The Nifty index futures has been a popular derivative index in the offshore market and generates large trading volumes on the Singapore Exchange (SGX). However, that may soon end as the Bombay Stock Exchange, the National Stock Exchange and the Metropolitan Stock Exchange have decided to stop sharing market data to foreign exchanges in a bid to stop shifting of trade volumes to foreign shores.

The exchanges have over the years entered licensing arrangements to provide market data (real-time or delayed feed and end of day) to index providers, and these indices were then licensed to various licensees, including foreign stock exchanges and trading platforms. This enabled the foreign exchanges to provide products for trading and settlement on their platforms based on Indian indices.

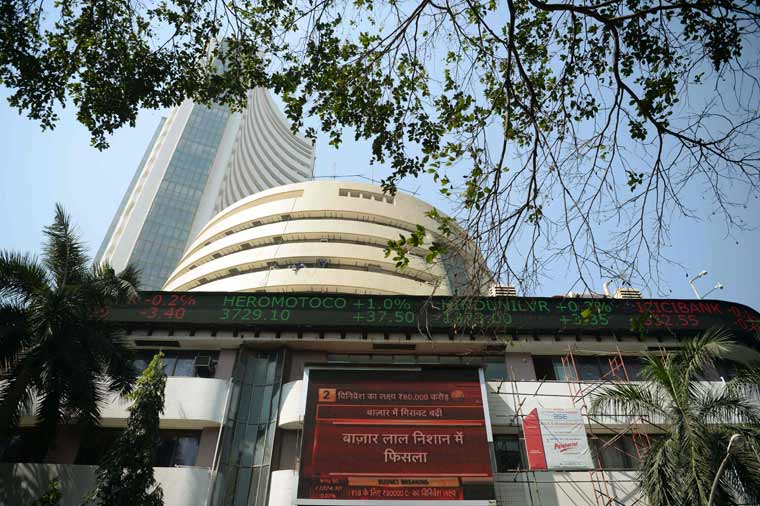

So, just like the Nifty index is traded on the SGX, the BSE's benchmark Sensex Futures is also traded on the Dubai Gold and Commodities Exchange. The foreign exchanges offered dollar-based derivative contracts based on the Indian indices, offering an entry point for those foreign investors who wanted to gain exposure to the Indian market, but without actually trading onshore.

The three exchanges—BSE, NSE, and Metropolitan—have now jointly decided that they will not license or provide any index data, including price of the securities to their foreign counterparts or trading platforms for trading and settling derivative contracts in foreign jurisdictions.

Also Read

- How much did Indian investors gain in two-day bull run? Dalal Street extends gains on third day

- Markets climb in early trade amid global trends; extend rally to 3rd day running

- Will ongoing Q4 earnings season keep markets volatile this week too?

- Mcap tracker: Bharti Airtel, HDFC Bank gain most in Top 10; TCS, Infosys major laggards

“The existing licensing agreements for licensing indices/prices of Indian securities for trading derivatives on foreign exchanges and/or trading platforms shall be terminated with immediate effect, subject to the notice period mentioned in the respective licensing agreements,” the bourses said.

“The other arrangements, if any, shall be grandfathered for a period of one month,” they said, adding that the exchanges, market participants, index providers, data vendors, their subsidiary, group companies or any other relevant party shall ensure that arrangements are terminated or modified to comply with this decision.

Futures trading on SGX Nifty was attractive to foreign investors due to dollar-based derivative contracts and tax and regulatory environment in Singapore was also seen more stable.

“It is observed that for various reasons, the volumes in derivative trading based on Indian securities including indices have reached large proportions in some of the foreign jurisdictions, resulting in migration of liquidity from India, which is not in the best interest of Indian markets,” the Indian exchanges said.

The SGX, which had only offered index derivative contracts had recently also introduced futures trading of single stocks in the NSE Nifty 50 index.

There was a worry that this move by the SGX would soak up a large amount of liquidity from Indian markets.

Finance Minister Arun Jaitley announcing a proposal in the Budget to levy 10 per cent long-term capital gains tax on equity trading had already irked investors, considering that there is already a short-term capital gains tax of 15 per cent and also a securities transactions tax (STT).

India is developing an International Financial Services Centre in Gujarat's GIFT City. Both the BSE and NSE have set up their international exchanges there, through which they offer derivative contracts.

India is keen to promote and popularise IFSC, but has so far not been able to attract a sizeable interest from foreign investors. The key disadvantage was that investors trading in IFSC had to pay a short-term capital gains tax, which is not levied in Singapore and Dubai.

In the Budget this year, the finance minister has proposed to exempt foreign portfolio investors and non-resident investors transacting derivatives, bonds and global depository receipts from capital gains tax. Further, non-corporate taxpayers operating in IFSC shall be charged Alternate Minimum Tax (AMT) at concessional rate of 9 per cent at par with MAT applicable for corporates.

The hope is that these proposals and the move to terminate existing agreements with foreign bourses for derivatives trading, will shift more FII volume to India and the IFSC.

However, how many of those investors trading in the offshore derivatives contracts in Dubai and Singapore, actually decide to trade onshore in India remains uncertain.