The finance minister is not a magician who can move his magic wand and perform economic miracles. But he has immense power to trigger an economic resurgence by altering the rules for managing the country’s finances. How he taxes and how he spends government resources determines the country’s course of development and welfare of the countrymen.

The last full budget before the general elections next year would undoubtedly have an influence on the overall tone of this year's allocations. It would be a soft budget devoid of any harsh taxation measures. Every FM has the common man in sight when he frames the budget. It is the welfare of the masses that is his final goal. But the society comprises different segments and he has to perform the difficult task of placating all, and at the same time, has to meet the objective of not crossing the prudent limit of budget deficit of 3.5 per cent.

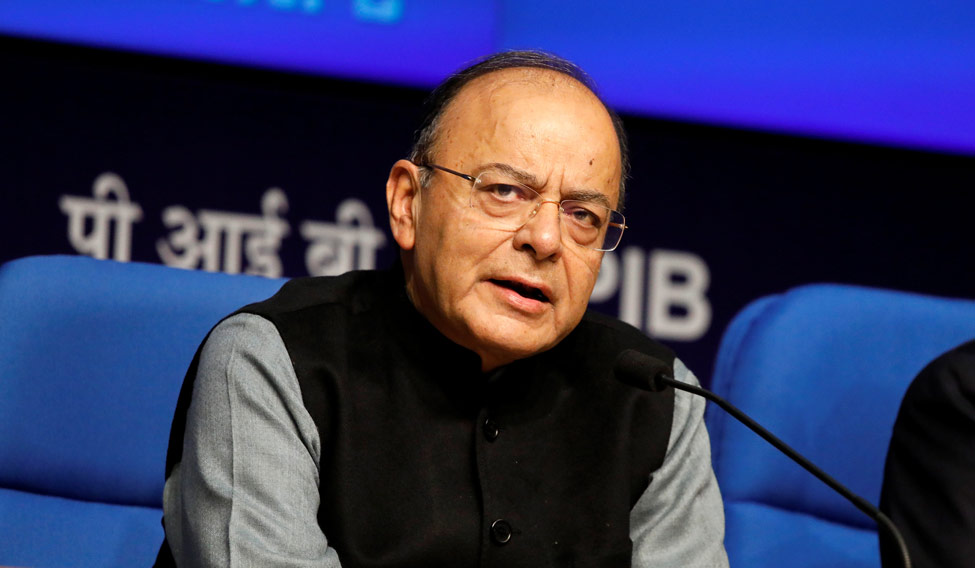

The first task Finance Minister Arun Jaitley has after the long-delayed structural reform in indirect taxation of GST is to further rationalise the GST rates. The five rates—0, 5, 12, 18, 28 per cent—are levied on goods and services looking at both revenue gain as well as consumer impact levels. In November, the GST Council moved 178 items from 28 per cent rate to 18 per cent and left only 50 items at 28 per cent. On January 25, the GST Council provided further reduction on 29 goods and 53 services. Among them, the most welcome was the cut in LPG rates for domestic consumers from 18 per cent to five per cent.

While the food and essential consumer goods are already taxed at 0 per cent and 5 per cent rates, Jaitley may find some more commodities to be in lower rates to provide relief to consumers. What is yet to be seen is the substantial reduction in prices of many commodities where the manufactured have gained due to avoidance of double taxation. The FM may warn the industry for non-compliance of passover of gains from GST to consumers.

The rise in petrol and diesel prices has been a concern both from macroeconomic as well as balance of payments angle. In fulfilling his promise to bring petrol and diesel under GST, the FM is expected to surprise the consumers and help lower their retail prices.

Over the last two years, demonetisation, lower use of currency and better tax compliance by citizens has led to an increase in the income tax payer base from four crores to 6.26 crores. It is heartening that the advance tax collection of personal income tax has gone up by 30 per cent. With this good news, the Jaitley is expected to give some bonanza to income tax payers by increasing the zero-tax limit from Rs 2.5 lakh to Rs 3 lakh. He is also expected to give some tax relief to corporates that incur capital investment by investment allowance or backward area investment allowance.

The FM's single best trump card is in respect of income tax, and which he would not shy away from playing. Last year he said, “During the period from November 8 to December 30, 2016, deposits between Rs 2 lakh and Rs 80 lakh were made in about 10.9 million accounts with an average deposit size of Rs 5.03 lakh. Deposits of more than Rs 80 lakh were made in 1.48 lakh accounts with average deposit size of Rs 3.31 crore. This data mining will help us immensely in expanding the tax net as well as increasing the revenues, which was one of the objectives of demonetisation.” He would give the data this year.

Agriculture has always been the core sector every FM plays to reward the rural economy through regeneration of growth. Droughts, crop failures and burden of farm loans have played havoc with farmers in the country. To ameliorate the suffering in these areas, the FM is expected to incur additional outlays in irrigation and other agro-infrastructure. It is expedient to launch concerted pilot irrigation projects with other agro-inputs to benefit farmers in these distress zones.

Marketing of farm products is still a big handicap for the farmers. The gap between the farm prices and retail prices is still huge. To ensure more remunerative prices the government has to increase the number of large mandis. Although the country has about 28,000 mandis, the large and well-organised are only 8,000. The government has to upgrade these mandis with better infrastructure making them more efficient, and free from local and regional cartels suppressing procurement prices. The government would also declare procurement prices for more cereals and pulses that would help farmers in obtaining fair minimum support price.

The government’s mission of housing for all by 2020 is laudable but allocation needs to be multiplied. Rural housing under several schemes gets allocation of Rs 14,000 crore. In order to achieve the target by 2020, the FM has to take measures for massive programme with an annual allocation of Rs 50,000 until 2020.

With the improvements in revenue generation from GST in the coming year and continuing buoyancy in direct taxes, the FM may aim to keep budget deficit at three per cent.

(The author is an independent economic consultant. Views expressed are personal)