The Goods and Services Tax (GST) being touted as a game changer for India’s economy, will soon be rolled out. In an economy that is struggling to go digital months after PM modi announced demonetisation, the tax plan could spell more chaos. Demonetisation was announced overnight and people are still reeling under its effect. While plans to roll out GST has been in talks since 2000, the economy hasn't got the time to prepare itself for the change. Here's what makes this tax so complicated.

Good and services will be charged at different rates depending on the categories they belong to.

Tax rates for hotels, restaurants and transportation is based on based on room tariff, turnover of business and so on.

Though the threshold for small businesses is high, small businesses who undertake inter-state transactions have to register irrespective of threshold.

The anti-profiteering clause is worrying tax experts as the results haven't been desired in countries where it has been tested.

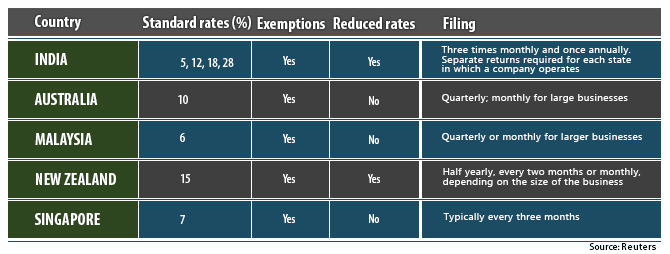

Multiple tax rates —four different rates for different industry groups— makes it difficult to be implemented.

Products like spices, mustard oil and so on will be taxed at 5 per cent; processed foods at 12 per cent; soaps, oil, toothpastes, smart phones, computers and so on at 18 percent; white goods and cars at 28 percent. This makes it very difficult for a supermarket or a hypermarket which carries products in various categories to file taxes.

Even the simplest GST with a single rate (plus zero rate and a few exemptions) requires at least 9 pieces of information from each taxpayer. But a GST with six different rates will require at least 25 pieces of information. Besides this, it will require firms to keep separate records for different purchases.

Taxes for various goods in the same category could vary, which could lead to further classification of goods.

The switch from physical to digital will be difficult for close to 60% businesses who still haven't digitized.

If goods worth more than Rs.50,000 need to be transported, you need to get a prior e-registration done and generate an e-bill.

To sum it up, multiple tax rates, cross-border transportation of goods, various threshold, will increase paperwork in an economy that is striving to be digital.