Zillionaire businessman Bill Gates has suggested a tax on robots that render people jobless. “If a robot comes to do the same thing [like a human], you’d think, we’d tax the robot at a similar level,” Gates told Quartz.com in a recent interview.

Gates said tax on robots could be used to fund 'caring' professions that can only be handled by empathetic human beings. “Let us do a better job of reaching out to the elderly, having smaller class size, helping kids with special needs. And all of those are things where human empathy and understanding are still very, very unique and we still deal with an immense shortage of people to help out there,“ he said.

Robots are a disruptor in today's evolving world. The machines have become smarter and can perform many jobs with efficiency and accuracy. Artificial intelligence is taking away jobs such as driving, warehouse work and cleanup. Even white collar jobs like accountancy, secretarial work, banking service, medicine and law are under threat.

“And what the world wants is to take this opportunity to make all the goods and services we have today, and free up labour,” said Gates. A part of the funding for relocating workers can come from the profits of companies generated by the labour-saving efficiency. Another share can come from a tax imposed on robots that replace the human labour.

Microsoft co-founder Bill Gates says robots must be taxed like employees.

Microsoft co-founder Bill Gates says robots must be taxed like employees.

Gates, the co-founder of Microsoft, which is a leader in artificial intelligence technology, said robot companies would not object to such a tax. “I don’t think the robot companies are going to be outraged that there might be a tax. It’s okay, ” he said.

Collecting an automation tax is not entirely new. European parliament has been mulling over a tax on robots just like the taxes humans pay. The income from robots would be used to train workers in other sectors and for funding a universal basic income.

Slow deployment

Automation will lead to loss of routine jobs, mostly for less educated people. Managing displacement of workers is a social issue. Temporary slowing down and handling the transition period is important here. Gates thinks that taxing automation would slow down the pace to save jobs during the changeover period. Retaining workers and diverting redundant people to jobs like taking care of children and caring for the elderly could help manage the crisis.

Hurried automation will lead to huge loss of jobs as new ones will emerge only slowly. Gates thinks that taxation is the best way to handle this transition period. “You ought to be willing to raise tax level and even slow down the speed,” he said.

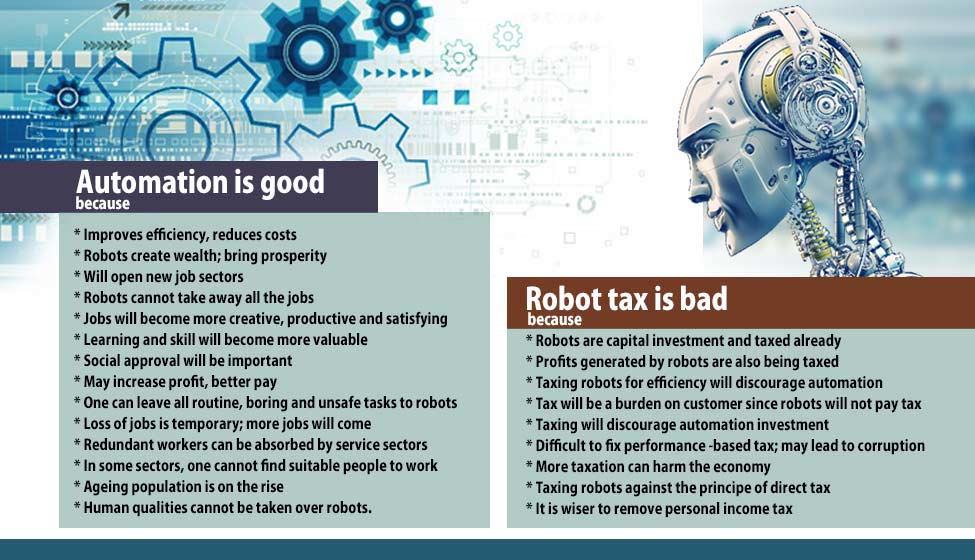

Should robot be taxed?

Governments are concerned about falling revenue as robots take over jobs. Gates think that financing the employment of people in caring sectors could be managed by taxing of robots and increasing profits owing to automation. However, economists are vary of Gates’s idea of robot taxing as companies treat robots as capital investment. Any tax levied on robots would be shifted to the customer. It works against the principle that direct taxes like personal income tax cannot be shifted to anybody else.

Fixing tax based on the performance of a robot will be a difficult task that can give rise to taxation issues. Furthermore, taxing robots would be deterrent to investment.

Replacing labour with capital will have a huge social impact. Automation just changes the nature of the human jobs. The typical example is the MS Word—word processioning developed by Bill Gates's own company. Automation will open new jobs in course of time.

However, there are many benefits from automation. Introducing robots is beneficial for working class in the long run. Adding new robots to work will increase quality and productivity. Cost of production will come down and the service can be extended to lower levels of society. Companies will welcome robots as paying tax on them is cheaper than paying full salary to employees.

Once the routine and tedious parts are automated, the remaining jobs would be more pleasing. So automation will lead to better job satisfaction. Some economists think that, instead levying tax on robots, it would be far wiser to get rid of income tax on humans.

Robots in India

Investing in robots may not be socially appealing for countries like India where cheap labour is in abundance. However, governments may find automation a welcome step in promoting the country as production hub. They might consider tax discounts for automation in schemes like 'Make in India'.

Managing human resources and retraining laid-off workers would be worse in the developing countries. The same argument was raised when computers were introduced in India. The country is now reaping the benefits of computerisation through improved efficiency and less corruption.

A robot interacts with a woman at the Mobile World Congress in Barcelona, Spain. Feb. 28. Photo: AP

A robot interacts with a woman at the Mobile World Congress in Barcelona, Spain. Feb. 28. Photo: AP