Will the Monetary Policy Committee (MPC) bring down the borrowing cost when it meets for the first time on October 4? Or will the committee, which has three academics and three RBI officers prefer to wait and watch?

Politicians and industry leaders had put pressure on the former RBI governor Raghuram Rajan to lower the benchmark rate, but they were not exactly successful.

Prime Minister Narendra Modi in his Independence Day speech backed an inflation target of around 4 per cent for the next five years. However, achieving a 4 per cent inflation target is an ambitious task.

Here are some factors that MPC might consider before arriving at a key interest rate.

Monsoon rain

Price of food in India is dependent on monsoon rainfall. A good rainfall can bring down food inflation. Moreover, nearly 75 per cent of Indians rely on agriculture for their livelihood. After two continuous years of drought, the monsoon this year has been fairly good for the economy.

The June-September monsoon has so far been slightly less than average. But it has been good for the monsoon crop, and a heavy rainfall now can only harm it.

Food inflation was 5.91 per cent in August of 2016 over the same month in the previous year. From 2012 till 2016, food inflation averaged 8.46 per cent. When the food inflation is rising, the RBI may wait further before it decides to bring down key short-term lending rate.

Banks in a bad shape

The central bank is concerned that the balance sheets of most public sector banks are weary. A surge in bad loans poses a major risk to the banking sector. Public sector banks have lost more than Rs 2.5 lakh crore on account of bad loans. Deposits as well as profitability have fallen. Though experts say the worst is over, public sector banks may require a budgetary allocation of more than Rs 25,000 crore.

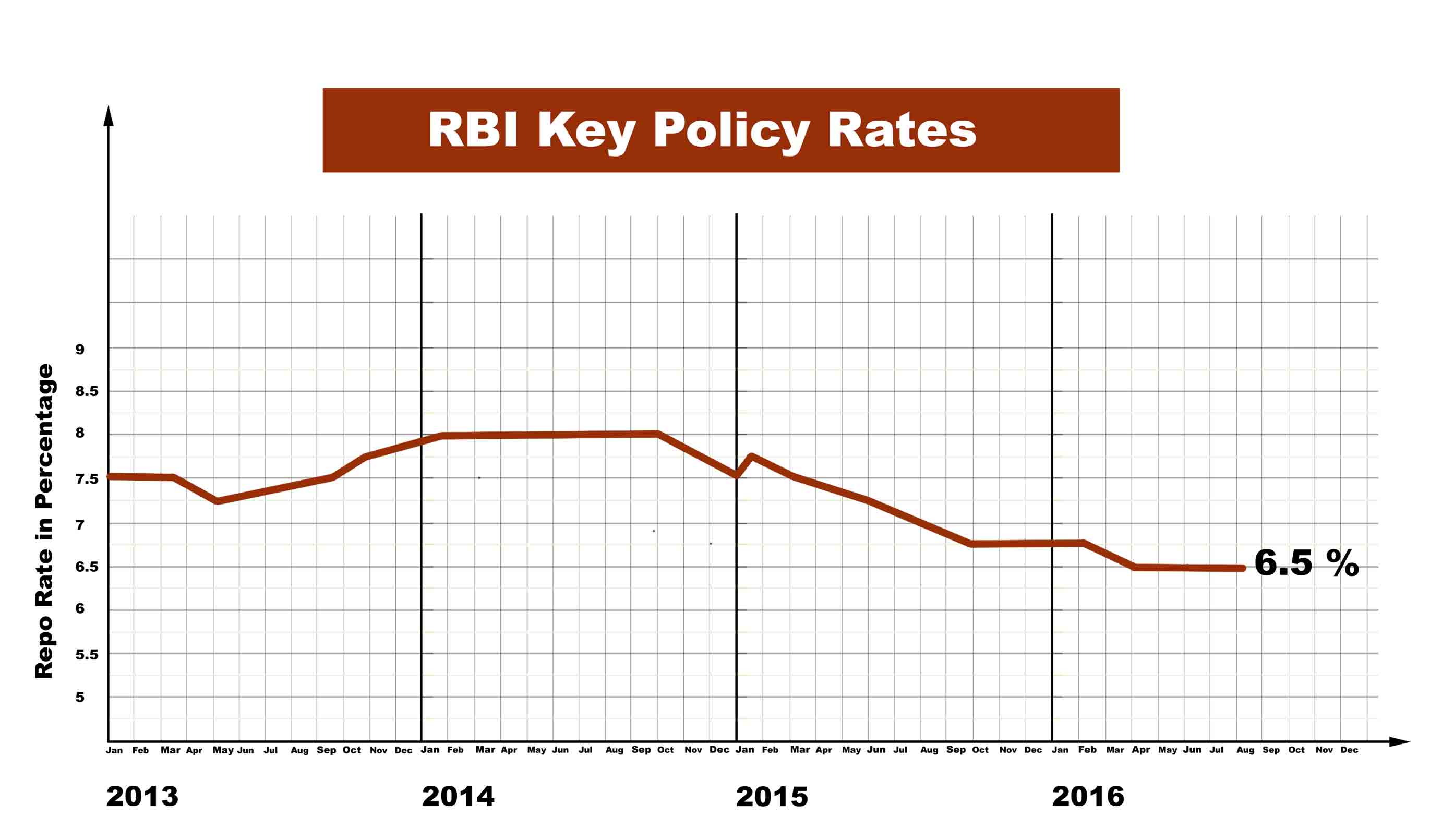

But the rate cuts in the past have not helped to reduce the EMIs on car or mortgages as the banks were unwilling to transmit the reduced lending rate.

Crude import bill

India’s oil import affects prices of products and services. A slump in oil price for more than two years helped the Indian economy. However, the country's dependence on oil import has gone up by 2.5 per cent in 2015-16 from the previous year owing to higher consumption at home.

Market watchers say crude will sell at $43 a barrel in 2016 and $52 a barrel on an average in 2017. The MPC will have to take into account upticks in future oil prices.

Fiscal deficit

The government is planning to present the Union budget on February 1. The government tides over fiscal deficit by borrowing money from the RBI and the bond market.

The burden on the exchequer in August 2016 due to the 7th Pay Commission was Rs 1.02 lakh crore, or roughly 0.7 per cent of the GDP. One Rank One Pension for retired defence staff coupled with the 7th Pay Commission could push up inflation by 1-1.5 per cent.

When the government is pushing up inflation, it cannot help the MPC to reduce the benchmark interest rate.

Value of rupee

The RBI has to maintain the value of the rupee steady. A fall in value of the rupee makes imports costlier, leading to further inflation. But then RBI does not expect much fluctuation in the rupee exchange rate of Rs 66 to a US dollar.

GST rates on the anvil

The government has set April 1, 2017 as target date to roll out the new indirect tax regime. But RBI governor Urjit Patel in a meeting with half-a-dozen economists said the GST regime would not step up inflation.

The RBI governor Urjit Patel. File Photo: AFP

The RBI governor Urjit Patel. File Photo: AFP

Global growth

Though the global economy is on right track, the central banks of advanced nations will wait for further evidence of continued progress. Also, there will only be gradual hikes. The Asian markets have gained soon after the US central bank and the Bank of Japan opted to hold on to their lending rates this month.

India is also concerned that protectionist policies favoured by the developed economies of the world are impeding global trade.

So it would not be in India's interest to let an outflow of foreign capital by lowering the key interest rate.

Focus on growth

Unlike Rajan, Patel considers inflation a lesser risk and wants to focus on growth. Though the governor sent out a dovish signal at his meeting with economists, it is most likely that the MPC will decide to hold its rate for the time being.