India's apex bank is considering to introduce an alternative banking scheme for people who disfavour the traditional interest-driven banking. Putting across this proposal in its annual report, the Reserve Bank of India (RBI) said it was in consultation with the Union government regarding financial inclusion for all people. The Modi government aims to extend banking and insurance service to all Indian citizens.

RRI's initiative will benefit mostly Muslims, the largest religious minority in the country, who are forbidden to use the traditional banking for religious reasons. According to the tenets in Islam, charging interest in any dealing is riba to be avoided. [see glossary of terms.]

India is home to the third largest Muslim population in the world. There are about 18 crore Muslims in the India. A sizeable number of them would not operate the traditional interest-driven banking. This situation requires the government to offer a non-conventional banking scheme such as the Islamic banking.

Though working on Islamic principles, the services are open for all, irrespective of one's religion.

Here's a brief understanding of the Islamic finance and banking.

Interest is haram

The foundation of Islamic finance is the Sharia or the Islamic law that prohibits all forms of interests in financial dealings. It coves banking, capital raising and lending. Its success depends on the people's capacity to save or on making a profit using the loan availed without interest.

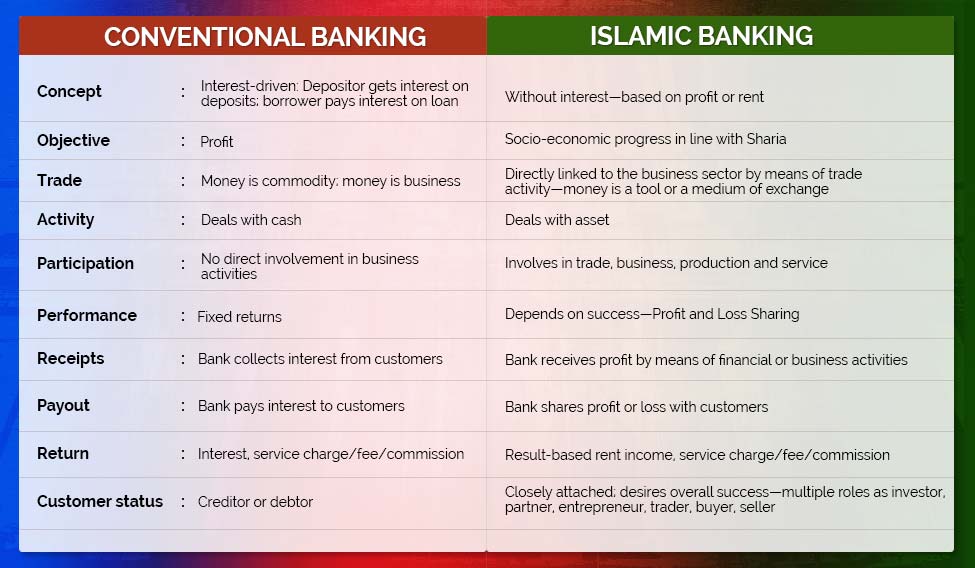

Islamic banking is a unique concept that encourages customers to work in partnership with the bank like an owner. The partners work a contractual longer-term relationship that sustains the financial health of the institution. Therefore, the risk factors are also shared between the banks and the customers who use its services.

The subject matter of Islamic banking is the economy, not money as is the case with interest based banking.

Investment in alcohol, tobacco, narcotics, prostitution, gambling, or non-halal products like pork is a taboo. So also are investments in media that thrives on gossip columns or pornography. It aims to free business of the ills that have flourished in a free market economy.

Money not a commodity

Money should not be used to make money. It should be used as a tool for doing business. The profit should also go into business.

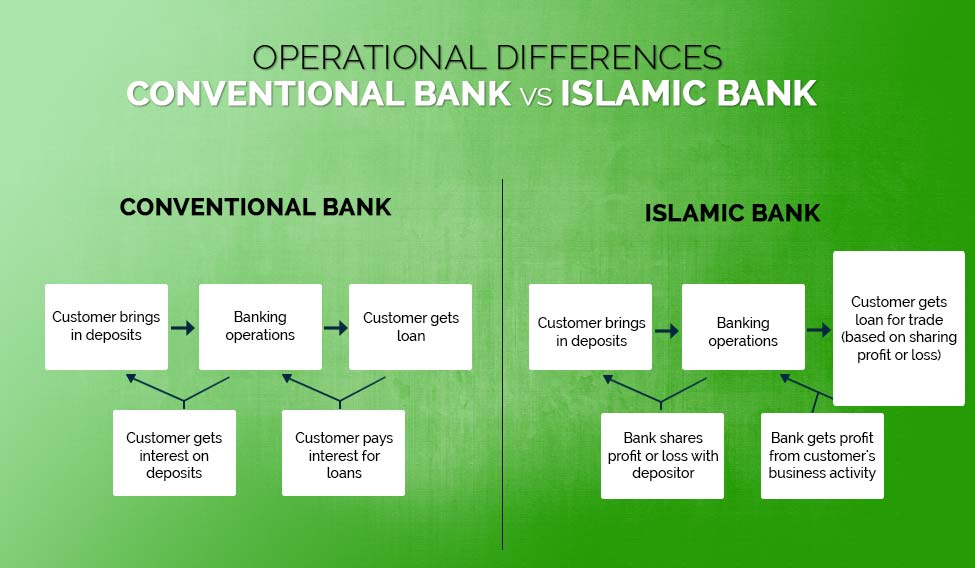

While traditional banks treat money as a commodity and earn profit by trading or pricing the money, Sharia-compliant Islamic banks can only exchange money as a medium for business activities. While the reward in conventional banks is interest, in Islamic bank its profit sharing.

Profit and Loss Sharing: In conventional banks, the depositor will be paid interest. But there is no interest based contract in Islamic banking. The depositor gets his share of the profit based on his capital percentage, if the bank earns profit by participating in the economy.

If interest is not a source of income, how does the Islamic bank work? Banks make money on schemes like ijara and murabaha. On iajara deal—leased asset—the bank will charge the customer a rent. In the murabaha—contract to buy and sell— scheme, the bank will make will profit by selling at a price more than the market value of the property.

A person who needs a house buys a house in partnership with a bank that invests a major share in it. As per the contract, the person pays rent to the bank for the part invested by it, say 75 per cent. The person owns the house after he has paid back the full amount including a profit. The tenant is content to live in his 'own' house and the bank doesn't have to worry about house maintenance.

Another example: The bank buys a car and leases it to a taxi service. The bank gets back its investment plus a profit by means of regular remittance by its business partner.

Keeps evolving

Sharia-compliant products and practices got an impetus with the tremendous oil wealth in Arab nations. Although Islamic finance had been in existence since the origin of Islam in the seventh century, a formalized system gradually evolved since early 1970s. The world's first commercial bank in compliance with Sharia was established in Dubai 1975. It has evolved in the last four decades—commercial banking in the 1970s, project finance and syndication in 1980s, equity and leasing in 1990s and bonds in 2000s.

The phenomenal growth of Islamic finance as well as its prospects for further growth has attracted western bankers to launch the service. It is a $1.5 trillion business now spanning commercial banking, capital market, and takaful, or the Islamic insurance.

Not strict adherence to Sharia

Though the ethical principles underlying the Islamic finance have brought customers closer to their banks, it has invited its share of criticism too.

A fixed fee is charged on the loan at the outset before it starts generating any income. Banks are unwilling to work according to the principle of mudarabah—sharing of risks. While banks seek profit-sharing, it shows an unbearable attitude towards risk.

The heart of the Islamic finance is a prohibition on interest. But banks, in whatever name they are known, work practically to make a profit. The 'profit rate' set by the bank is competitive with the interest rate charged by the traditional banks.

As the business continues to evolve, Islamic banking offers a range of products not much different from the products of conventional banks—Islamic term deposit, Islamic credit card, Islamic car loans, Islamic mortgages and Islamic insurance.