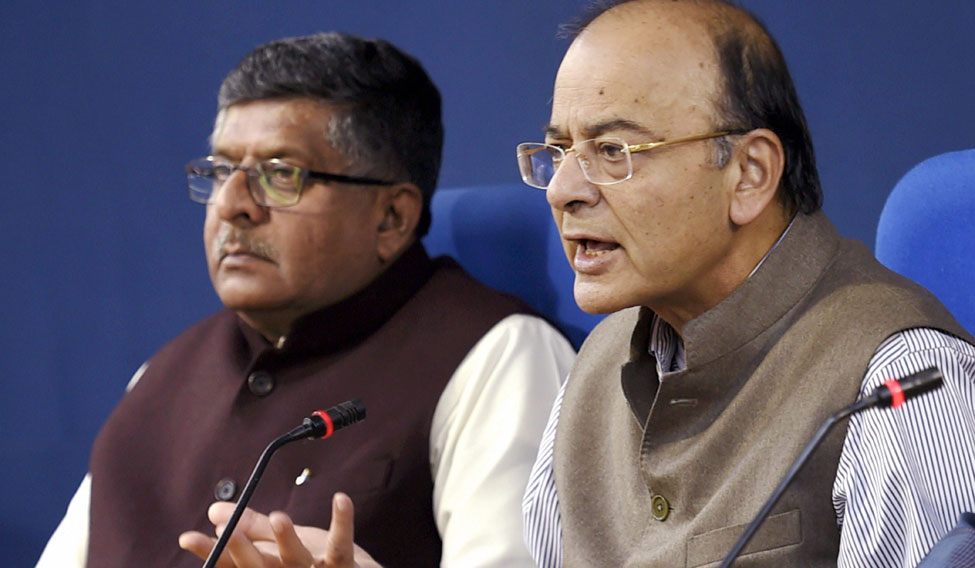

The Union Cabinet on Wednesday approved an ordinance to introduce certain changes to the Insolvency and Bankruptcy Code (IBC), Finance Minister Arun Jaitley announced.

Following a cabinet meeting, Jaitley told reporters here that the cabinet has forwarded the ordinance to effect the changes for the President's assent and, as such, details could not be revealed at this time.

"Some changes have been proposed to the Insolvency and Bankruptcy Code and since these are being done by ordinance, we cannot give the details of the proposals that the cabinet has recommended to the President," he said.

Official sources here said the ordinance will be presented in the forthcoming winter session of Parliament, which will be held in December-January.

The IBC, being implemented by the Corporate Affairs Ministry, became operational in December 2016 and provides for a time-bound insolvency resolution process.

The changes proposed are expected to help streamline the process of selecting buyers for stressed assets. For instance, currently the Code does not specify the type of buyers who can bid for stressed assets of companies that are undergoing bankruptcy proceedings.

Commenting on the development, Deloitte India Partner Kalpesh Mehta said the amendment will make the insolvency resolution process more robust and make things difficult for unscrupulous promoters.

"The implementation of this amendment would block failed promoters from regaining control of the companies facing insolvency proceedings under the Insolvency and Bankruptcy Code," Mehta said in a statement.

“It would also curb promoters of companies identified for insolvency proceedings from preparing to bid for the stressed assets of the same companies," he added.

The government announced earlier this month that insolvent corporates seeking a resolution plan under the new law will now be subject to more stringent tests regarding creditworthiness and credibility by the Insolvency and Bankruptcy Board of India (IBBI).

The IBBI has strengthened its due diligence framework by making amendments to the Insolvency and Bankruptcy Code, 2016, a Corporate Affairs Ministry statement said here.

"Now prior to approval of a resolution plan, the resolution applicants, including promoters, will be put to a stringent test with respect to their creditworthiness and credibility by the Committee of Creditors," it said.

"Amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Resolution Process, 2016, impose a greater responsibility on the resolution professionals and the Committee of Creditors in discharging their duties," it added.

The revised regulations make it obligatory to provide information about the corporate applicant, including details of antecedents "in terms of convictions, disqualifications, criminal proceedings, categorisation as wilful defaulter as per RBI guidelines, debarment imposed by (markets regulator) SEBI, if any, and transaction, if any, with the corporate debtor in the last two years".

"The Resolution Professional has to also submit details in respect of transactions observed or determined, if any, covered under Section 43 (Preferential Transactions); Section 45 (Undervalued Transactions); Section 50 (Extortionate Credit Transactions); Section 66 (Fraudulent Transactions) under Insolvency and Bankruptcy Code, 2016," it added.