) might be in works—one that would widen the deficit to 3.7 per cent of GDP.

Bhalla, however, said the government has stuck to its fiscal deficit targets over the past three years and is expected to do so this year as well.

Growth slipped to its lowest level in three years in the first quarter, logging an annual rate of 5.7 per cent, but Bhalla said there were signs of recovery in the economy. GDP growth could be close to 6.5 per cent for the fiscal year, he said, although that is lower than the government’s earlier estimate of about 7.3 per cent.

“I am more optimistic on the economy than I was two weeks ago,” Bhalla said.

Bhalla’s comments come amid concerns about a slowdown in the economy after a major tax reform and a shock move to ban high-denomination currency notes last November.

Modi formed the Economic Advisory Council last month to address “issues of macroeconomic importance” and present its views to the prime minister. The panel is headed by economist Bibek Debroy, a member of the federal think-tank Niti Aayog.

Bhalla said the council had made the recommendations on the fiscal deficit target and banking reform to Modi and Finance Minister Arun Jaitley.

—Reuters